Russia’s invasion of Ukraine has sent fuel prices skyward, with oil surpassing $100 per barrel. Americans are paying more than $4 per gallon at the pump, and states such as Maryland and Georgia have temporarily cut state gasoline taxes to take the pressure off the consumer. Meanwhile, California is considering offering a $400 rebate to drivers, and other states are expected to follow the same.

In times like these, the significance of renewable energy and clean energy rises, encouraging people to turn to cheaper carbon-free alternatives. The solar energy sector, which attenuates the high electricity costs faced by consumers in both residential and commercial markets, is one such sector that is poised to gain from the rising fuel prices and elevated awareness of decarbonization.

As seen from the above charts, the solar energy sector produced a minor 2.8% of total energy production in the U.S. in 2021. Over the years, in pursuit of a secure carbon-free environment, the installation of solar panels has seen a dramatic rise in the U.S.

According to the Solar Energy Industries Association (SEIA), despite the pandemic triggering supply chain disruptions and labor issues, solar photovoltaic (PV) installations in the U.S. peaked at 23.6 GW in 2021, bringing the total to an estimated 171 GW.

Strong underlying demand from utilities, states, corporations, and distributed solar customers continues to drive the sector’s growth, albeit the solar industry experienced a rise in prices due to pandemic-related challenges.

A report produced by the National Renewable Energy Laboratory (NREL) projects 209 GW of PV installation in 2022 and 231 GW in 2023. This simply shows the exponential growth the industry is set to witness over the coming years.

Moreover, the Biden Administration has proposed 100% carbon-free electricity in the U.S. by 2035, further bolstering the growth prospects of solar electricity stocks.

We have chalked down two solar microinverter companies which expect stellar growth in the years to come. These inverters are used to convert direct current (DC) generated from the power of the sun in the PV module into alternating current (AC) electricity, which is fed into the electricity grid.

Let us take a closer look at the performance and future growth prospects of these stocks.

SolarEdge Technologies (SEDG)

Israel-based SolarEdge is involved in the production of solar power with offerings including power optimizers, inverters, and monitoring portals. The company’s products are used in a broad array of energy market segments including residential, commercial, and large-scale PV, energy storage and backup solutions, electric vehicle (EV) charging, grid services and virtual power plants, batteries, and uninterrupted power supply (UPS) solutions.

The product that differentiates SolarEdge from its competitors is its power optimizers, which enable enhanced cost savings by maximizing the power produced by solar panels.

SolarEdge is a truly global player with operations in more than 133 countries. To date, SEDG boasts of more than 3.5 million inverters and more than 83.9 million power optimizers delivered worldwide.

The company debuted on the NASDAQ in 2015, and yesterday, SEDG completed its underwritten public offering of 2.3 million shares and raised approximately $678.5 million.

SolarEdge has a strong balance sheet with $530 million in cash. With further cash raised, it is well placed for future growth prospects both organically and via acquisitions.

As investors flock to renewable power in times of rising gas prices, SEDG stock is up more than 20% over the past month, against a 22.3% gain over the past year.

According to a Needham report, SolarEdge is expected to post a revenue gain of over 35% for FY22. Non-GAAP earnings of $6.28 per share for FY22 are projected, reflecting growth of over 30% year-over-year.

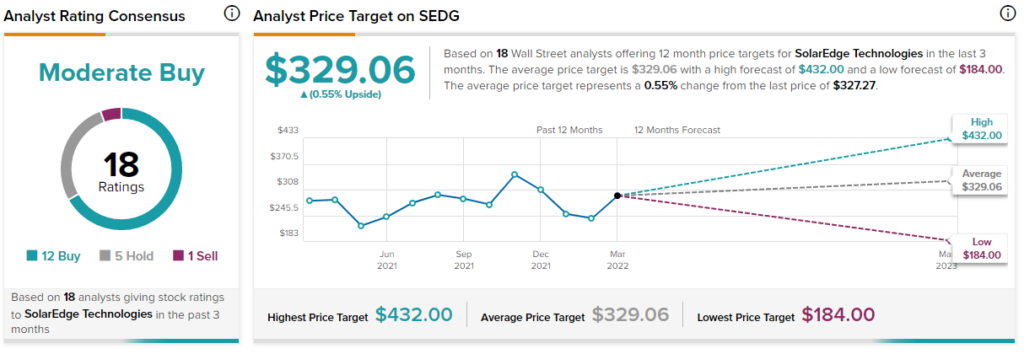

Analysts on the Street are cautiously optimistic about the SEDG stock with a Moderate Buy consensus rating based on 12 Buys, five Holds, and one Sell. The average SolarEdge price target of $329.06 implies, which the stock is almost fully valued at current levels.

Enphase Energy (ENPH)

American energy technology company, Enphase Energy offers software-driven home energy solutions, which span solar generation, home energy storage, and web-based monitoring and control. Its emphasis remains in the residential and commercial markets of North America, Europe, and Australia. The company has installed over 42 million solar microinverters on over 1.9 million homes to date.

The ENPH stock has gained over 29% in the past month as investors are seeking shelter in clean energy stocks to hedge the looming threat of high oil prices due to the ongoing war in Ukraine. Over the past year, the stock has gained 28.5%.

As per Needham’s forecast, Enphase is expected to post a revenue jump of over 44% for FY22. Non-GAAP earnings of $3.18 per share are projected for FY22, reflecting a jump of 33% annually.

Wall Street analysts have awarded the ENPH stock a Strong Buy consensus rating. That is based on 17 Buys and four Holds. The average Enphase price target of $218.79 implies 15% upside potential to current levels.

Comparative Valuation

A comparative analysis of both companies shows that currently both SEDG and ENPH are trending supremely higher than industry averages.

However, as per the analysts’ consensus price targets, SEDG seems to be almost fully valued at current levels, while ENPH stock still has room to grow over the next twelve months.

Nonetheless, the growth doesn’t stop here! Considering the wide growth prospects for the solar energy sector as a whole, every company is certain of gaining a sizable chunk of the pie. The benefits of the accelerated decarbonization shift reflect huge upside potential for both companies.

To attain the aggressive goal of securing a carbon-free world, both private sector companies and public sector policies must work hand-in-hand, which in turn will drive greater growth for all companies in the renewable energy industry.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure