We can see that there is a genuine unease in the market at the start of the Q4 results season, as the Omicron strain of COVID-19 has spread and market volatility has edged higher, owing to rising rate fears.

These anticipated interest rate rises will be good news for a few industries, such as banking, but bad news for others, such as the construction industry, as interest hikes will raise borrowing costs.

In such a market scenario, investors are likely looking for quality picks to avoid being harmed by the continued selloff. Solid corporate earnings releases from large banks like Citigroup (C) and JPMorgan (JPM) on January 14 may, however, boost investor optimism by the end of the week.

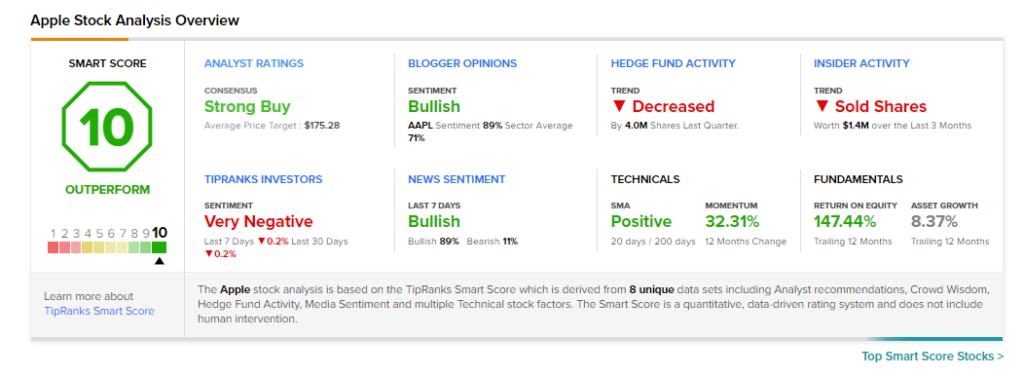

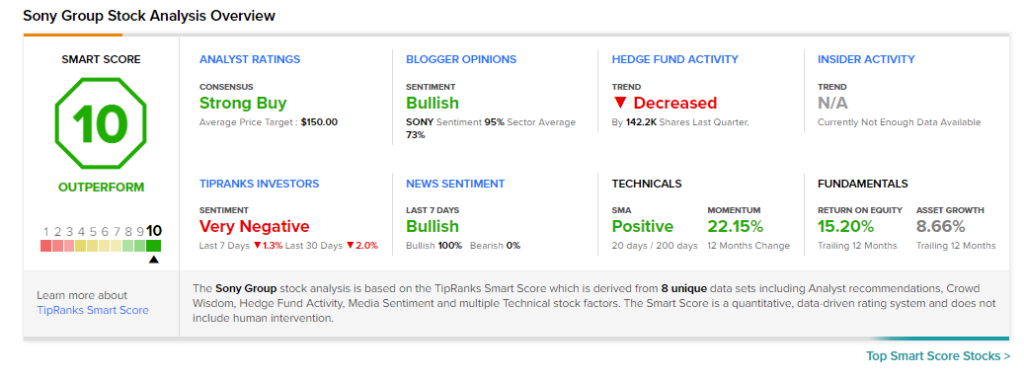

In light of this, TipRanks’ Smart Score System is a great tool for investors, since it allows them to evaluate a company in greater depth.

This technique takes eight important factors into consideration, such as hedge fund and insider trading activity, and provides a score to the equities on a scale of 1 to 10. Stocks with a ‘Perfect 10’ score are more likely to outperform the market than those with a lower score. As a consequence, it supports investors in putting together a portfolio that will maximize returns.

Using TipRanks’ Top Smart Score Stocks, we discovered two stocks that scored a “Perfect 10” on the Smart Score scale. Both these stocks also have a Strong Buy average rating.

Apple (AAPL)

Apple is a worldwide corporation that has received a “Perfect 10” rating for the past three days. The corporation is regarded as the most valuable in the world, with the highest brand loyalty.

Despite supply-chain worries, Apple’s fiscal fourth-quarter 2021 earnings were excellent. Sales increased by 29% year-over-year to $83.4 billion. In addition, earnings of $1.24 per share were up 69.9% over the year-ago quarter. Apple’s financials were driven by strong sales across all product categories.

On January 27, Apple is anticipated to release its upcoming earnings, which might function as a catalyst for the stock.

Looking ahead, the company should continue to thrive across all business segments, as noted by Citigroup analyst Jim Suva. Apple stock provides a variety of reasons for the analyst to stay positive.

First, Suva expects Apple to continue to expand its revenue, owing to robust iPhone demand and expansion in associated services. He also feels that the virtual/augmented reality business “is poised for growth,” and that Apple will profit from his upcoming hardware launches, which include a virtual/augmented reality headset. Suva goes on to say that Apple’s aggressive approach of returning cash to shareholders through dividends and stock repurchases should continue to benefit the business.

As a consequence, Suva raised his price objective $200 from $170, implying about 16.2% rise in value from present levels.

Overall, the Apple stock forecast is a Strong Buy, according to consensus from Wall Street analysts, with 26 recent assessments, including 21 Buys, 4 Holds, and 1 Sell. The stock is now trading at $172.19 and the average AAPL price target of $175.28 implies around 1.8% upside from that level.

Sony Group (SONY)

Sony Group is another consumer electronics company that has achieved a “Perfect 10” in the last three days.

The Japanese multinational has a wide business portfolio that includes professional and consumer electronics manufacturing, film production, and gaming publishing.

Recently, Sony declared its ambition to enter the electric vehicle space with new products at the annual Consumer Electronics Show (CES) in Las Vegas. The business showed an SUV version of its VISION-S concept electric vehicle. Interestingly, Sony has formed a separate firm, Sony Mobility, to focus solely on electric vehicles. Kenichiro Yoshida, Sony’s CEO, has stated that the company is “exploring a commercial launch” for its EV.

With the latest news in mind, Morgan Stanley analyst Masahiro Ono maintained his optimistic outlook on Sony and confirmed his Overweight rating.

According to Ono, Sony intends to influence the future of the mobility sector with sensor technology, 5G and cloud connection, and content that transforms the car interior into an entertainment zone. In the medium run, he expects these contributions to boost the company’s profitability.

Overall, on TipRanks, Sony Group stock commands a Strong Buy consensus rating based on 3 unanimous Buys. The shares are priced at $123.17 and the average SONY price target of $150 implies around 21.8% upside from that level.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure