Investing isn’t easy, to say the least. A massive quantity of raw data is constantly circulating on the Street, and all of it must be evaluated before making any investing decisions.

How do you go about finding the right combination of stocks to invest in? TipRanks’ Smart Score System is here to help.

TipRanks’ Smart Score System is a tool that aggregates multiple metrics regarding a stock’s expected future market performance, summing them up into a single numerical score.

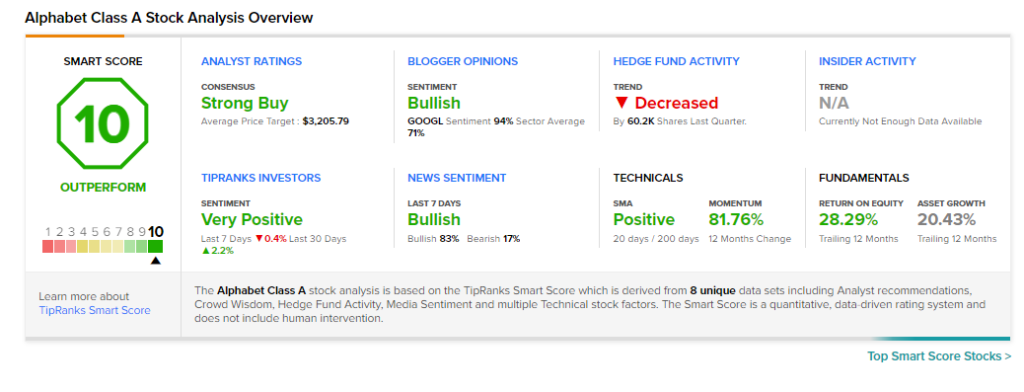

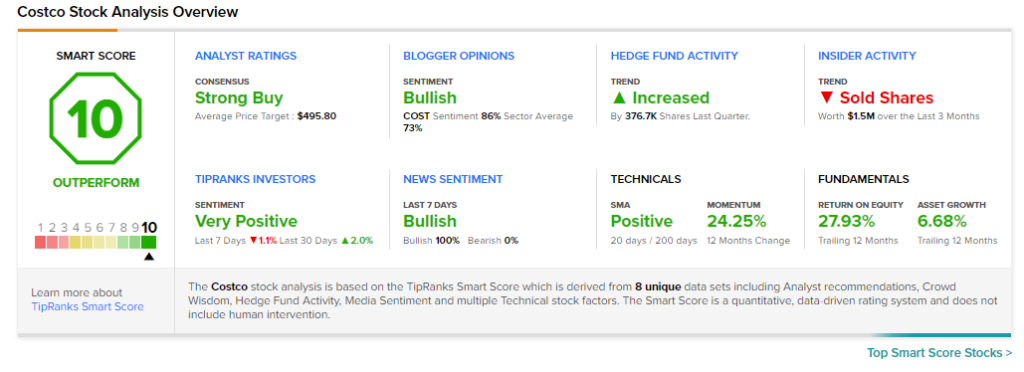

Eight essential factors comprise the TipRanks Smart Score System: Fundamentals, Technicals, Analyst Ratings, Investors, Blogger and News Sentiment, in addition to Hedge Fund and Corporate Insider Activity. The tool examines each parameter and assigns a score to the stocks on a scale of 1-10.

Stocks with a score of “Perfect 10” have a better chance of outperforming the market than those with a lower score.

Using TipRanks’ Top Smart Score Stocks tool, we were able to maximize TipRanks’ database to find two large- to mega-cap stocks that have Strong Buy consensus ratings and considerable upside potential. Both the stocks have received a “Perfect 10” score over the past three days.

Here’s the full scoop:

Alphabet

The first “Perfect 10” stock we’ll look at is Alphabet (GOOGL), a tech sector behemoth. Over the past few years, Alphabet has evolved into more than a search company, though search and online advertising still account for the majority of the company’s revenues.

Given its unrivaled abundance of data, the firm has made great progress in the cloud and is probably one of the leaders in AI (artificial intelligence). Other business lines, such as Waymo, Alphabet’s self-driving vehicle venture, and Stadia, Alphabet’s cloud gaming business, should be growth drivers for the company over the next decade.

According to Alphabet’s Smart Score page on TipRanks, nearly all of its metrics are favorable. Individual Investors on TipRanks are optimistic on GOOGL, with Technical indicators almost 82% positive and News Sentiment 83% bullish, among other favorable aspects.

Analyst Brian White of Monness supports that view, saying, “Alphabet is well-positioned for a continued recovery in digital ad spending and further momentum in the cloud.” Antitrust probes, on the other hand, are likely to continue apace, according to the analyst.

Nonetheless, he gave Alphabet a Buy rating and a price target of $3,500, emphasizing his optimism for the company’s growing cloud business.

In addition to its perfect Smart Score, Alphabet has a unanimous analyst consensus rating of Strong Buy. The stock is now trading at $2,855.56, with an average Alphabet price target of $3205.79 implying around 12% one-year upside potential.

Costco

Costco (COST) is a membership warehouse and e-commerce online retailer. It offers low prices on a wide range of branded and private-label products across a range of categories.

Costco’s membership program, which offers a continuous stream of predictable income flows, sets it as distinct from other traditional retailers. This allows the firm to offer products at a substantial discount, resulting in higher client retention.

As a result, the firm has experienced rapid development in recent years. This trend should continue in the future, since the company delivered strong sales for September 2021, indicating a healthy start to FY22. Costco’s net sales for the retail month of September totaled $19.50 billion, up 15.8% from the previous year.

Impressed with the company’s robust sales, Stifel Nicolaus analyst Mark Astrachan highlights that “Costco remains a best-in-class retailer, with continued reinvestment appropriate to sustain outperformance of peers.”

The five-star analyst reiterated a Buy rating on the stock and a price target of $475.00.

The stock scores a ‘Perfect 10’ rating, since all of the factors are positive: its Technical and Fundamental factors are in the green, and News and Investor Sentiment are favorable. The only exception is Insider Activity, which remains negative.

Once again, we’re looking at a stock with a Strong Buy consensus rating from the Wall Street analyst community. They are not unanimous, however; 16 of the 21 recent evaluations are Buys, while 5 are Holds. Shares are trading at $461.95 and the average Costco price target of $495.80 implies ~7% upside from that level.

Disclosure: At the time of publication, Shalu Saraf did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.