Sometimes, when a top executive leaves a company, there’s a big party with a cake and maybe some gifts to celebrate the good memories. Generally, this type of event should mark an optimistic transition to a new chapter for a company.

This, unfortunately, wasn’t the scenario, as an executive at The Gap (GPS), a clothing and accessories retailer, surprised many onlookers with an announcement that she was stepping down from her position at the company. The mood certainly wasn’t festive as the C-suite transition comes at a difficult time for The Gap and U.S. retail store chains in general.

Indeed, the mood is decidedly sour among some stock traders as The Gap’s departing executive provides warnings about the company’s fiscal outlook. Shares finished over 5% lower today. So, you can leave your champagne and party hat at the door as we delve into the numerous gaps in the bull case for The Gap. I am bearish on the stock.

Sometimes, Dividends Just Aren’t Enough

When a company offers a high dividend yield, this can be a good sign. It could indicate that the company is in a strong financial position. Besides, what investor doesn’t like to receive a hefty cash payment every three months?

However, a generous dividend yield shouldn’t always be equated with a financially-sound business. When a company has serious financial problems, investors have every right to wonder whether its dividend is sustainable. Furthermore, big dividend payments won’t make up for even bigger share-price declines.

Thus, we have GPS stock, which has skidded all year long. Just 12 months ago, it was a $32 stock. Nowadays, it’s trading in the single digits. Even The Gap’s generous ~7% forward annual dividend can’t make up for long-term investors’ losses.

Overall, 2022 has been a downbeat year so far for The Gap. The company’s fiscal first-quarter results were disappointing, with the company reporting a 12.9% year-over-year decline in revenue and a 14% downturn in same-store sales. Perhaps worst of all was The Gap’s quarterly loss of 44 cents per share, which was much worse than the 13 cents analysts had expected.

The Gap is known as a shopping-center-based retail store chain, but the company does have an online presence. However, its 17% year-over-year decline in online sales reminded investors that this company is definitely not an e-commerce specialist.

In light of these underwhelming results, it’s understandable that CreditSights analyst James Goldstein maintained an Underperform rating on GPS stock.

Goldstein even went so far as to suggest that The Gap’s free cash flow could end up in negative territory after interest and capital expenditures. Clearly, The Gap had hit rock bottom, and things couldn’t get any worse for the company – right?

The CEO Leaving a Sinking Ship Signals Trouble Ahead

It might not be exactly accurate to say that CEO Sonia Syngal is abandoning The Gap now. However, Syngal did create shockwaves when she recently announced that she was leaving The Gap. She’ll be replaced by the company’s executive chairman, Bob Martin, but only on an interim basis.

This is a tough time for The Gap to undergo such a major transition, as the company is gearing up to report its second-quarter earnings on August 25. This will be a high-stakes data release because investors will want to know if The Gap has been able to manage threats from e-commerce retailers, supply-chain constraints, and high inflation.

Even the company itself seems to acknowledge that its prospects of success aren’t strong. In the press release announcing Syngal’s departure, The Gap admitted that it “continues to navigate margin headwinds.”

Furthermore, the company “still expects to incur an estimated $50 million of transitory incremental air freight expense” during the second fiscal quarter, along with “inflationary costs on raw materials and freight.”

Consequently, it’s advisable for investors and onlookers to keep their expectations low. For 2022’s second fiscal quarter, The Gap is bracing for net sales to “decline in the approximately high-single-digit range,” which isn’t particularly ambitious. Moreover, the company warned that it expects to report a quarterly adjusted operating margin percentage of “zero to slightly negative.”

So, is Syngal leaving a sinking ship? Put it this way: during her tenure as The Gap’s CEO, the GPS share price fell 21%. As a basis of comparison, the S&P 500 (SPX) rose 43% during that time.

Wall Street’s Take on GPS Stock

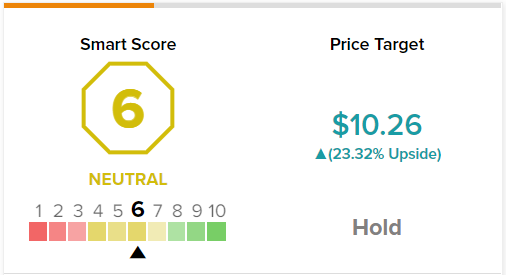

Turning to Wall Street, GPS stock comes in as a Hold based on two Buys, 10 Holds, and six Sell ratings. The average Gap price target is $10.26, implying 23.3% upside potential.

The Gap’s Smart Score Rating

Interestingly, on TipRanks, GPS scores a 6 out of 10 Smart Score rating. According to this indicator, the stock is likely to perform roughly in line with the broader market, going forward.

The Takeaway – More Downward Revisions are Likely; Risks Remain

Don’t be too surprised if analysts soon have to revise their price targets lower for GPS stock. It’s been a toxic asset in 2022 so far, and even a 7% dividend yield isn’t making up for the stock’s rapid decline in value.

On the bright side, at least The Gap might be able to start a new chapter with a CEO change. The way things are going for this struggling retailer, however, The Gap’s final chapter might come sooner than expected.