The official earnings season kicks off today, with the big U.S. banks all set to announce their first-quarter performances. It is time to reshuffle our portfolios and get insights from one of the top-ranked Wall Street analysts on banks.

Today, in our Expert Spotlight piece, we will learn about five-star analyst Ken Usdin, and take a sneak peek into his take on the bank’s earnings season.

Based out of New York, Ken Usdin is the Managing Director of Equity Research at Jefferies & Company. Usdin is an expert in tracking U.S. commercial banks and the banking sector in general.

Usdin joined Jefferies in October 2010 after holding various research positions at famous Wall Street firms including Bank of America Merrill Lynch, UBS, and Lehman Brothers.

According to TipRanks Star Ranking, Ken Usdin ranks 7 among the Financial Services Sector analysts and has an overall ranking of 80 out of the 7,922 analysts in the TipRanks universe.

TipRanks Star Ranking is based on an expert’s success rate, the average return generated, and statistical significance that gives higher weightage to a higher number of transactions or recommendations made by an expert.

Accordingly, Usdin has a success rate of 67%, and he has generated an average return of 21.20% over the past year. Moreover, during the same period, Usdin’s calls have generated an alpha of 10.5% over the S&P 500, and an alpha of 5.9% over the Financial Sector.

To date, the most profitable rating given by Usdin was a Buy rating on Customers Bancorp (CUBI) between the period of January 7, 2021, and January 7, 2022. The analyst generated a humongous 246.2% return on this call.

Ken Usdin’s Latest Take on Banks

Recently, Jefferies produced its Q1FY22 Preview of the banking universe. With the Fed’s hawkish tone, Usdin has incorporated ten rate hikes in the models, eight in 2022 and two in 2023.

Usdin expects higher earnings per share (EPS) for banks on the back of rate hikes coupled with decent loan growth. Notably, the rate hikes will also uplift the bank’s net interest income (NII), which will more than offset the weak fees earned from its trading, mortgage banking, wealth management, and deposit service activities. Accordingly, Usdin has revised the revenue projections upwards for all the banks in the universe.

Moreover, the analyst believes that the flat curve propelled by the rate hikes has led to recession concerns “even though on-the-ground vibes are sanguine.”

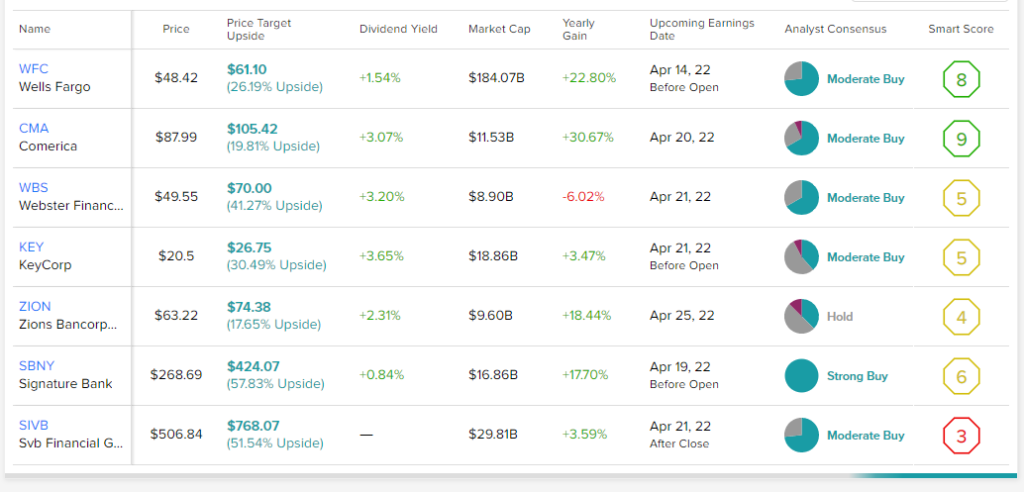

Under the large-cap banks in his coverage, Usdin’s top picks are Wells Fargo (WFC), Comerica (CMA), and Zion Bancorp (ZION). Meanwhile, Webster Financial (WBS), Signature Bank (SBNY), and SVB Financial (SIVB) remain his favorites among the mid-caps.

On the contrary, the analyst has downgraded KeyCorp (KEY) to a Hold rating from Buy on the expectation of a lower NII boost vs. peers.

Let’s take a closer look at some of these companies and why Usdin has a positive conviction for them.

Wells Fargo (WFC)

WFC is the third-largest U.S. bank by deposits, with a significant market share in commercial banking, mortgage banking, and retail banking.

Usdin has lowered the price target on WFC stock to $58 (19.8% upside potential) from $69 but maintained his Buy rating. The price target is based on the 10x price/earnings (P/E) multiple of his EPS estimate of $5.85 per share in 2023.

A noteworthy point here is that Usdin’s 2023 EPS estimate for WFC is much higher than the consensus estimate of $4.90 per share. For 2022, Usdin has revised the revenue estimates upward to $75.78 billion and the EPS estimate higher to $4.65 per share (higher than the consensus of $3.92 per share).

Usdin has given a total of 49 ratings on WFC to date, with a success rate of 70%. Moreover, Usdin has generated an average profit of 9.4% on the stock.

Comerica (CMA)

Next on the list is Comerica, a Dallas-based middle market lender, with operations in Michigan and Texas, and a growing presence in California and Arizona.

Based on his view of Comerica’s mid-single-digit loan growth, low-single-digit fee growth, and mid-single-digit expense growth, Usdin has lowered the price target on the CMA stock to $103 (17.1% upside potential) from $114 while maintaining a Buy rating.

His price target is based on a P/E multiple of 10x his 2023 EPS estimate of $10.30 per share. Like with WFC, Usdin’s EPS estimates for Comerica are much higher than the consensus estimates for both 2022 and 2023.

To date, Usdin has given a total of 51 ratings on CMA, with a success rate of 50%, and has generated an average profit of 9.7% on the stock.

Webster Financial (WBS)

Webster Financial is a major player in Connecticut’s deposit market. Within its New England-based footprint, WBS offers retail banking, commercial banking, and consumer finance services to individuals, small businesses, middle-market clients, and municipalities.

Usdin expects WBS to record high single-digit loan and fee growth, and negative expense growth. Like with other banks, the analyst maintained a Buy rating on the WBS stock but lowered the price target to $72 (45.3% upside potential) from $76.

WBS’s price target is based on an 11x P/E multiple of the 2023 EPS forecast of $6.55 per share, again higher than the consensus estimate. Although Usdin lowered the EPS estimate for 2022 to $5.40 (from $5.47) per share, it is still 30 cents higher than the consensus of $5.10 per share.

Notably, Webster’s merger with Sterling Bancorp in February 2022 created the largest commercial bank in the Northeast. Moreover, with a Health Savings Account (HSA) bank onboard, Usdin believes it provides “WBS with a low beta, sticky and cheap source of funds and should continue growing at a solid rate, with industry consultants projecting a high teens CAGR over the next several years.”

KeyCorp. (KEY)

Of all the stocks in his coverage, Usdin downgraded KEY Stock to a Hold rating from Buy and also lowered the price target to $22 (7.3% upside potential) from $30.

According to Usdin, the current rising rate scenario provides “less revenue/ earnings upside for KEY vs. other large regional peers,” as KEY has “a heavier mix today of fixed-rate consumer loans and a larger swap portfolio, which is used to artificially neutralize asset-sensitivity through the rate cycle.”

Additionally, Usdin believes that Key’s exposure to both capital and mortgage market activities, which received a higher proportion of revenues from the boom during 2021, will remain under pressure in 2022 and beyond. This is based on the uncertainties in the capital markets and the cooling mortgage markets.

The analyst’s price target on KEY is based on a 9.5x P/E multiple of his 2023 EPS estimate of $2.30 per share, lower than the consensus of $2.37 per share. However, Usdin’s 2022 EPS estimate for KEY of $2.35 per share is higher than the consensus of $2.20 per share.

For KEY, Usdin has given a total of 44 ratings to date, with a success rate of 62%. Moreover, the analyst has generated a high average profit of 21.2% on the stock.

Ending Thoughts

Considering the performance history of Ken Usdin’s ratings over the years, it may be a good choice for investors to follow the analysts’ ideas and picks, especially for those who are inclined toward the banking sector.

Out of the 1,273 ratings assigned by Usdin to date, he has had a Buy conviction on 43.8% of the stocks, a Hold rating on 56.1% of the stocks, and a minor 0.1% Sell rating on the stocks he covers. This simply reflects the confidence Usdin has in the banking sector, which is also a very important indicator of an economy’s overall health.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure