The collapse of SVB Financial (NASDAQ:SIVB) wreaked havoc on the banking sector and led to a sell-off in bank stocks, causing the S&P Regional Banking ETF (KRE) to decline about 12.3% yesterday. Wondering if it’s still safe to invest in bank stocks? If yes, then which stocks to consider? TipRanks has a very quick and easy solution to this problem.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Our Top Smart Score Stocks tool helps identify stocks that have a greater potential to beat the market. The tool assigns a score to each stock between 1 and 10, on the basis of eight different factors. It is worth mentioning that shares with a “Perfect 10” Smart Score have historically outperformed the S&P 500 Index (SPX) by a wide margin.

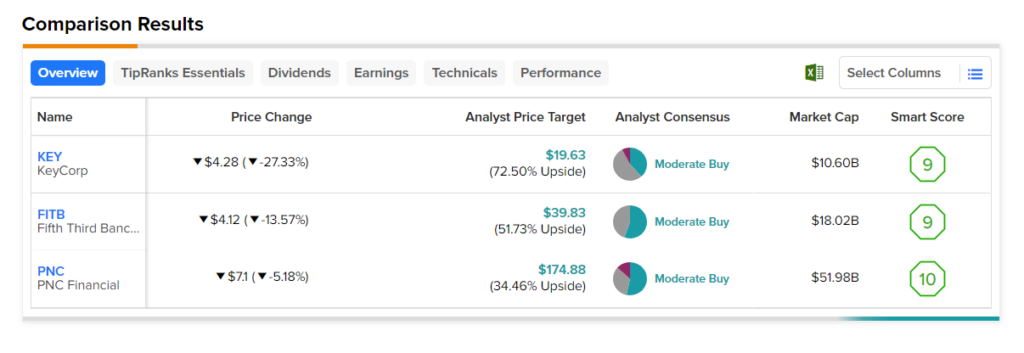

Today, we have handpicked three bank stocks that are carrying an Outperform Smart Score of 9 or 10: PNC Financial (NYSE:PNC), Fifth Third Bancorp (NYSE:FITB), and KeyCorp (NYSE:KEY).

Let’s take a closer look at these stocks.

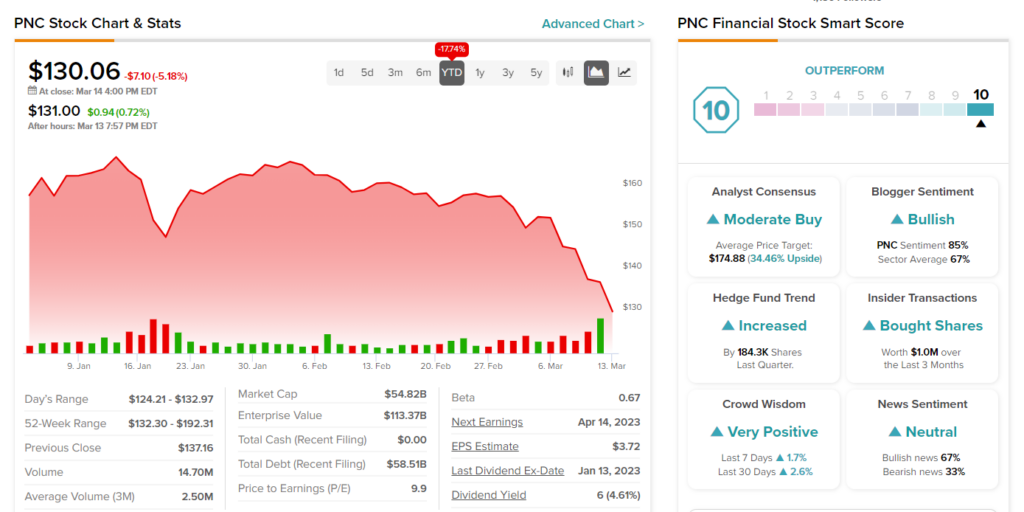

The PNC Financial Services Group, Inc.

PNC stock boasts a “Perfect 10” Smart Score. The stock also has positive signals from retail investors, hedge funds, and insiders. Our data shows that insiders bought PNC stock worth $1 million in the past three months. The stock also enjoys bullish Blogger sentiment and a Very Positive News Sentiment on TipRanks. Lastly, an ROE of 11.9% is also encouraging.

PNC Financial provides consumer and business banking services. With $552.31 billion in total assets, PNC is the 6th largest bank in the U.S. PNC increased dividend payouts for 12 consecutive years, including the 2020 pandemic year, in which several banks had frozen or cut their dividends. The stock’s current yield is 4.61%, much higher than the sector average of 2.11%.

Currently, PNC stock seems to be highly undervalued, which makes it an attractive stock. Its price/earnings (P/E) ratio of 9.9x is trading at a discount of 33.6% from its five-year average of 14.92.

Is PNC a Good Stock to Buy?

Wall Street is cautiously optimistic about PNC stock. It has a Moderate Buy consensus rating based on eight Buy, five Hold, and two Sell recommendations. The average price target of $174.88 implies 34.5% upside potential from current levels. The stock is down 17.7% so far in 2023.

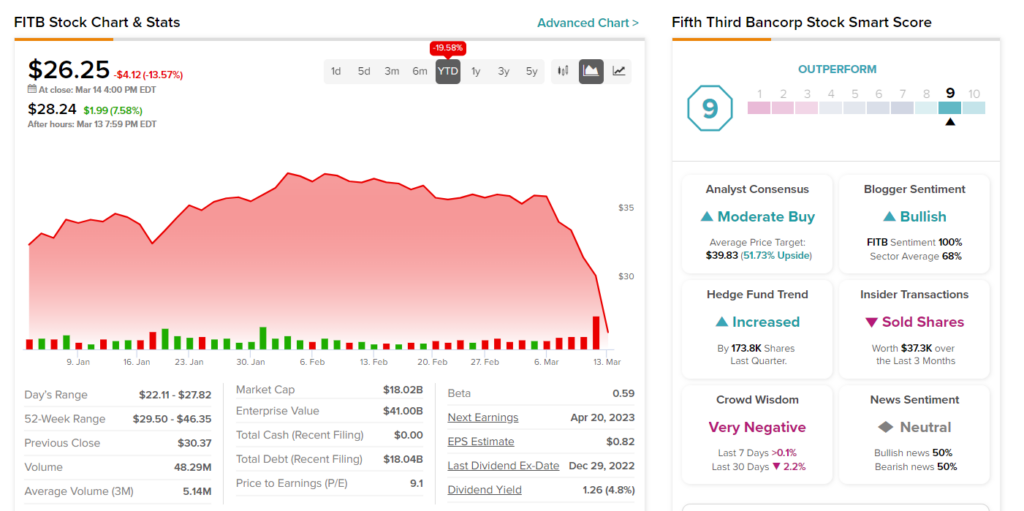

Fifth Third Bancorp

Fifth Third has an Outperform Smart Score of nine. The stock also has a Positive signal from the hedge funds. Our data shows that hedge funds bought 173.8K shares of the company in the last quarter. FITB stock also enjoys bullish Blogger sentiment. Lastly, an ROE of 12.4% is another positive factor.

With assets of $207.4 billion as of December 31, 2022, Fifth Third operates as a diversified financial services company in the United States. On the strength of its strong capital position, the company continues to diversify its revenue through strategic acquisitions. Furthermore, it delivered a strong performance in the last reported quarter with a 52.6% efficiency ratio. The ratio measures expenses as a percentage of revenue.

Additionally, the recent decline in share price has made the stock even more promising. Its current P/E ratio of 9.1x is trading at a discount of 15.1% from the stock’s five-year average of 10.72.

Is FITB a Good Buy?

FITB stock has a Moderate Buy consensus rating on TipRanks. This is based on five Buy and four Hold recommendations. The average price target of $39.83 implies 51.7% upside potential from current levels. Shares of the company have tanked 19.6% year-to-date.

KeyCorp

KeyCorp has a Smart Score of nine on TipRanks. Hedge funds have maintained a positive outlook on the KEY stock. Our data shows that hedge funds bought 528.3K shares of the company in the fourth quarter. Bloggers are bullish on the stock, while News Sentiment is positive.

KeyCorp provides banking, commercial leasing, investment management, consumer finance, and investment banking products. The company has an asset base of $189.8 billion. KeyCorp’s top line continues to benefit from the high-interest environment. Also, the bank’s efforts to maintain cost discipline are commendable.

Following the 27% dip in the stock’s price yesterday due to investors dumping shares on SVB’s failure woes, KEY seems undervalued. Its current P/E ratio of 8.1x is trading at a discount of 26.2% from its five-year average of 11.05.

Is KeyCorp a Good Stock to Buy?

KeyCorp has a Moderate Buy consensus rating on TipRanks. This is based on five Buy, seven Hold, and one Sell recommendations. The average price target of $19.63 implies 72.5% upside potential from current levels. KEY stock is down 34.6% so far in 2023.

Last Words

The Federal Reserve’s strict vigilance on the performance of banks through the annual stress tests makes it less likely that the 2008 Financial Crisis episode will repeat itself. Interestingly, the recent bank sell-off has created attractive entry points for investors.

Meanwhile, investors can also leverage TipRanks’ Experts Center tool to identify top stocks that can outperform the broader market averages.