It is a sign of the times when a company posts the worst quarterly results in its history, yet no one is surprised by the decline.

United Airlines (UAL) reported 2Q20 earnings with revenue dropping by 87% year-over-year to $1.48 billion. Nevertheless, the incredible decline beat Street expectations by $80 million. Non-GAAP EPS of -$9.31 missed by $0.06.

The airline’s cash burn rate in the quarter amounted to $40 million a day, the result of a fleet mostly consigned to the tarmac due to COVID-19’s destruction of the air travel industry. However, cost cutting initiatives mean the company is expecting the hemorrhaging to slow down. The burn rate has been reduced from April’s $100 million a day and is expected to drop further to $25 million by the end of the September quarter. As a result, UAL should have $18 billion of liquidity by the end of Q3.

Although flight capacity has gradually been picking up – from June to July, UAA’s schedule doubled – and more flights are expected to be added in August, the airline is by no means out of trouble just yet. The recent rise in coronavirus cases has provided another setback and the company still expects third quarter flights to down by 65% on the same period last year. Still, this will be a marked improvement on the second quarter’s 88% drop.

In a deeply challenging macro climate, Deutsche Bank’s 5-star analyst Michael Linenberg thinks UAL is moving in the right direction.

“UAL reported an adjusted June quarter pretax loss of $3.2 billion, much better than our forecast of $4.3 billion… Despite experiencing the worst financial quarter in its 94-year history, United managed to substantially boost its liquidity, including among other capital raising actions, the largest debt deal in the history of aviation: $6.8 billion in financings backed by its MileagePlus loyalty program,” the 5-star analyst said,

But what does it mean for investors? Linenberg reiterated a Buy along with a $54 price target. Should the figure be met, expect upside of 75% from current levels. (To watch Linenberg’s track record, click here)

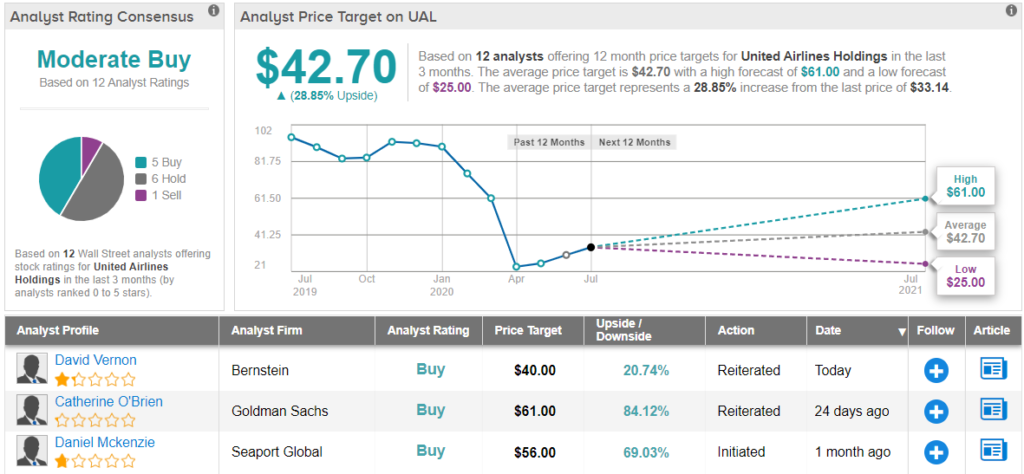

Ultimately, Wall Street is just not sure yet about UAL, but the optimists still win out in the bigger picture. Out of 12 analysts polled in the last 3 months, 5 rate the stock a Buy, 6 say Hold, while only one suggests Sell. There’s upside of 29% in the cards, should the $42.70 average price target be met in the year ahead. (See UAL stock-price forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.