Speaking of economic opportunity, and the general benefits of wide-ranging growth, President John Kennedy once said, “A rising tide lifts all boats.” As the COVID crisis fades, and economic activity starts returning to normal, we may be seeing just such a situation.

The corporate earnings season, which is underway now, is clobbering expectations for the first quarter of 2021. We’ve seen reports from 121 S&P-listed companies, and so far earnings are up 45.3% year-over-year.

Weighing in from Oppenheimer, chief investment strategist John Stoltzfus noted, “As the number of vaccines administered stateside has moved higher, business and consumer sentiment [have] broadly improved from the end of last year… for now the equity markets in our view reflect a continuing capitulation of a bearish overview of stocks and prospects for the economy that has overstayed its welcome among many investors… We continue to favor equities in the current transitional environment.”

Taking Stoltzfus’s outlook into consideration, we wanted to take a closer look at two penny stocks scoring rave reviews from Oppenheimer. These tickers trading for less than $5 per share could gain over 100% in the next year, so say the firm’s analysts. Using TipRanks’ database, we found out what exactly makes both so compelling even with the risk involved with these plays.

CASI Pharmaceuticals (CASI)

The first penny stock we’re looking at is a pharmaceutical company with one foot in each of the world’s largest markets. CASI is based in both Beijing, China and Rockville, Maryland. The company is US in origin, with Chinese operations conducted by a wholly owned subsidiary. CASI has one drug available in the commercial market; Evomela has applications in both cell transplant procedures and the treatment of multiple myeloma, and has been available in China since 2019.

In addition to Evomela, CASI has an active pipeline, featuring four drug candidates in various stages of development – from preclinical to Phase 1 or 2 trials. CASI’s pipeline focuses on hematological oncology, with drug candidates under investigation as treatments for non-Hodgkin’s Leukemia, multiple myeloma, and AML, as well as general solid tumor applications. CASI’s product line is designed for commercialization in the Chinese medical markets.

CNTC19, CASI’s most advanced program, has received a Breakthrough Therapy Designation from China CDE, due to success shown by initial data in the Phase 1 study of safety and efficacy for the treatment of relapsed B-cell acute lymphoblastic leukemia (B-ALL). The next step, a Phase 2 study for patients with B-cell non-Hodgkin Lymphoma, is currently enrolling.

Also of note, CASI’s drug candidate BI-1206 showed potential after a Phase 1/2a trial. The company believes that the drug has potential to restore activity of rituximab in patients with non-Hodgkin lymphoma, already treated with rituximab, who have relapsed. Further trials are planned for later this year.

On the financial end, CASI reported for full-year 2020 revenue of $15 million, compared to $4.1 million in 2019. This was based primarily on sales of Evomela, and exceeded the previously published guidance of $14 million for the year. The company finished 2020 with $57.1 million in cash on hand, and in March of this year, to raise capital, put over 15.8 million shares of common stock on the market. The stock sale grossed over $32 million before expenses.

Covering CASI for Oppenheimer, analyst Leland Gershell believes that the recent financing “strengthens CASI’s position as the company continues to evaluate opportunities to further expand its portfolio of differentiated oncology assets.”

The analyst added, “We believe CASI is one of a few publicly traded biotech companies positioned to achieve success by targeting the burgeoning Chinese pharmaceutical market. Through a licensing-driven business model, the company continues to build an oncology-focused portfolio of drug assets at all stages of development. Evomela is expected to grow 50%+ in 2021 and we believe the company’s CD19 CAR-T therapy for B-cell malignancies will become the preferred option in China within this competitive class.”

In line with this bullish outlook, Gershell puts an Outperform (i.e. Buy) rating on the stock, and his $5 price target implies an upside of 192% for the next 12 months. (To view Gershell’s track record, click here)

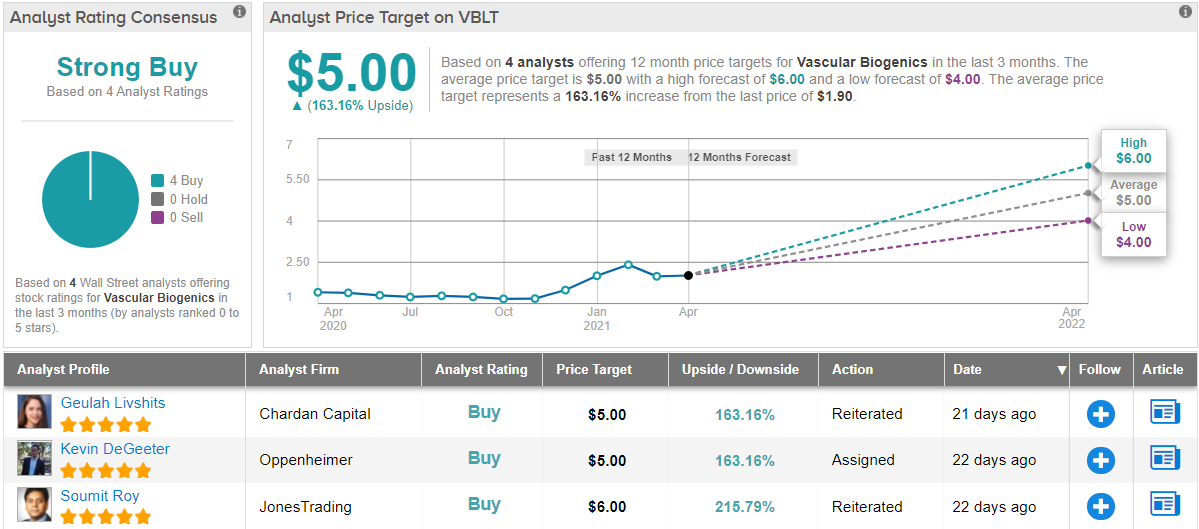

In general, the rest of the Street has an optimistic view of CASI. The stock’s Strong Buy status comes from the 3 Buys issued over the previous three months. The stock is selling for $1.70 per share, and its average price target of $4.10 suggests it has room for ~140% growth in 2021. (See CASI stock analysis on TipRanks)

Vascular Biogenics (VBLT)

Shifting focus slightly, from China to the US, we’ll look at Vascular Biogenics, a biopharma company developing treatments for both cancer and immune/inflammatory diseases.

VBLT’s leading drug candidate is VB-111, an oncology drug being investigated as a treatment for multiple solid tumors. This first-in-class gene therapy has applications for ovarian cancer, recurrent glioblastoma, colon cancer, and thyroid cancer. In a Phase 1 trial, VB-111 was shown to be well-tolerated by over 300 cancer patients across those conditions. Further successful trials included Phase 2 studies that were tumor-specific for ovarian cancer, thyroid cancer, and recurrent glioblastoma. The drug candidate is currently undergoing a Phase 3 study, OVAL, for platinum-resistant Ovarian Cancer. That study has enrolled over 200 patients, and shows high response rates in over 50% of the evaluable patients.

The next most advanced candidate, VB-201, in January of this year began dosing patients in a Phase 2 study. This randomized controlled study will investigate VB-201 as a treatment for COVID-19.

Biopharmas require funds for continued research, and Vascular Biogenetics reported finishing 2020 with $30.8 million in cash, cash equivalents, and short-term bank deposits available. In a move to increase available funds, the company made a public offering of 6.9 million shares of common stock in April. At closing, the offering had raised over $28.3 million gross capital. After deducting expenses, the company will use the proceeds to fund continuing operations.

Oppenheimer’s 5-star analyst Kevin DeGeeter is bullish on VBLT, especially with the OVAL study proceeding “on track.”

“Phase III OVAL study of VB-111 for treatment of platinum-resistant ovarian cancer demonstrates improvement in ORR in second interim analysis that translates into an overall survival benefit. The company’s prior investment in commercial-scale manufacturing allows VBLT to secure attractive partnering/takeover economics despite the relatively modest size of the advanced ovarian cancer market,” DeGeeter opined.

The analyst added, “Our differentiated outlook for VBLT is based in large measure on potential to engage FDA regarding regulatory filing based on PFS in 2H22 vs. primary endpoint of OS (2H23). We view 6-plus months of PFS as a successful outcome. Based on a disappointing update for Mersana’s XMT-1536 in January, we now view VB-111 as well positioned to be potential new SOC in r/r platinum-resistant ovarian cancer patients that have also failed prior Avastin therapy.”

To this end, DeGeeter rates VBLT an Outperform (i.e. Buy), and sets a $5 price target that suggests the stock will grow 163% from the current share price of $1.91. (To view DeGeeter’s track record, click here)

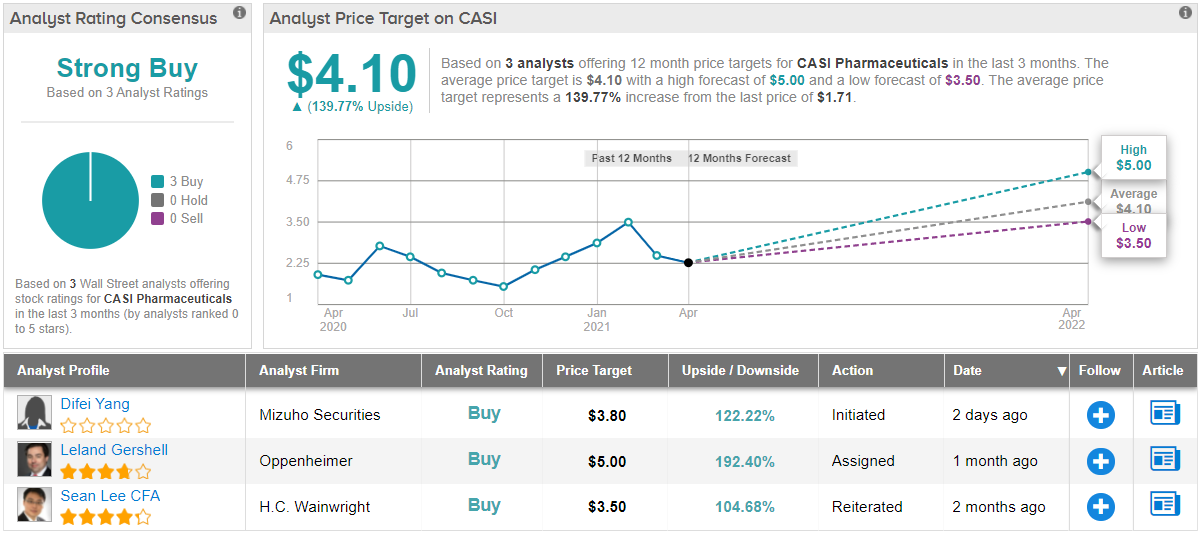

DeGeeter’s colleagues are also pounding the table on VBLT. Only Buy ratings, 4, in fact, have been issued in the last three months, so the consensus rating is a Strong Buy. With an average price target of $5 – matching DeGeeter’s above – VBLT shows room for a robust upside in the next 12 months. (See VBLT stock analysis on TipRanks)

To find good ideas for penny stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.