U.K.-based Farfetch (FTCH) may be better known overseas than it is among U.S. investors. If it is on your radar, you know full well how last year’s pandemic-related tailwinds dramatically boosted both the results and the share price of this luxury e-commerce platform.

Briefly falling to high single-digit prices at the onset of the pandemic, the stock went on two parabolic runs in the ten months that followed. First, with COVID-19 becoming a tailwind for e-commerce, the stock took off on a big run from its low (around $8 per share), up to around $25 per share by October.

With the vaccine rollout, Farfetch went on another jaw-dropping run. However, after soaring from $25 per share to nearly $74 per share, it has been on a downward slide.

The reason? For one, markets have been cycling out of e-commerce stocks as the world continues to recover from the impact of COVID-19 and reduce its internet use. Additionally, Farfetch faces downward pressure resulting from the blow-up of family office Archegos Capital. Both factors may point to continued lower prices, but we may be approaching a point where the dust is ready to settle.

Farfetch’s Growth Story Remains Strong

As hinted above, 2020 saw a material improvement in the company’s key performance metrics.

Revenues soared 64% year-over-year, and gross merchandise value, or GMV, saw a 49% boost. Additionally, after years of this early-stage company operating in the red, it’s finally generating positive adjusted EBITDA. Furthermore, the company’s growth last year was not a “once and done” event.

Given the unique circumstances of last year, analyst projections call for growth to slow a bit in 2021. However, with sales expected to grow at a 30%-plus clip this year and the next, there’s still a growth story at play here. Losses per share are also expected to narrow, as the company is finally scaling up to profitability. (See Farfetch stock analysis on TipRanks)

That said, these strong results and booming prospects were not enough to absorb the Archegos Capital blow-up. Archegos, which held a large stake in FTCH, sold off huge amounts of its holdings, including Farfetch shares. Farfetch was also affected by the cycling out of e-commerce stocks. However, with the impact of these factors fading, we may be getting close to a point where shares could begin a recovery.

Moving Towards A Solid Entry Point

The liquidation of Archegos may be wrapping up, and the cycling out factor could be played out as well. Does that mean shares are ready to bounce back?

On the one hand, at today’s prices ($48.99 per share), FTCH stock has a more reasonable valuation. On the other hand, a price-to-sales ratio of 10.4 is by no means “cheap.”

Yet, considering its high levels of projected future growth and its more richly priced e-commerce peers, which sport higher price-to-sales ratios, Farfetch shares are trading at a more than fair price.

Moreover, based on the analyst community’s continued bullishness, shares could be set to see a decent boost.

What Analysts Are Saying About Farfetch Stock

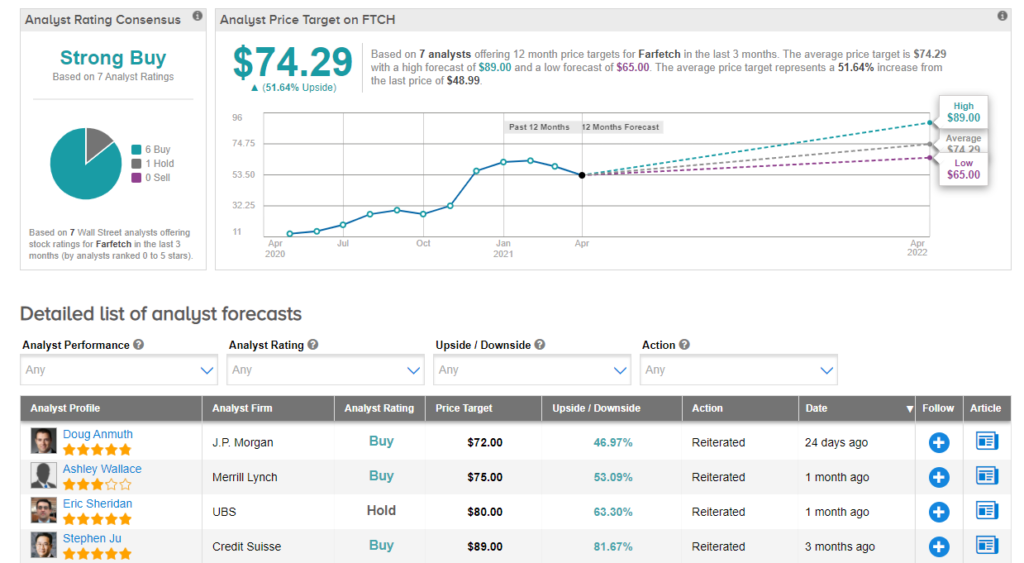

According to TipRanks, FTCH stock comes in as a Strong Buy. Out of 7 analysts covering the stock, 6 rate it a Buy and 1 rates it a Hold.

As for price targets, the average analyst price target on FTCH stock today is $74.29 per share, implying around 51.64% upside potential.

Takeaway

The negative factors, such as the Archegos blow-up and e-commerce stock sell-off, have largely played out.

In addition, with high growth (30%-plus) still in the cards, the stock could see a nice recovery as it finds a near-term bottom.

Bottom line: as the dust starts to settle, investors should keep an eye on FTCH stock.

Disclosure: Thomas Niel held no position in any of the stocks mentioned in this article at the time of publication.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.