Food inflation and ‘lunchflation’ is the new table talk for Americans. However, while they talk about inflation while enjoying a beef steak, little do they realize that they are partially responsible for the rising food prices, especially meat.

Americans have been eating too much meat over the past two years. While this could have been good news for the meat industry, the truth is quite the opposite. According to agricultural economists, meat demand has burgeoned during the pandemic, leading to a shortage of slaughterhouse beef capacity.

U.S. cattle ranchers are shrinking their cattle herds to survive the inflation, and various reasons are behind it.

A Chicken-and-Egg Situation

The issue going on in the meat industry has so many facets that it is difficult to understand which is causing what. Inflation has seeped into everything. Inevitably, the costs of maintaining cattle for slaughter, especially costs of fodder, have become more expensive.

Moreover, making matters worse are the persistent droughts in the Western U.S. that are drying up the grazing pastures, leading ranchers to depend more on supplemental feed.

This is making it increasingly difficult for beef farmers to make ends meet, especially given the oligopoly created by a handful of companies in the meatpacking industry, who are notoriously keeping large margins for themselves, overcharging customers due to the high demand (which is feeding the inflation), and underpaying the ranchers/meat farmers.

Federal data found that to survive in these inflationary times, ranchers are selling their calves into feedlots more rapidly. This means that the volume of cattle available for slaughter later this year and next year is rapidly declining. Earlier this month, the U.S. Department of Agriculture revealed that in 2023, beef production is likely to remain under pressure, declining about 7% year-over-year along with record-high levels of cattle prices.

Now, these higher prices mean higher costs for members of the oligopoly. As their profits take a hit, meatpackers like Tyson Foods (TSN), JBS (JBSAY), Cargill, and National Beef Packing, are expected to raise consumer meat prices higher, leading to a vicious cycle.

Breaking the Cycle

However, two reasons are threatening to put a stop to the hefty profits enjoyed by beef processors and packers for the past two years — the Biden administration’s crackdown on the oligopoly and meat consumers looking for cheaper meat options, like chicken.

Amid these rising prospects for chicken, two chicken processors are positioned to gain popularity among non-vegetarian Americans.

Pilgrim’s Pride (NASDAQ: PPC)

Pilgrim’s Pride produces, processes, and distributes fresh, frozen, and value-added chicken products to various sources. The stock has returned 19.50% so far this year.

Pilgrim’s Pride’s approach to doing business is highly customer-centric. Moreover, its efforts to invest in the marketing of its brands have enabled it to enter new regions and penetrate new markets.

Additionally, its frequent supply-chain improvements ensure that the company is updated in terms of cost and performance efficiencies. As part of this effort, Pilgrim’s Pride is investing about $100 million towards building robots for its processing plants to increase production efficiency and address labor shortage issues.

Moreover, acquisitions have been helping the company grow and expand its business. In September last year, Pilgrim’s Pride acquired the Meats and Meals business of Kerry Consumer Foods, strengthening its business by bringing the acquired business under PPC’s European operations as a separate business division.

Last month, BofA Securities analyst Peter Galbo reiterated a Hold rating on the stock but raised the price target to $32 from $28.

Overall, Wall Street maintains a Moderate Buy consensus rating on PPC stock based on two Buys and one Hold. The average Pilgrim’s Pride price target of $31.33 implies 6.7% downside.

Sanderson Farms (NASDAQ: SAFM)

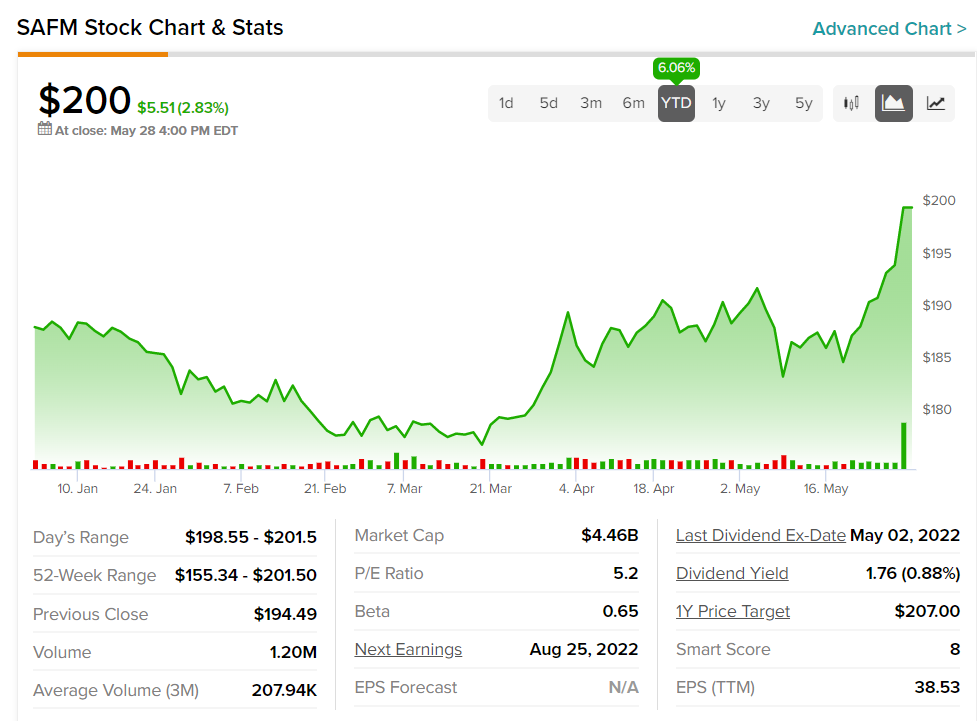

Poultry processing company Sanderson Farms deals in the production to distribution of fresh, frozen, further processed, and partially cooked chicken products. The stock has gained about 6% in the year-to-date period.

Sanderson is the third-biggest chicken producer in America, and it recently reported its highest earnings per share in Q1. The average selling price for the company’s chicken was around 34% higher year-on-year, while costs for feed increased 14%. Strong demand for chicken helped the company tide over supply-side snarls.

Most importantly, the company is being acquired by meat processing rival Cargill Inc. and Continental Grain Co., in a $4.53 billion deal expected to be completed in the first half of 2022. This announcement comes amid criticism by the government of the growing consolidation in the meat industry. Notably, a few companies like Cargill have gobbled up smaller fishes in the industry in order to gain control in the market.

Recently, J.P. Morgan analyst Kenneth Goldman, who is the only Wall Street analyst covering the stock in the past three months, reiterated a Hold rating on the stock with a price target of $207. However, bearing in mind the strong performance of the company, its upside potential, and its impending buyout, investors entering the company right now are likely to profit in the short term.

Parting Thoughts

Demand for chicken is expected to spike in the upcoming months due to the shortage of beef in the market that is likely to persist throughout the rest of the year and well into 2023. This demand will bode well for companies dealing in chicken processing and distribution.

Moreover, the upcoming National Fried Chicken day on July 6 is also expected to be a demand booster amid the already upbeat prospects, giving ample opportunity for investors to cash in.

Full Disclosure