Energy was one of the hottest trades of 2021 and 2022. After oil stocks spent years in the wilderness, rising oil prices led the Energy Select Sector SPDR Fund (NYSEARCA:XLE) to surge to a 53.3% total return in 2021 and a 64.2% total return in 2022. However, with crude oil stabilizing and coming down from its peak, the energy-focused ETF is down about 16% from its 52-week high, which could create a nice entry point for investors looking to gain exposure to the energy sector, and analysts agree.

Here’s why XLE looks like an attractive option for investors.

Energy Stocks Aren’t Going Away Anytime Soon

While WTI crude oil is down to about $72/barrel from a high of around $129 last year, the setup isn’t all bad for oil companies. For one thing, they don’t need $129 oil to make money. Many oil companies have much lower breakeven costs and can still make money with oil at lower levels than today’s prices.

Secondly, while I won’t hazard a guess where oil demand will be a week or a month from now, it seems fairly obvious that oil demand isn’t going to just vanish overnight. The global population is growing. Not only that, but as more people around the world enter the global middle class, they will demand a higher standard of living, and more energy is necessary for that. Even if oil demand does decline at some point in the future, we are still likely going to need oil, so it’s not as if these companies are just going away.

Also, it’s important to note that energy giants like XLE’s ExxonMobil are more than just oil companies — ExxonMobil (NYSE:XOM) is a major producer of natural gas, and it is working to explore renewable energy technologies like blue hydrogen and others.

XLE’s Favorable Valuation, Juicy Dividends

While oil companies aren’t going away, the market seems to be valuing them that way. With a price-to-earnings ratio of just under 10 (as of March 31), XLE trades at less than half of the valuation of the S&P 500 (SPX), which has been sporting a P/E ratio in the low-to-mid 20s recently.

Additionally, the energy sector is known for prioritizing shareholder returns, so it is no surprise that XLE pays a dividend and yields an attractive 4.2%. This is more than double the yield of the S&P 500, which currently yields just 1.7%.

On top of its significant yield, XLE also has a strong track record as a dividend-paying ETF. XLE has paid dividends for 23 years in a row and counting, and it has grown this payout for two years in a row.

Minimal Expense Ratio

In addition to its attractive valuation and its great dividend yield, XLE also has a very investor-friendly expense ratio of just 0.10%. This means that an investor putting $10,000 into XLE would pay just $10 in fees over the first year. Assuming a 5% return and no change to the expense ratio, an investor in XLE would pay just $32 in fees over three years, $56 over five years, and $128 over 10 years, according to the fund’s prospectus. Investing in a low-fee ETF like this allows investors to protect the value of their overall investment over time.

Strong Portfolio

One downside of XLE is that it isn’t particularly diversified. It invests in the energy sector of the S&P 500 and only holds 24 stocks. Furthermore, it is dominated by its top 10 holdings, which account for nearly 75% of the fund. ExxonMobil, the largest position, makes up 23.5% of the fund, which is a huge amount for one stock.

After that, Chevron (NYSE:CVX), XLE’s second-largest holding, has a weighting of 19.5%, so ExxonMobil and Chevron make up about 43% of holdings. While investors should be aware that these two stocks dominate the fund, to some extent, this isn’t necessarily a bad thing for investors that like those companies.

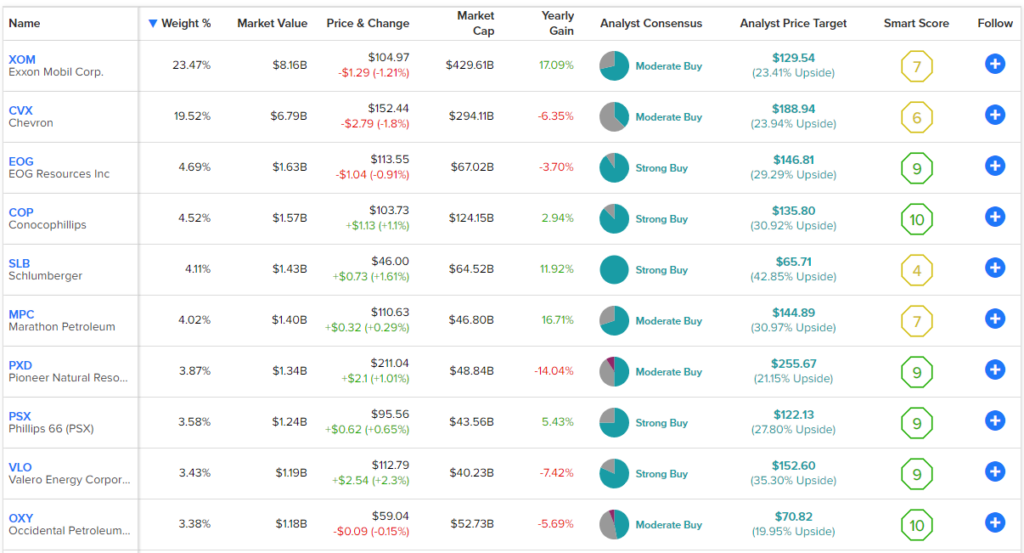

Below, you can take a look at XLE’s top 10 holdings using TipRanks’ Holdings tool.

You’ll immediately notice that XLE’s top holdings boast a very strong collection of Smart Scores.

The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. The score is data-driven and does not involve any human intervention. A Smart Score of 8 or better is equivalent to an Outperform rating.

Six of XLE’s top 10 holdings have ratings of 8 out of 10 or better. ConocoPhillips (NYSE:COP), and Occidental Petroleum (NYSE:OXY) both have ‘Perfect 10’ ratings. Also of note, there are no Underperform-equivalent ratings among XLE’s top 10 holdings.

Furthermore, other top holdings like EOG Resources (NYSE:EOG), Pioneer Natural Resources (NYSE:PXD), Phillips 66 (NYSE:PSX), and Valero (NYSE:VLO) clock in with 9 out of 10 Smart Scores. XLE itself features an ETF Smart Score of 7 out of 10 — just shy of an Outperform rating.

Is XLE Stock a Buy, According to Analysts?

Analysts are bullish on XLE stock, giving it a Moderate Buy consensus rating. Furthermore, the average XLE stock price target of $101.06 implies upside potential of 27.4% from current levels. Of the 327 analyst ratings on XLE, 65.44% are Buys, 32.11% are Holds, and 2.45% are Sell ratings.

Additionally, the lowest analyst price target ($86.79) is well above the ETF’s current price ($79.31), implying that a lot of downside may already be priced into XLE.

Investor Takeaway

While energy may not be as exciting to some investors as areas like generative AI or cryptocurrency, we need energy to power the global economy, and it isn’t going away any time soon. XLE looks like a good way to gain instant exposure to the sector. It has a low expense ratio, yields more than twice as much as the S&P 500, and has a price-to-earnings ratio that is less than half of that of the S&P 500.

Furthermore, it has a respectable ETF Smart score, a portfolio of energy companies with great Smart Scores, and analysts collectively believe there is considerable upside potential ahead.