GrubHub (GRUB) has sent Uber on its way, as it will sign on the dotted line with European company Just Eat Takeaway.

Yesterday, the Nethe rlands-based food-delivery company announced that it had made an agreement with Grubhub to purchase the US food delivery app. The all share deal is worth $7.3 billion and not only represents consolidation of a food delivery powerhouse – the largest food delivery service outside China – but a coup for Just Eat, as up until yesterday, Uber Eats and GrubHub had been in talks regarding a possible merger.

According to Just Eat, the deal will result in the new company having 70 million active customers in 25 countries. The acquisition is expected to close early next year.

For a while now, GrubHub has been losing its footing in the food delivery space as the company has found it difficult to maintain a leading position in a competitive environment with other well-funded players such as Uber Eats, DoorDash and Postmates grabbing increasing market share.

GrubHub, though, dominates New York – where it has a 62% market share, along with other big Northeastern cities such as Chicago and Boston.

GrubHub shares popped in May by over 21% when rumors of the possible Uber merger began circulating. But the two players couldn’t reach an agreement, while possible antitrust issues also played their part with fears a merger would result in regulatory heat.

Following the news, Oppenheimer analyst Jason Helfstein has dropped his coverage on GrubHub stock.

Despite the win for Just Eat, the 5-star analyst is perplexed by the deal, and notes GrubHub’s “expensive valuation.” Helfstein said, “We struggle with the logic of this transaction given: 1) limited synergies (partial R&D, at best); and 2) lack of “real” consolidation in US will cause sustained promotions and incentives, now funded by TKWY.NL. As result, we would expect UBER/DoorDash or DoorDash/Postmates to pursue deals, even in the face of regulatory scrutiny, which could become moot if fee caps remain permanent.” (To watch Ellis’s track record, click here)

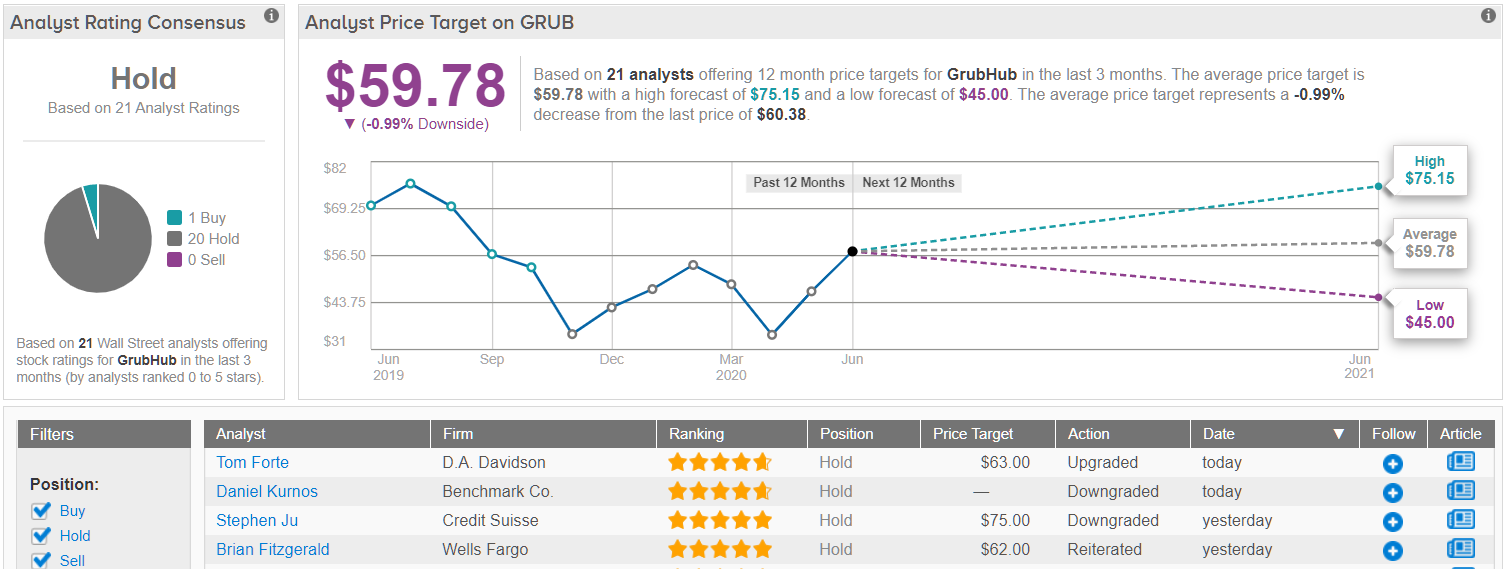

If we turn to the Street in general, we can see that the GRUB has a Hold analyst consensus rating, based on single Buy rating and 20 Holds. Given that GRUB is currently trading at $60.38, the average price target of $59.78 implies a modest downside. (See GrubHub price targets and analyst ratings on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.