This article is based on an earlier version written by Payal Chhawchharia

The U.S. apparel industry is undergoing change as companies adjust to a sudden shift in consumer preferences. The recent results of many apparel companies show that people are now leaning towards formal and official wear over the casual or informal clothing that was in high demand in the pandemic-lockdown era.

Fashionable clothing for various sizes, along with expensive clothing is being produced to target different sections of society.

Meanwhile, the companies have now started scaling their digital businesses and are using effective marketing strategies to keep their customers hooked.

Apparel companies have also been able to pass on the higher freight costs and expenses to consumers.

According to a Statista report, the U.S. apparel industry’s revenues are expected to be $335.1 billion in 2022, up 5.5% year-over-year. From 2022 to 2026, the industry’s revenues are anticipated to rise by 2.15% CAGR.

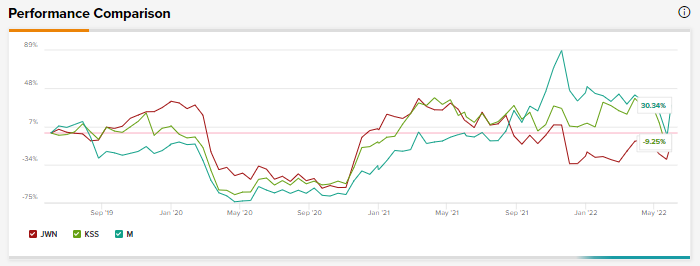

Let’s discuss three large-cap companies from the U.S. apparel industry by using the powerful TipRank’s Stock Comparison tool that enables us to compare stocks from the U.S., Canada, and U.K. markets on a range of criteria, from industry to hedge fund actions and more.

Macy’s, Inc. (NYSE: M)

- Top Brands: Bluemercury, Macy’s, and Bloomingdale’s

- Sales Growth: 13.6% in Q1 of fiscal 2022 (ending April 30, 2022)

- One-Year Price Performance: 27.8% increase

- Market Capitalization: $6.32 billion

For the fiscal year 2022 (ending January 2023), the company anticipates revenues to be within the $24.46 billion to $24.7 billion range. Adjusted earnings per share are expected to be in the range of $4.53 per share to $4.95 per share, up from $4.13 per share to $4.52 per share expected earlier.

Recently, Kimberly Greenberger of Morgan Stanley upgraded Macy’s to Neutral from Sell while increasing the price target to $22 (6.98% downside potential) from $20. The analyst finds the company’s projections conservative and expects a “lower risk of future earnings cuts from Macy’s, which could result in relative share outperformance versus peers.”

Analysts on the Street have a Hold rating on M, based on three Buys, six Holds, and three Sells. Macy’s average price target of $26.55 per share suggests a 12.26% upside potential from current levels.

Kohl’s Corporation (NYSE: KSS)

- Top Brands: Croft & Barrow, Apt. 9, and Jumping Beans

- Sales Growth: (5.2%) in Q1 of fiscal 2022 (ending April 30, 2022)

- One-Year Price Performance: 27.7% decline

- Market Capitalization: $5.38 billion

For the fiscal year 2022, the company anticipates a year-over-year change of 0% to 1% in sales and earnings to be in the range of $6.45 per share to $6.85 per share. The projections are lower than the sales growth of 2% to 3% and earnings of $7 per share to $7.50 per share expected earlier.

A few days ago, Oliver Chen of Cowen & Co. maintained a Buy rating on KSS while lowering the price target to $60 (48.81% upside potential) from $75.

KSS has a Hold consensus rating based on five Buys, six Holds, and two Sells. KSS’s price target of $50.67 suggests a 25.67% upside potential from current levels.

Macy’s has delivered better price gains than Kohl’s over the past year, and its expected sales growth leaves Kohl’s behind. Additionally, hedge funds remain positive on Macy’s while they are very negative on Kohl’s at present, as indicated by our comparison tool.

Nordstrom, Inc. (NYSE: JWN)

- Top Brands: BP, 1901, and Calibrate

- Sales Growth: 19% in Q1 of Fiscal 2022 (ended April 30, 2022)

- One-Year Price Performance: 22.8% decline

- Market Capitalization: $4.26 billion

For the fiscal year 2022, the company anticipates revenues to increase in the range of 6% to 8% year-over-year and adjusted earnings to be within the range of $3.20 per share to $3.50 per share. These projections are higher than the 5% to 7% revenue growth and earnings of $3.15 per share to $3.50 per share expected earlier.

A few days ago, Lorraine Hutchinson of Bank of America maintained a Sell rating on JWN while lowering the price target to $21 (20.54% downside potential) from $26.

Presently, the company has a Moderate Sell consensus rating based on 10 Holds and four Sells. JWN’s average price target of $24.33 suggests a 7.95% downside potential from current levels.

While Nordstrom’s expected sales growth is higher than the other two names on our list, the stock falls short on hedge fund sentiment, which is negative, coupled with the expected price decline by analysts.

Conclusion

Demand for apparel is likely to stay strong going forward as the number of people stepping out of their homes increases. The trend may be marked occasionally by ever-evolving consumer tastes. As of now, the major challenge for apparel companies like Macy’s, Kohl’s, and Nordstrom is adjusting to the new demand trends and parameters like costs and inventory levels.

In the current dynamic, compared to the other two names, Macy’s seems to be in a better position due to a host of positives, including potential double-digit share price gains in the offing, anticipated sales growth, and a positive hedge fund confidence signal.

Read full Disclosure