There’s no two ways about it, Netflix (NFLX) served up a dog’s meal for its latest quarterly earnings. Investors took a sniff of what was on offer in Q1 and turned away, leaving shares to crash hard in the subsequent session.

It was mostly bad news for the streaming giant, with the headline being the first instance of Netflix losing subscribers in a decade. Netflix lost 200,000 subs in the quarter, while the Street was expecting 2.5 million additions. Making matters worse, the company also said it anticipates losing another 2 million subs in Q2. Wall Street was expecting 2.6 million adds.

Revenue also came in below expectations; at $7.87 billion, the figure missed the consensus estimate by $70 million. Although offering respite from the negativity, the company posted a beat on the bottom-line as EPS of $3.53 beats the analysts’ forecast of $2.89.

The company put the lackluster performance down to a combination of factors, including closing the service down in Russia, broadband penetration, macro headwinds and password sharing.

By Netflix’ estimations, in over 100 million households worldwide – including in 30 million UCAN households – password sharing is a thing. As part of its efforts to kickstart growth again, the company plans on monetizing multi-household sharing and over the coming year will try out new paid sharing features. The company is also considering reversing its no ads stance and will be looking into the possibility of having commercials on the platform with the addition of another membership tier.

Looking at the positives, Canaccord’s Maria Ripps highlights the “strong engagement” seen in the quarter, and while the analyst concedes the stock faces a rough time, she remains positive on Netflix’ long-term prospects.

“Shares are likely to remain volatile as investors digest the near-term challenges,” said the 5-star analyst, “although we see multiple levers available to Netflix to reaccelerate growth and drive enhanced profitability as the shift from linear to streaming video consumption continues.”

To this end, Ripps kept her Buy rating intact but lowered the price target from $600 to $400. Following Wednesday’s meltdown, the new target still implies ~80% upside potential. (To watch Ripps’ track record, click here)

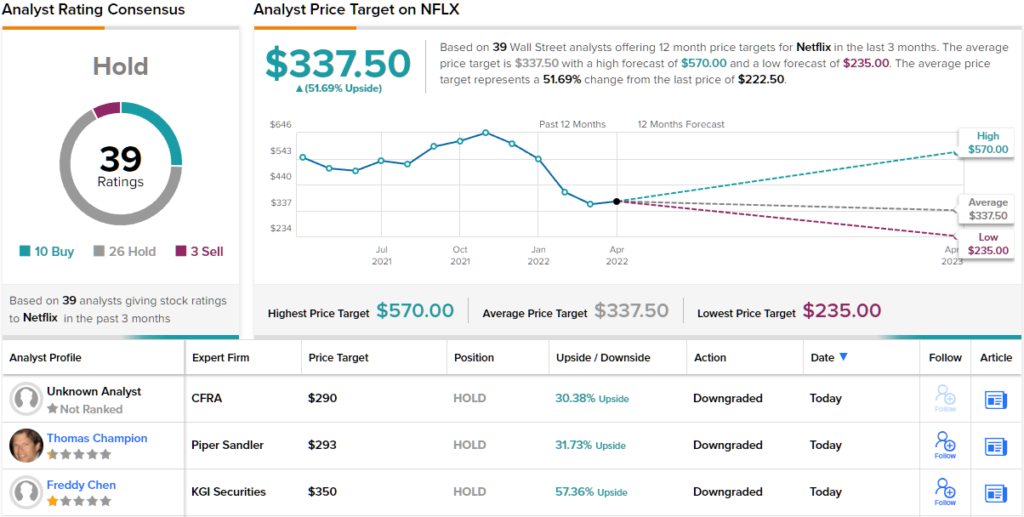

Ripps stays upbeat, more so than several of her colleagues who have been changing their NFLX tune. The stock now has a Hold consensus rating based on 26 Hold recommendations, 10 Buys and 3 Sells. However, going by the $337.50 average target, the stock could climb ~52% higher over the coming year. (See Netflix stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.