The ball hasn’t fallen yet, but we’re already able to discern some outlines of what 2024 will have to offer for investors. An improving economic environment will likely give consumers more confidence, and that will have ripple effects at many levels. One sector certain to reap gains: internet stocks.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

According to Wedbush, in a recent note authored by a team of digital economy experts, those gains will be broad-based – but eCommerce and online advertising will be particular beneficiaries as consumer spending ramps back up. Increased consumer activity will boost the eCommerce/online retail segment, which in turn will find itself required to spend more on digital advertising and media. The result will be rich opportunities for investors willing to buy in.

Laying out his vision for the year ahead, leading the Wedbush team, Scott Devitt presents the bullish case. “Looking ahead to 2024, we believe leading consumer internet platforms remain well positioned with rising margins and improving industry growth rates across eCommerce and digital advertising,” the 5-star analyst explained. “We expect more normalized growth rates for eCommerce and digital advertising in 2024 with both industries positioned to accelerate next year. eCommerce penetration of total retail should rise 99bps in the U.S. in 2024 while digital advertising’s share of total U.S. media spend will increase 230bps to ~77%.”

Specifically, Devitt has earmarked three names as his top internet stocks for 2024. All are giants holding commanding positions in the digital world, and more than capable of bringing returns to their investors. And it is not only Devitt who sees these stocks as ones to own. According to the TipRanks database, all are currently rated as Strong Buys by the analyst consensus. Let’s take a closer look.

Amazon (AMZN)

The first Wedbush pick we’ll look at is Amazon, the $1.57 trillion giant of the online retail world. This survivor of the original dot.com bubble has built itself into the dominant player in eCommerce, basing its business on two solid pillars: one of the world’s most trafficked retail sites, boasting more than 2 billion hits per month, and a global brick-and-mortar network of nearly 300 warehouses, some of which total over 1 million square feet. Working from this base, Amazon generates approximately $1.47 billion in daily sales revenue.

Online retail is only one facet of Amazon’s business, however. The company has plenty of pots on the burners, and customers can find a wide array of online services, including the TV streaming service Prime; audiobooks; home automation, with Alexa, the voice-activated personal assistant interface; and the cloud computing subscription service AWS. These online services bring digital convenience to bear on businesses, on home offices, and on everyday life.

Put into financial terms, Amazon’s varied business lines brought in $143.1 billion in revenue for 3Q23. This total included a 16% increase in international retail sales – but also worthy of special notice in the company’s gains were AWS, which saw $23.1 billion in quarterly revenue for a 12% year-over-year gain, and advertising services, which rose 25% year-over-year to bring in $12.06 billion in revenue. Overall, Amazon saw a 12.6% y/y increase in revenue for the third quarter, and beat expectations by $1.54 billion. Elsewhere, operating income rose to $11.2 billion in Q3, significantly higher than the $2.5 billion generated in 3Q22.

For Wedbush’s Devitt, the key points here are Amazon’s growth in AWS and advertising service – he sees those segments as likely to continue lifting Amazon in the near future. Devitt writes, “Amazon is our top pick across our internet coverage, and we think the company is well positioned for 2024 as retail margins continue to rise, AWS accelerates against easing comps, and advertising revenue growth continues to materially outperform the broader digital advertising industry. As retail capacity utilization further improves, Amazon’s higher margin businesses also continue to become a larger share of the overall revenue mixing, leading to higher consolidated operating margins.”

These comments support Devitt’s Outperform (Buy) rating, and his $210 price target indicates his confidence in a one-year upside potential of 38%. (To watch Devitt’s track record, click here)

This giant of the online commerce field has picked up 42 recent reviews from Wall Street’s analysts – and they are all unanimous that this is a stock to Buy, giving AMZN its Strong Buy consensus rating. The shares are trading for $151.94, and their $181.05 average target price implies a gain of 19% over the coming year. (See Amazon’s stock forecast)

Meta Platforms (META)

From the giant of online retail, we’ll turn our attention to the giant of social media. Meta Platforms is well known, having been set up by Mark Zuckerberg. Zuckerberg, most famous as the early developer in social media, created the company to be a parent/holding firm for his social media concerns – Facebook, Messenger, Instagram, and WhatsApp. Meta’s dominance of the social media world can be summed up in one number: the 3.96 billion monthly active users (MAU) the company reported in the third quarter of this year, or more than half the world’s total population.

That MAU number was up 7% year-over-year, and well over the 3.88 billion that had been expected – and it included gains across the drill downs. Facebook, the largest platform, had 3.05 billion monthly active users in Q3, up 3% y/y, and a 5% y/y increase in daily active users, to 2.09 billion. Overall, the ‘Family of Apps’ showed a 7% y/y increase in daily active users, to 3.14 billion. The forecast had been for 3.09 billion.

These numbers were accompanied by solid monetization figures in Meta’s newer media, particularly the Reels short video format. Reels became a net-neutral figure relative to consolidated ad revenue in 3Q23, and has a $10-billion-plus run rate. The company’s click-to-message ads also boast a run rate above $10 billion.

All of this helps cement Meta’s position as a leader in the constantly evolving landscape of online advertising and commerce – and shows the company’s ability to make progress despite the reputation of its flagship platform, Facebook, as a haven for older social media users.

Meta’s expansions in its social media reach have been accompanied by a move into AI initiatives, designed to automate and smooth the online experience. These initiatives include the use of AI to facilitate translation operations for speech-to-text, speech-to-speech, text-to-speech, and text-to-text in up to 100 languages – an important capability for a company with a world-wide reach. Meta plans to continue refining its AI technology, and to incorporate newer technologies, such as augmented, virtual, and mixed reality technology, into its family of platforms. The possibilities inherent in AI and VR technologies are nearly endless, and Meta aims to explore as many as it can imagine.

On the financial site, Meta last reported results for 3Q23. The company had a top line of $34.15 billion, beating the forecast by $700 million and growing 23% y/y. At the company’s bottom line, the EPS of $4.39 per diluted share, came in 76 cents better than had been anticipated. META shares posted growth of a huge 194% during 2023.

Checking in again with analyst Devitt, we find him laying out several reasons to keep a bullish stance on the stock. He says, “We expect Meta to benefit from improving monetization of new products (Reels, click-to-message), with Reels providing a modest tailwind to revenue in 2024 after becoming revenue neutral and as short-form video spending increases… Advantage+ Shopping Campaigns reached a $10B+ annualized run rate in 3Q23, and we expect healthy adoption of Advantage+ will continue in 2024… New generative AI features like Meta AI (chatbot assistant) and AI avatars on Facebook & Instagram have the potential to increase engagement in 2024 and beyond.”

At his own bottom line, Devitt rates META shares as Outperform (Buy), with a $420 price target that implies a gain of ~18.5% for the next 12 months.

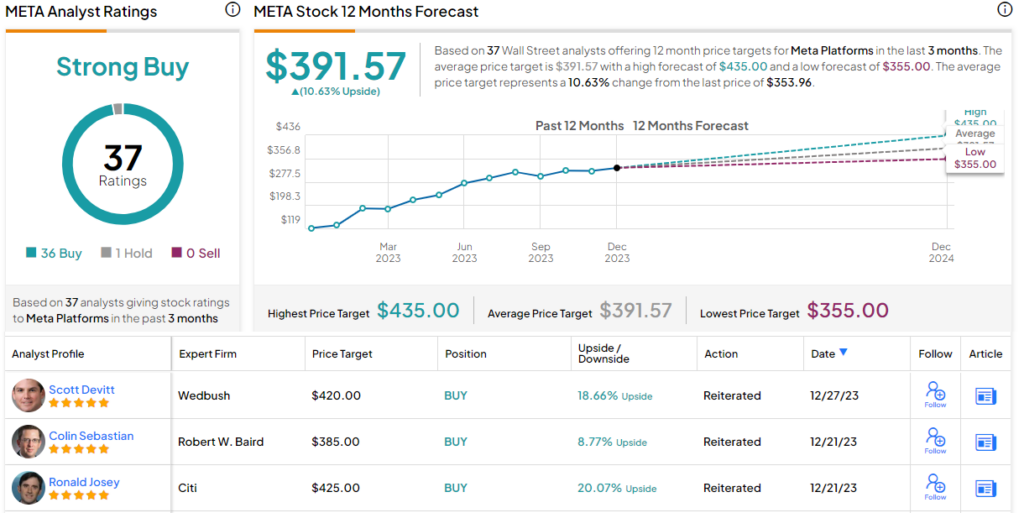

Scott Devitt, of course, is far from the only bull on Meta. The company’s stock has picked up 37 reviews from the Street recently, and these break down in a decidedly lopsided 36 to 1 in favor of Buys over Holds, making the consensus a nearly-unanimous Strong Buy. The shares are currently trading for $353.96 and their average price target of $391.57 suggests a ~10.5% one-year upside potential. (See META stock forecast)

MercadoLibre (MELI)

Last on our Wedbush-backed list of internet stocks is one of Latin America’s leading online retail companies. MercadoLibre, from its base in Uruguay, focuses its operations on the vast area ‘south of the border,’ from Mexico to Argentina and Chile. While this region is sometimes overlooked, it is a potential powerhouse – with a population over 659 million and collective GDP of $6.82 trillion (per World Bank data) in 2022. The region boasts a growing middle class, that is eager to improve its standard of living. In short, this is fertile ground for an aggressive online retailer.

MercadoLibre has been operating in that niche for the better part of two decades, and has built itself into the regional leader. The company boasts a market cap of almost $80 billion, and describes its business as ‘a trusted, agile, and people-centric ecosystem,’ split into two branches: Mercado Libre, for eCommerce, and Mercado Pago, for fintech. The company describes its business culture as taking an attitude of ‘continuous beta,’ always innovating to implement new ideas, and testing everything, with the twin goals of developing the strongest possible competitive advantage and giving customers and users the best possible experience.

This foundation has allowed MercadoLibre to build a solid business edifice. Looking at some basic statistics from the company, we find that it boasted 120 million unique active users at the end of 3Q23, up from 88 million one year earlier. During the quarter, the company sold 357 million unique items, and shipped 350 million items. Year-over-year, these figures were up 25% and 26% respectively. The company’s total payment volume came to $47.26 billion, up 46% y/y.

When we turn to the headline metrics – revenue and earnings – we find that MELI reported total Q3 revenue of $3.8 billion, up 41% y/y and some $250 million over the estimates. On a foreign exchange neutral basis, the company’s revenue was up 69% y/y. On the bottom line, the company reported a net income available to shareholders of $7.18 per common share; this was $1.35 better than the forecast – and was up significantly from the $2.57 reported in the prior-year period.

When Devitt turned his eye to this Latin American eCommerce powerhouse, he was impressed by the company’s clear potential for further gains, writing, “MercadoLibre’s consolidated eCommerce take rate (excluding 1P) will reach 15.9% in 2023, below marketplace peers in the U.S. and we see a clear path to deeper monetization over time driven by fulfillment adoption, advertising growth, and scale. We expect ~50bps of take rate expansion in 2024… MercadoLibre’s take rate should trend higher over time due to adoption of its advertising and fulfillment services. MeracdoLibre’s Advertising revenue grew 70%+ Y/Y (ex -FX) in 3Q23, marking the sixth consecutive quarter of advertising growth above 70%. Advertising revenue is nearing 1.7% of GMV (implying ~$886mm of revenue in FY24).”

For Devitt, this justifies another Outperform (Buy) rating, and he backs that up with an $1,800 target price – pointing toward a 14.5% increase in share value during 2024.

Over the past 3 months, 12 analysts have weighed in on MELI, and they have given the stock 10 Buy ratings to just 2 Holds – for a Strong Buy consensus view. The stock’s average target price, currently standing at $1,715.5, suggests a potential 12-month upside of 9% from the current trading price of $1,571.54. (See MercadoLibre’s stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.