We are in the middle of uncertain times.

Even one round of interest rate hikes by the Federal Reserve did very little to curb raging inflation meaningfully, which led to a slightly tighter policy in the second round.

On top of that, fears of a recession were fanned further when Fed Chair Jerome Powell refused to take the chance of a “soft landing” off the table. He hinted that the policy may have to be tightened more hawkishly, notwithstanding the recession that can result from it.

Bearing these situations in mind, investors have been jittery, scrambling to settle on safe bets to reallocate their money into. However, this is also a time when hedge fund activities are closely followed.

Hedge funds allocate a large amount of money pooled in by institutional and high net-worth investors into a large variety of assets like stocks, bonds, commodities, real estate, etc. These assets are held in the fund for both short and long terms and are constantly monitored and reallocated in tune with the economic situation. This means that risks are spread significantly enough to minimize any impact from economic downturns.

Even though most hedge funds are out of reach of retail investors, the activities of the best hedge fund managers can be tracked on TipRanks. Today’s Expert Spotlight is on five-star hedge fund Gavin M. Abrams, and two stocks from his portfolio.

Our Expert of The Day

Abrams is a hedge fund manager, value investor, and founder of Abrams Bison Investments. He graduated with a BA in Economics from Harvard University in 1994, after which he worked as a research analyst at ESL Investments till he founded his hedge fund in 2000.

As the manager of a long-term equity and risk arbitrage-focused fund, Abrams invests mainly in U.S. companies that are trading at a significant discount. Under his management, the fund currently holds $1,339,403,000 worth of assets.

The TipRanks Star Ranking shows Gavin M. Abrams in fourth place among the 390 top Hedge Fund managers of the U.S. The number of stars on an expert’s ranking on TipRanks is directly proportional to his/her success rate on a portfolio, average return on a stock, and statistical significance which increases with the number of recommendations or transactions.

Also, a hedge fund manager’s portfolio returns is best measured by the Sharpe Ratio, which gives us the proportion of returns to risk. A Sharpe Ratio greater than 1 indicates that the portfolio has higher returns than risks. In this regard, Abrams boasts of a Sharpe Ratio of 5.31.

Over the past 10 years, the portfolio under the management of Abram, has returned 357%, which is higher than the 92.7% average returns of all the hedge fund portfolios. Moreover, Abrams’ portfolio has also returned more value to investors than the 252.8% 10-year returns by the S&P 500.

The hedge fund under Abrams’ management is an impressive blend of stocks from all major sectors: 25.1% of assets in the financial sector, 24.3% in technology, 22.8% in healthcare, 14.7% in industrial goods, 8.1% in utilities, and 5% in services.

One of Abrams’ Favorite Stocks

December 31, 2021, was a pretty dynamic day for Abrams. Most of his transactions on that day were sells. However, one stock stood out in his portfolio:

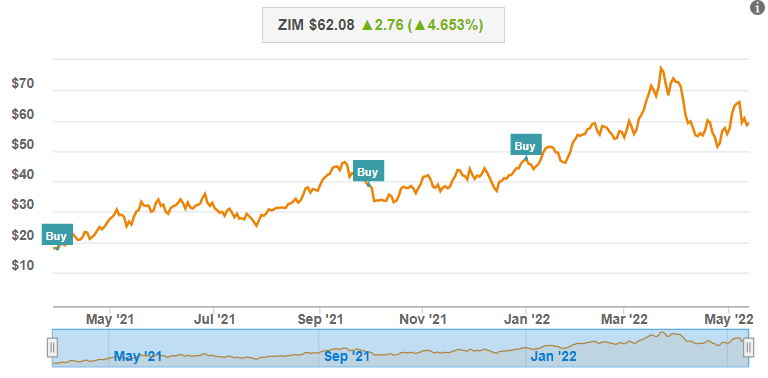

ZIM Integrated Shipping Services (NYSE: ZIM)

ZIM Integrated Shipping Services offers complete tailored shipping services, including land transportation services, out-of-gauge cargo transportation solutions, refrigerated cargo transportation, and hazardous cargo shipping. So far this year, the company is one of those which generated positive returns amid economic tumults. The ZIM stock has gained almost 30% year-to-date.

ZIM’s consistent dividends make it an attractive stock for shareholders. The company increased its annual dividend to $17 per share, which is massive. This took its dividend yield to 31.43%.

In March, Jefferies analyst Randy Giveans reiterated a Buy rating on the stock, and raised the price target to $120 from $100 after the company’s announcement of a dividend of $17 per share.

“In line with its dividend policy, ZIM announced a massive $17 per share dividend, payable on April 4, 2022. This is at the top end of its 30-50% of net income range when including the $2.50 per share already paid ($19.50 per share total). Since being publicly listed in January 2021 at $15 per share, ZIM’s total cash distributions, including the recently announced dividend, amounts to $21.50 per share, or $2.57 billion, with more to come in subsequent quarters,” stated Giveans.

However, Wall Street consensus is more cautious than Giveans, with a Hold rating on ZIM, based on one Buy, one Hold, and one Sell. The average ZIM price target is $80.60.

ZIM’s continued focus on investing in equipment to expand its fleet capacity has been boding well during these times of increased demand for shipping. This has also helped the company hold up well in the face of the current capacity constraints and port congestions.

However, heightened voyage operating costs due to increased fuel prices are a headwind to the near-term profitability of the company. This is something investors should be wary of if looking at a shorter time horizon.

Our expert, Abrams, increased his holdings of ZIM by 11.1% on a quarter-over-quarter basis in December.

Bottom Line

With consumer spending expected to take a hit in the second half of the year due to inflation, and higher operating costs leading to lower profitability of companies, investing in equity is becoming increasingly precarious. Thus, it makes all the more sense for self-driven investors to make informed decisions based on experts’ investing activities.

Our Expert Center brings together the opinions and transaction activities of the world’s top finance experts, which can play an important role in the success of your investment decisions.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure.