After the disappointing August jobs report, it’s only natural to start thinking about a defensive investment stance – and that will lead to dividend stocks. This is the classic move for protecting an investment portfolio’s income stream; while they tend to offer a lower long-term share appreciation return, they also tend not to lose as much in bear markets – and the best dividend stocks provide a steady quarterly payment.

There’s one last point in their favor. In today’s market environment, the Federal Reserve has made it clear that – at least for the next 18 months – it has no intention of changing interest rates. The current low-rate regime has reduced interest income across the board (the 10 year US Treasury bond is only yielding 1.33%), making dividend stocks, which have no ceiling on the yield, the place to go for steady returns.

So much for the background. We’ve gotten into the nitty-gritty, and used the TipRanks platform to look up details on several reliable dividend payers. These are Strong Buy stocks, yielding at least 4% on the dividend payment. Here are the details, along with analyst commentary.

Valero Energy Corporation (VLO)

We’ll start with Valero Energy, a petroleum refiner with its finger – or rather, its whole fist – in a wide range of refined oil products, from gasoline and kerosene and jet fuel to diesel and lubricating oils. The company also produces important non-fuel petroleum derivatives, such as asphalt. Valero has the good fortune to occupy an economic niche that is absolutely essential in the modern economy, and while the Biden Administration has cut back oil pipelines and exploration licenses, and the Democratic Party is pushing hard for a ‘Green’ economy, Valero sees itself as insulated from these pressures, at least in the short term.

Valero isn’t relying solely on the necessity of its product line to weather the political winds. The company has important renewable and biofuel segments, producing ethanol and ethanol-based fuels along with biodiesel from renewable resources. These fuels are likely to figure prominently in any push toward a green economy, and Valero is well-positioned in that market.

Over the past year, Valero has delivered four consecutive quarters of sequential revenue gains. The most recent quarter, for 2Q21, showed $27.75 billion at the top end, the highest since 4Q19, and up 138% from the recession trough in 2Q20. The company’s recent earnings have also shown strength. In 2Q21, Valero’s EPS turned positive, to 39 cents per share, after four straight quarters of losses. Both results beat analyst expectations.

The sound quarter provides a foundation for the company’s cash return policy. Valero reported returning $401 million in cash to shareholders during Q2, through the 98-cent per common share dividend. This payment annualizes to $3.92, and gives a yield of just over 6%.

Covering VLO for Raymond James, analyst Justin Jenkins writes, “The company’s disciplined strategy in recent years has positioned VLO at the forefront of top-tier refining operations, while the footprint in both renewable diesel and now carbon capture is well ahead of energy industry peers. We think both trends represent a “re-rate” story for the stock, while the broader macro pivots back toward the refining industry’s favor.”

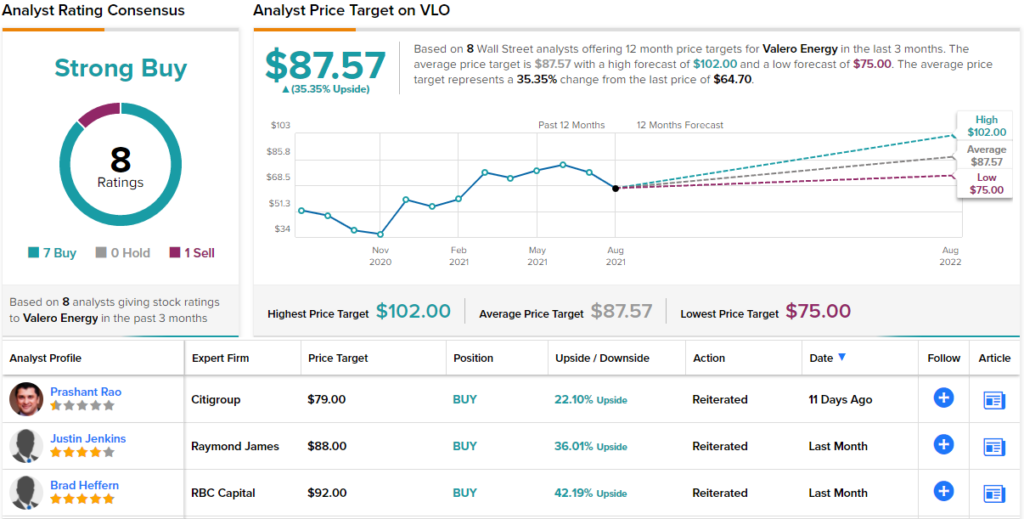

Jenkins describes Valero as the ‘best-positioned refiner,’ and rates the stock as a Strong Buy. His $88 one-year target price implies an upside potential of 36%. (To watch Jenkins’ track record, click here.)

This stock’s Strong Buy consensus rating is based on new fewer than 7 positive reviews, which clearly over balance the single Sell on record. The stock is priced at $64.70 and its average target of $87.57 suggests an upside of 35% in the next 12 months. (See Valero’s stock analysis at TipRanks.)

Marathon Petroleum Corporation (MPC)

Next up, Marathon Petroleum, is another energy company – and a well-known one, too. Marathon Petroleum is one of the Big Oil giants, and a $37 billion behemoth of the North American refining industry. Marathon refines, markets, and transports a full range of petroleum products, and its 16 refiners are capable of turning out over 3 million barrels per day of product. The company brought in almost $75 billion in revenue last year, and is the largest refiner in the US.

More recently, Marathon has been working to streamline operations and improve its cash return to shareholders. The company in May announced the finalization of the sale of its Speedway gas station chain to 7-Eleven, a deal worth $21 billion and bringing in over $16.5 billion after-tax proceeds. The company also announced plans to use those proceeds in the repurchase of up to $10 billion in company stock.

Along with the share repurchases, MPC declared its 58-cent per common share dividend payment. The company has held the dividend at this rate for 7 quarters in a row, holding the payment steady even during the height of the COVID crisis. The $2.42 annualized payment yields a solid 4% return.

Marathon supports its regular dividend with a sound financial base. The company’s 2Q21 showed $8.5 billion in total income, with $437 million in adjusted income. The adjusted figure came to 67 cents per common share. At the top line, the company showed $29.55 billion in revenue. Total revenue for the 1H21 came to $52.19 billion, up 58% from the first half of 2020. Like Valero, the top-and bottom-line results came in above the Street’s expectations.

Once again, we’ll turn to Raymond James analyst Justin Jenkins, who notes that MPC’s 2Q earnings and revenue beat his estimates too. He writes, “Following a better than feared 2Q result, we still envision a continued improvement and recovery into 2022+. And, given the prospect of balance sheet flexibility provided by the Speedway sale along with self-help on cost/capital controls, it’s clear Marathon is trending in the right direction.”

Jenkins puts another Strong Buy rating on this stock, and his $75 price target indicates a 29% upside over the coming year.

Marathon Petroleum’s Strong Buy consensus rating is based on a unanimous 8 positive reviews. MPC shares are selling for $58.24, and with their $71.75 average price target they have an upside potential of 23% for the year ahead. (See Marathon Petroleum’s stock analysis at TipRanks.)

Philip Morris (PM)

We’ll finish this list with a ‘sin’ stock, Philip Morris, one of the world’s largest tobacco companies. These companies offer products that are inherently unhealthy, and in recent decades have been met with some degree of social disdain; they have used reliable dividends to entice investors. Philip Morris is the owner of Marlboro, it’s best-selling product line and one of the world’s most-recognized brands. The company has been moving away from traditional cigarettes in recent years, and making a move toward smokeless tobacco products, a shift prompted by concerns over both health and regulation.

In the last couple of years, Philip Morris has seen share price volatility transform into steady gains. During this time, the company saw a proposed merger with competitor Altria Group (MO) fall through, and then saw its own iQOS, a smokeless tobacco product designed to provide users with the nicotine fix while bypassing the unhealthy pollutants of smoke, gain positive press reaction. In the last 12 months, PM has moved past the volatility and gained more than 34% in share value, just edging ahead of the S&P 500’s 31% uptick.

The company achieved that share appreciation with maintaining relatively steady revenues – Q2 came in at $7.58 billion, flat sequentially and up from $7.45 billion in each of the last two quarters of 2020. EPS came in at $1.39 per share for Q2, up 11% from the year-ago quarter, and unlike the top-line result, beat the consensus estimate.

PM is one of the market’s dividend champs, and has a 12-year history of keeping up the payment with gradual increases. The company raised the dividend in both 2019 and 2020, and the current $1.20 per share payment is the fourth at the current level. The $4.80 annualized payment yields 4.63%, more than double the average dividend found among S&P-listed stocks.

Writing from Deutsche Bank, Gerry Gallagher notes the strong dividend, which he describes as superior to peers’, and goes on to add, “The share price performance highlights a large cap staple (never mind a large cap staple in the form of a tobacco stock) that has all but performed in line with the S&P500 over the last 12 months. That fact may surprise some; but perhaps not if it was noted that PMI exceeded market expectations consistently in recent quarters… While the jury is out on the (relatively small) Vectura and Fertin deals, business fundamentals are strong, allowing the group to continue to transition to being dominated by the higher multiple reduced risk portfolio.”

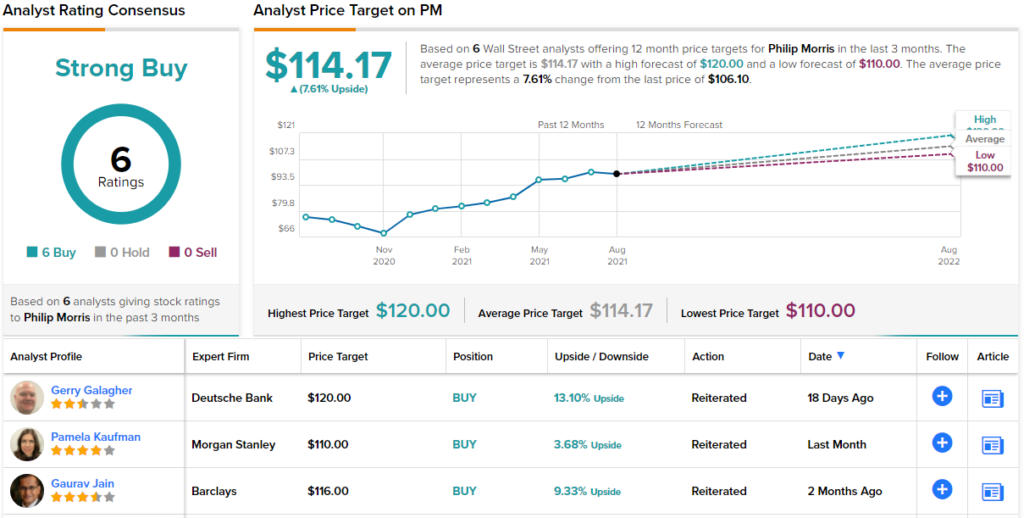

Gallagher’s price target of $120 supports his Buy rating and suggests an upside of 13% in the next 12 months. (To watch Gallagher’s track record, click here.)

All six of the recent ratings on this stock are positive, backing up the Strong Buy analyst consensus. The shares have an average price target of $114.17, implying an upside of 7% from the $106.10 trading price. (See Philip Morris’ stock analysis at TipRanks.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.