The latest disclosure by House Speaker Nancy Pelosi shows that the Democratic leader has lost a little less than a million dollars in recent trades (buy and sell). The trades were carried out under her husband Paul Pelosi’s name and showed the sale of call options on chip stocks, Micron Technology (NASDAQ:MU) and Nvidia (NASDAQ:NVDA).

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Meanwhile, Pelosi exercised call options on technology giant Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) and bought stock worth $2 million (20,000 shares). At the same time, he also let 50 call options on media powerhouse Walt Disney Co. (NYSE:DIS) expire for a loss of $132,824. Interestingly, these trades were carried out just a few days before the House proposed a bill banning members of Congress and their spouses from engaging in individual stock trades.

Notably, the regulatory filing showed that on September 16, Pelosi sold 100 call options of MU stock, marking a loss of $392,575. Also, he sold 50 call options of NVDA stock and recorded a loss of $361,476.

In stark contrast, Pelosi’s made millions by betting on big tech names last year. Let us look at each of the three stocks that have generated a loss for the congressional leader.

Micron Technology (NASDAQ:MU)

Micron produces computer memory and computer data storage products, including dynamic random-access memory, flash memory, and USB flash drives. Amid the sluggish demand for personal computers and supply chain snarls affecting the chip industry, MU stock has lost 43.8% so far this year.

What is the Target Price for MU Stock?

On TipRanks, the average Micron Technology price target is $65.04, which implies 21.6% upside potential to current levels. Also, analysts have a Moderate Buy consensus rating on Micron stock. This is based on 21 Buys, four Holds, and two Sells.

Nvidia (NASDAQ:NVDA)

Nvidia designs and manufactures computer graphics processors, chipsets, and related multimedia software. Owing to the downturn in the semiconductor industry, NVDA stock has lost 60.5% so far this year.

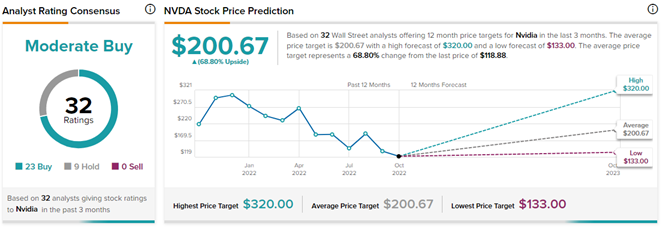

What is a Good Price for Nvidia Stock?

Currently, NVDA is trading at a steep discount from its 52-week high of $346.47, representing a good entry point. On TipRanks, NVDA stock has a Moderate Buy consensus rating based on 23 Buys and nine Holds. The average Nvidia stock prediction of $200.67 implies 68.8% upside potential to current levels.

The Walt Disney Company (NYSE:DIS)

Entertainment and media powerhouse Walt Disney Co. has several offerings, including amusement parks, media networks, production houses, and direct-to-consumer streaming. DIS stock has lost 37.9% year-to-date, owing to the tough macroeconomic backdrop.

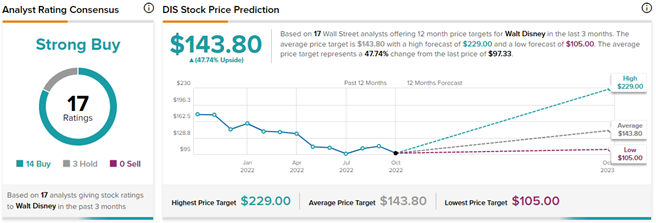

What Are Analysts Saying About Disney?

Wall Street analysts are highly optimistic about Disney’s stock trajectory. On TipRanks, DIS stock commands a Strong Buy consensus rating based on 14 Buys and three Holds. The average Walt Disney price forecast of $143.80 implies 47.7% upside potential to current levels.

Parting Thoughts

Paul Pelosi’s recent trades have resulted in a loss this time around. However, his past trades have shown the full potential to attract huge profits. The current macroeconomic backdrop is such that even the best of investors may lose the game. Nonetheless, an investor may choose to follow Pelosi’s trades to make informed decisions.