“Attractive at current levels,” is a phrase investors have come across many times over the past year. That of course is down to the battering many equities have taken against the backdrop of economic uncertainty and persistently high inflation/rising interest rates.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

However, there is a good reason why some phrases get overused and having pulled back since its post-earnings bump, it is one used by Oppenheimer analyst Jason Helfstein to highlight the opportunity Netflix (NASDAQ:NFLX) shares currently present to investors.

After a “strong” Q4, Netflix shares surged ahead, but then due to a combination of “fears around higher churn from enforcing password sharing, slower ad launch, and Fed fears,” pulled back again. “However,” Helfstein says, “we believe nothing has changed from our original thesis: advertising increases the TAM, content competition is easing, and paid account sharing will be a long-term tailwind.”

That last point is an interesting one because although Helfstein expects the enforcement of account sharing to “drive material upside” to revenue over the long term, investors see this issue as a headwind to the stock. Dependent on the recapture rate, Helfstein forecasts revenue upside anywhere between $2–8 billion, amounting to 6– 23% to his 2023 revenue estimate. “More importantly,” notes the 5-star analyst, “the incremental revenue would be close to 100% margin.”

On where the company stands vs. the growing competition, Helfstein notes that in Q4, Netflix boasted the second highest net adds. At 7.6 million, the company trailed Paramount+ at 9.9 million, but beat Peacock’s 5 million adds, Discovery+/HBO Max’s 1.1 million and Hulu’s 0.8 million, while Disney+ shed 2.4 million subs. Peacock and Disney+ aside, all streamers’ outlook calls for increased content spend.

“However,” Helfstein added, “all competitors talked about increased focus on profitability, especially through reduced marketing expenses.” To the analyst, this suggests we are now “past peak competition.”

To this end, Helfstein rates NFLX stock as Outperform (i.e. Buy) alongside a $415 price target. The implication for investors? Upside of ~37% from the current trading price. (To watch Helfstein’s track record, click here)

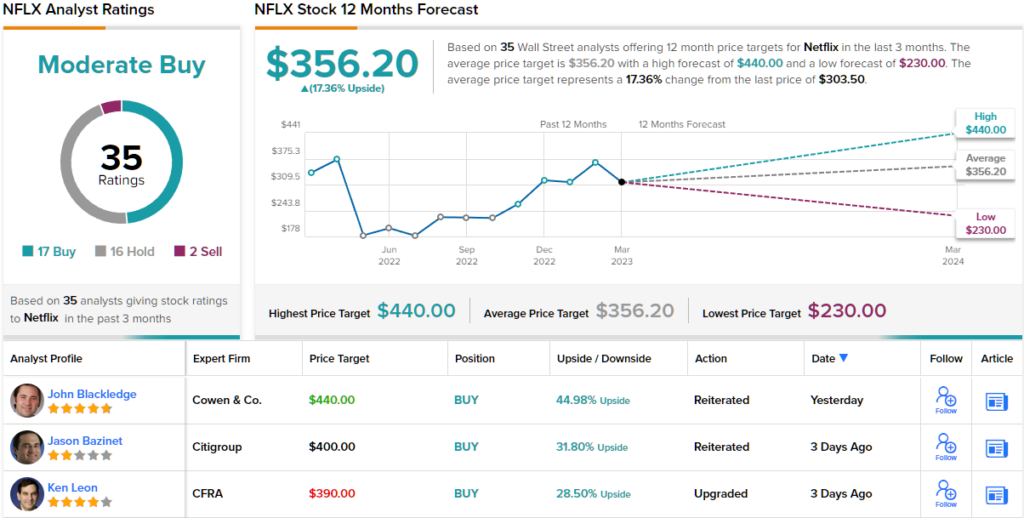

Looking at the ratings breakdown, based on 17 Buys, 16 Holds and 2 Sells, the analyst consensus rates this stock a Moderate Buy. According to the $356.20 average target, a year from now the shares will be changing hands for a 17% premium. (See Netflix stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.