We’re looking at conflicting trends in the markets right now. Stocks are rising, investors are clearly not afraid to buy – but at the same time, inflationary pressures appear to be mounting in the economy at large, a trend that will, if unchecked, apply a brake to growth as the dollar weakens.

In a recent note from Raymond James, market strategist Tavis McCourt comes down squarely on the side of sustained growth moving past a temporary inflation event.

“The markets were universally fearing runaway inflation just 3 months ago, and now consensus is that economic data feels ‘peaky’ and growth and inflation will trend down after 2Q in a return to a low growth/low rate future. As evidence, this level of tightness in many markets was last seen in 2Q18… In 2018, this was soon followed by a bullish bond/bearish equity trend… the Fed was 2 years into a hiking cycle at that point, the yield curve was flat and short term rates were well above 2% – in short, we were in the late cycle. Essentially, the Fed was actively slowing demand. We simply aren’t there yet, we won’t be there until 2023/24 at the earliest,” McCourt explained.

McCourt’s colleagues among the Raymond James stock analysts have taken his bullish leanings and run with it, picking out the stocks they see as winners in the current environment. In an interesting move, they have tapped two strong dividend payers as choices for investors to buy now.

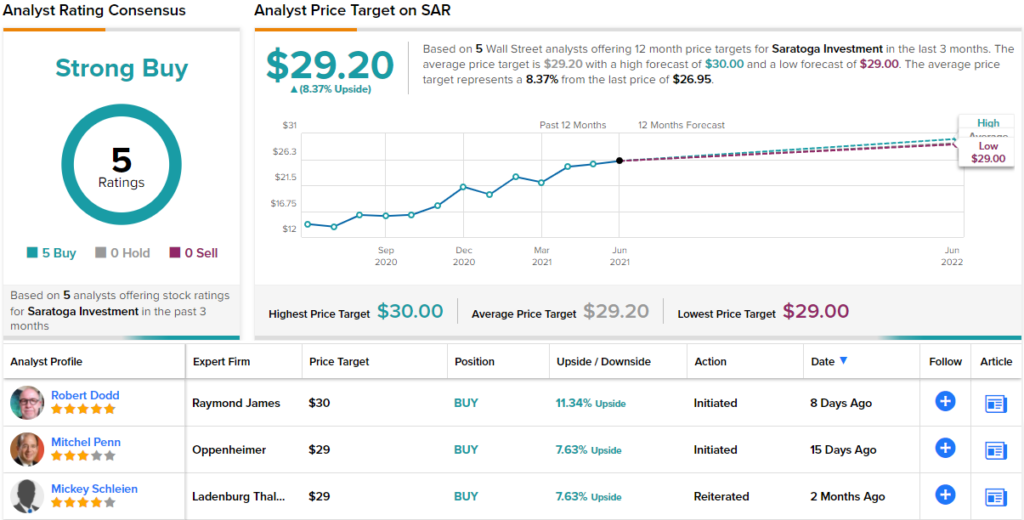

Using TipRanks’ platform, we wanted to see if other Wall Street analysts agree with Raymond James’ calls. Here’s what we found out.

Saratoga Investment (SAR)

The first stock we’ll look at, Saratoga Investment, is an investment management company focused on a mid-market clientele. Saratoga currently has over $550 million in assets under management, from a varied portfolio. The company invests in growth financing, debt refinancing, recapitalizations, acquisition financing, and leveraged buyouts, with the typical investment coming between $5 million and $30 million.

These investments are growing. Saratoga reported $554 million in total assets under management at the end of fiscal year 2021 (ended February 28), up from $485 million at the end of FY20, and $402 million for FY19.

While AUM has been expanding, Saratoga saw declines in earnings during FY21, attributed to the impact of COVID. Investment income slipped from $58.4 million to $57.6 million, while earnings per share dropped from $5.98 to $1.32.

Despite the fall in financial results, SAR shares are up over the past 12 months. The stock has gained an impressive 87% over the past year, far outpacing the broader markets.

And at the same time, Saratoga has been able to maintain its commitment to its high-yield dividend. In July of 2020, the company slashed the payout, cutting it by 28%, in response to the pressures of the pandemic crisis. But since then, Saratoga has been gradually increasing the dividend. The current declaration marked the fourth consecutive increase, and the payment is now 44 cents per share. At $1.76 annualized, this gives a strong yield of 6.6%.

This stock attracted Raymond James’ 5-analsyt Robert Dodd, who was impressed enough to initiate his coverage with an Outperform (i.e. Buy) rating and a $30 price target implying a one-year upside of 11.5%. Based on the current dividend yield and the expected price appreciation, the stock has ~17% potential total return profile. (To watch Dodd’s track record, click here)

Backing his stance, Dodd noted both the dividend potential and Saratoga’s historic overperformance, writing: “We believe SAR will continue to modestly increase its dividend from current levels (it has raised its dividend by a penny in each of the four last quarters), with projected over-earning accreting to NAV/share….

“Since inception, SAR has delivered a top quartile GAAP ROE compared to the BDC industry… Additionally, from August 2017 on, total economic return (change in NAV/ share + dividends relative to BoP NAV/share) has outperformed the industry in every quarter.”

That Dodd’s positive outlook is in accord with the Street is clear from the stock’s consensus rating – a Strong Buy, based on 5 unanimous positive reviews. The shares are priced at $26.95 with an average price target of $29.20, suggesting an upside potential of ~8% in the next 12 months. (See SAR stock analysis on TipRanks)

EnLink Midstream (ENLC)

Now let’s turn to the energy industry, an economic sector that is indispensable – and that drips cash. EnLink is a midstream company, supplying transport and marketing services to oil and natural gas producers. EnLink gathers, treats, processes, transmits, and distributes both crude oil and gas products, moving it from well heads to end-use consumers. The company has assets – 12,000 miles of pipelines and 21 processing plants – across Texas, Oklahoma, and Louisiana, as well as in the Appalachian region and the upper Ohio River valley.

Last year’s COVID-inspired economic dislocations hurt EnLink at both the supply and demand ends. Production was down, and consumers were using less fuel – but that has been reversing in recent months, and the company is recovering. Quarterly revenues have been increasing since Q3 of 2020, and while they are not yet back to the pre-pandemic peak, the 1Q21 top line of $1.25 billion was the highest of the past 6 quarters. During Q1, EnLink reduced its debt load by $100 million, and reported $94.2 million in free cash flow – after making distributions.

Distributions, of course, include the dividend. The common share payment was declared at 9.375 cents for the quarter, giving an annualized payment of 37.5 cents. At that rate, the dividend yields just over 6%, which is more than triple the near-2% average found among stocks on the S&P 500, and more than triple the 10-year Treasury bond, which is only returning 1.48%.

ENLC shares have surged 181% in the last 12 months, and that – plus the stock’s generally sound position has gotten the attention of Justin Jenkins, another of Raymond James’ 5-star analysts.

“We think ENLC should be able to narrow the valuation gap relative to mid-cap midstream at ~8.5x in a better operating environment. Further, EnLink’s financial/valuation leverage (e.g., only about ~4 turns of the current capital structure comes from equity value) suggests it will have more equity per unit upside relative to peers in a scenario in which the broader group valuation multiple were to drift higher,” Jenkins wrote.

Jenkins rates the stock as Outperform (i.e. Buy), and sets a $7.50 price target that indicates a potential for 17% share appreciation in the year ahead. (To watch Jenkins’ track record, click here)

Granted, not everyone is as enthusiastic about ENLC as Jenkins. Out of 5 analysts polled in the last 3 months, 2 are bullish on the stock, 2 remain sidelined, and 1 is bearish. Worthy of note, the 12-month average price target stands at $5.70, which implies ~11% downside from current levels. (See ENLC stock analysis on TipRanks)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.