Thermo Fisher Scientific (TMO) offers life sciences solutions, analytical instruments, specialty diagnostics, and laboratory products and services worldwide. We are neutral on the stock.

Thermo Fisher Creates Value

Great companies often have great management teams who can effectively allocate capital to profitable projects. Many professional fund managers tout the importance of meeting with a company CEO in order to gauge if that person is right for the job.

However, we may be able to get a good picture of management’s effectiveness by simply looking at the numbers. A metric we like to look at is the economic spread, which is defined as follows:

Economic Spread = Return on Invested Capital – Weighted Average Cost of Capital

The idea is very simple; if the return on invested capital is greater than the cost of that same capital, then the company is creating value for its shareholders through well-thought-out projects. Otherwise, the company is destroying value and would be better off simply investing money into risk-free bonds.

Since Thermo Fisher saw strong benefits from the pandemic, we will use the five-year average of its return on invested capital. The economic spread is as follows:

Economic Spread = 9.9% – 6.5%

Economic Spread = 3.4%

As a result, the company is creating value for its shareholders, implying that management is efficiently allocating capital. Its efficient capital allocation has translated to consistently rising diluted EPS numbers, going from $3.80 in 2012 to $21.43 in 2021.

Risks

To measure Thermo Fisher Scientific’s risk, we check to see if financial leverage is an issue. We do this by comparing its debt to EBITDA. Currently, this number stands at 2.8x.

In addition, when it comes to historical trends, its debt-to-EBITDA ratio has remained relatively flat. Overall, we don’t believe that debt is currently a material risk for the company.

However, there are other risks associated with Thermo Fisher Scientific. According to TipRanks’ Risk Analysis, the company disclosed 26 risks in its most recent earnings report. The highest amount of risk came from the Legal & Regulatory category.

Dividend

Thermo Fisher Scientific currently has a very low 0.2% dividend yield which is below the sector average of 1.37%. When taking a look at its LTM free cash flow figure of $6.8 billion, its $395-million dividend payment looks safe.

Taking a look at its historical dividend payments, we can see that its yield range has trended downwards in the past several years.

At 0.2%, the company’s dividend is near the low end of its range, implying that the stock price is trading at a premium relative to the yields investors have seen in the past.

Wall Street’s Take

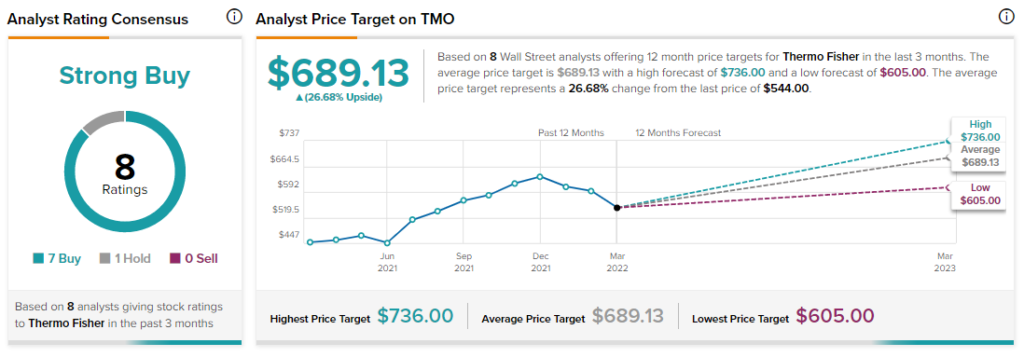

Turning to Wall Street, Thermo Fisher Scientific has a Strong Buy consensus rating, based on seven Buys, one Hold, and zero Sells assigned in the past three months. The average Thermo Fisher Scientific price target of $689.13 implies 26.7% upside potential.

Final Thoughts

Thermo Fisher is a solid business that creates value for its shareholders. In addition, the company is relatively less risky than its industry peers.

The stock is not suited for income investors due to its low dividend yield, and may not be suitable for value investors either due to its 31.4 price/FCF multiple. Nonetheless, for those looking for capital gains, analysts see solid upside potential.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure