New Year lists and resolutions are just part of the celebrations – and that holds true for stock investors, too. Every year, like clockwork, Wall Street’s research firms and analysts will take some time to publish their ‘top picks’ and ‘best ideas’ for the coming year. This year, Cowen is obliging us, with its list of the ‘Best Ideas for 2024,’ and we can dig into their recommendations for some valuable New Year market advice.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It’s an interesting list, with stocks from varied sectors, from health care to high tech to necessary utilities, and includes some major names; companies like AstraZeneca and Datadog are quickly recognizable as leaders in their fields.

So, let’s take a look ‘under the hood’ of these stocks, and find out why they’re Cowen’s best ideas. Using the TipRanks platform, we can also see how the rest of the Street expects the coming months to pan out for these names. Here are the details, presented with the commentaries from the Cowen analysts.

Don’t miss

- There’s an Opportunity in the Latin American Consumer Sector, Says Jefferies – Here Are 2 Stocks to Take Advantage

- TipRanks’ ‘Perfect 10’ List: These 3 High-Scoring Stocks Are Set to Outperform the Market

- Obesity Drugs Have Multi-Billion-Dollar Market Potential, Says Oppenheimer — Here Are 2 Stocks to Take Advantage

AstraZeneca (AZN)

We’ll start in the world of Big Pharma, where British-based AstraZeneca, with $44.35 billion in annual revenue last year, ranks as the ninth largest drug company in the world. AstraZeneca works in the development, manufacture, and marketing of both old and new pharmaceuticals, as well as other biotech products for the medical sector.

AstraZeneca’s operations – both the sale of existing drugs in the company portfolio and its development of new drugs – are divided into a number of separate medical categories. These include portfolios in cardiovascular, gastrointestinal, neuroscience, oncology, and respiratory specialties, as well as work on the treatment of inflammatory and infectious diseases. The company has an American subsidiary, Alexion, based in Boston, that specializes in orphan drugs used in the treatment of rare diseases.

Overall, AstraZeneca can boast more than 50 approved drugs on the market across its categories. The company’s research and development pipeline includes 167 projects, of which 14 are ‘new molecular entities,’ or novel drug candidates, in the late stages of pipeline development.

Turning to AZN’s financial performance, we find that the company brought in $11.5 billion in 3Q23, a result that was up almost 5% year-over-year – although it did miss the forecast by approximately $40 million. At the bottom line, AstraZeneca reported a non-GAAP earnings per share of $1.73; this was up 4% from the year-ago period, and came in 91 cents better than had been expected. For the period January through September 2023, the equivalent figures were $33.8 billion at the top line and $5.80 per share at the bottom line. Looking ahead, the company increased its guide for 2023 to a mid-single-digit uptick for total revenues from the prior expectation of a low-to-mid single-digit increase.

Cowen analyst Steve Scala covers AstraZeneca, and he is impressed by the company’s sound combination of overall position and future prospects. While he doesn’t point to any single ‘standout’ feature here, he does come down firmly on the side of Goldilocks, that this one is just right: “AZN has promising new products and pipeline and participates in many large, high-growth markets. These prospects are further strengthened by Alexion’s durable revenue outlook. EPS growth appears above industry average, with upside possible. In sum, AZN’s outlook is one of the strongest in pharma, yet the valuation is on par with the pharma sector average.”

These comments support Scala’s Outperform (Buy) rating, while his $86 price target indicates potential for a 32% upside in the coming year. (To watch Scala’s track record, click here.)

There are 6 recent analyst reviews on this drug company, and they break down 5 to 1 in favor the Buys over the Holds – to give AZN a Strong Buy consensus rating. The shares are selling for $65.02, and the $81.5 average price target suggests a one-year upside of 25%. (See AstraZeneca’s stock forecast.)

Itron, Inc. (ITRI)

Next up on our list of Cowen’s picks is Itron, an interesting tech company that works with both Internet of Things technology and the legacy utility industry. Itron has developed a line of products, from both the hardware and software ends, that permit utility providers to better streamline their service. These include utility meters, modules, and sensors on the hardware end, to analysis, services, and smart payments on the software end.

Overall, Itron’s products allow utility companies to network their communications, automate their meter management and billings, and keep accurate records of service delivery. Itron’s hardware and tools will allow cities and utility companies together to better oversee their utility and water management, and allow the achievement of ambitious goals to cut public energy use without cutting public services.

There is a market for this, and Itron’s recent performance shows that. In the last quarter reported, 3Q23, Itron’s revenues came to $561 million, up 33% y/y and beating the estimates by $20.7 million. The company’s bottom line, the non-GAAP diluted EPS, was reported at 98 cents per share, a figure that was 47 cents per share better than expected. Those are substantial beats, and show an underlying strength to the company.

Jeff Osborne, in his coverage of ITRI for Cowen, notes that the company has achieved its impressive year-to-date results despite headwinds coming from the semiconductor chip sector. He writes of ITRI, “We see continued momentum for Itron in 2024 as the company continues to showcase the value its Distributed Intelligence (DI) and distributed energy management solutions provide. The company performed well in 2023, but operations and execution were still impacted by semiconductor availability, especially during 1H23. With these headwinds effectively in the rearview, we see 2024 as a year for Itron to further showcase its ability to expand margins and deliver on strong backlog levels that are ‘recession resilient’ in an uncertain macro.”

For Osborne, this adds up to an Outperform (Buy) rating, that supports his $95 price target and 35% upside prediction on ITRI shares. (To watch Osborne’s track record, click here.)

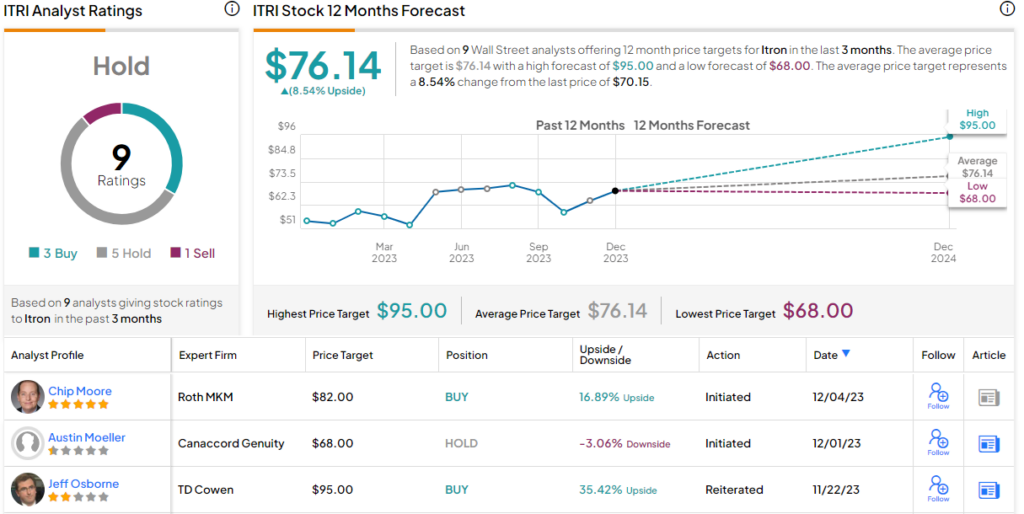

While the Cowen view here is bullish, this stock still has a Hold rating from the analyst consensus. This is based on 9 analyst reviews that include 3 Buys, 5 Holds, and 1 Sell. The shares have a current trading price of $70.15 and an average price target of $76.16 that implies a one-year gain of 8.5%. (See Itron’s stock forecast.)

Datadog, Inc. (DDOG)

Last on our list is Datadog, a company in the cloud software world. Datadog offers a range of observability tools, designed to provide real-time data analysis gleaned from monitoring, tracking, and securing cloud-based websites. At its heart, Datadog makes cloud monitoring systems available to customers through the popular as-a-Service subscription model.

It’s a good business model to bet on. Our digital infrastructure is shifting toward a cloud-based architecture, and Datadog is right there with the tools administrators will need to keep it running smoothly. These include package deals, offering automation, source control, bug tracking, troubleshooting, optimization, and basic monitoring instrumentation that customers will need to keep tabs on their own sites. Other features permit easy navigation and searching of site logs, tools to follow and generate key metrics and site traces, the high-quality data necessary for proactive decision making.

Datadog is always working to expand its products and its business, and made several announcements to that end just in November. The company announced that it had expanded the tools available on its monitoring and security platform for cloud applications; that it had expanded its existing strategic partnership with Google Cloud and completed an integration with Vertex AI; and that it had expanded its observability and security support for AWS serverless applications. These are important moves, that will enhance Datadog’s position in the cloud universe.

That position is already strong. The company last released financial results in early November, and saw its shares jump as much as 28% in response. The 3Q23 report beat the forecasts at both the top and bottom lines – revenue was $547.54 million, up 25% y/y and $23.3 million ahead of the estimates, while non-GAAP earnings came in at 45 cents per diluted share, 11 cents better than the forecast. The outlook was strong too, with revenue for Q4 expected in the range between $564 million and $568 million, compared to consensus at $543.95 million and non-GAAP EPS anticipated to come in between $0.42 and $0.44 vs. the Street’s $0.34 forecast.

This all gives Andrew Sherman the impetus he needed to mark Datadog as Cowen’s ‘Best Idea’ heading into next year. Citing the recent solid earnings report, among other factors, Sherman writes, “DDOG is our Best Idea for 2024. DDOG is a clear leader in observability & we see them as the #1 beneficiary from tool consolidation onto a single platform, a trend that is accelerating. Coming off the strong 3Q & guide, we see reacceleration likely in Q4 & mid-20s growth in ’24, w/ upside likely if historical AWS multiplier holds. At ~41x EV/CY25E FCF, we think valuation is attractive.”

Sherman’s stance is complemented by his Outperform (Buy) rating, and his price target, set at $140, implies the stock will gain 18.5% over the coming year. (To watch Sherman’s track record, click here.)

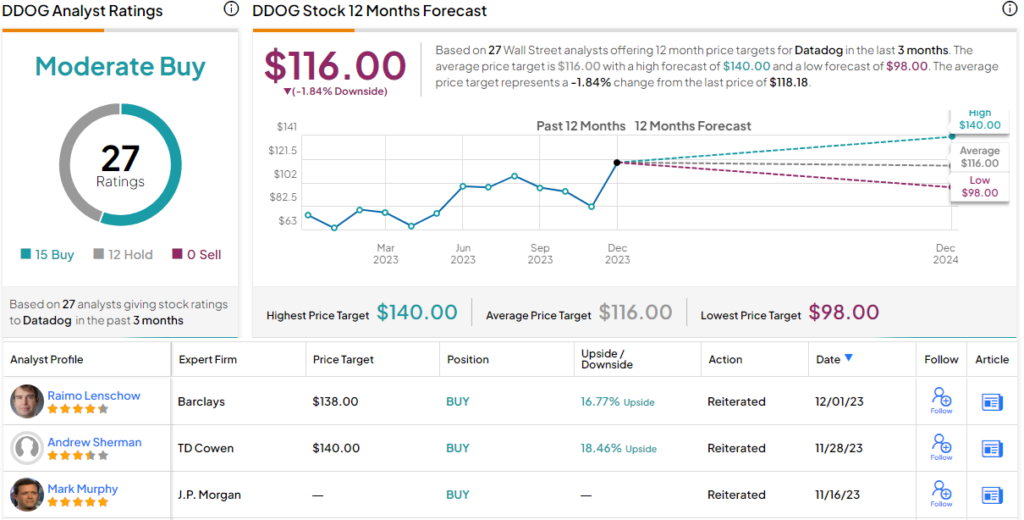

While the Cowen analyst is bullish on DDOG, the Street has a bit of caution mixed with its optimism. The stock gets a Moderate Buy consensus rating, based on 27 recent analyst reviews that include 15 Buys over 12 Holds. The $116 average price target suggests the shares will stay rangebound for the time being. (See Datadog’s stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.