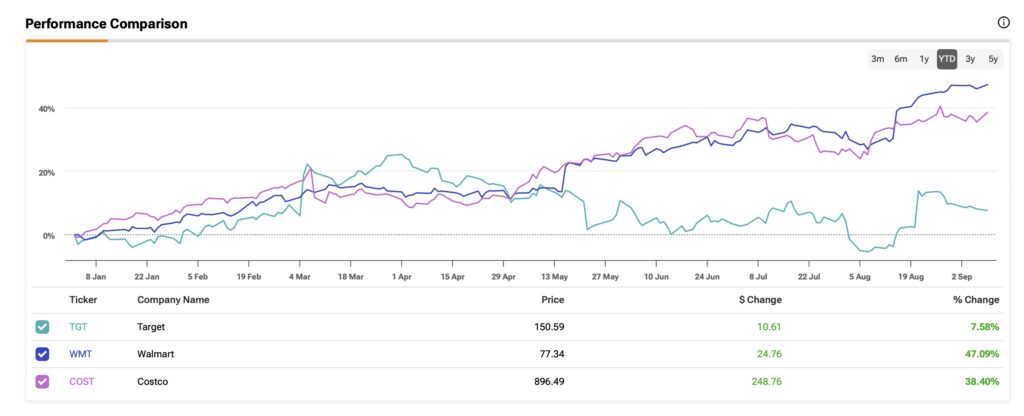

Retail giants like Target (TGT), Walmart (WMT), and Costco (COST) have all performed strongly, particularly since August, thanks to reports of a rebound in U.S. retail sales in July, which suggest robust consumer spending despite ongoing economic challenges. In this article, using the TipRanks Stock Comparison tool, I’ll detail why Target, which I view as a Buy, may be a better investment choice moving forward compared to Walmart and Costco, where I maintain a Hold stance.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Target (TGT)

Starting with Target, the company’s strong investment case is built around its well-integrated omnichannel fulfillment network. This network allows Target to leverage its physical stores for same-day services, a capability that often surpasses what e-commerce giants like Amazon (AMZN) can offer. Additionally, Target’s exclusive private label brands enhance customer loyalty and generate higher margins.

Target’s shares have seen significant volatility, with a 52-week range of $181.86 to $102.93, largely due to external economic uncertainties affecting discretionary spending. However, since early August, Target has rallied sharply, buoyed by Walmart’s unexpectedly strong earnings, which have positively impacted retail stocks overall.

Moreover, Target’s Q2 results provide further reassurance that consumer spending is stabilizing. The company reported a 2% increase in comparable sales for the second quarter, which is at the higher end of its expectations. Store traffic grew by 3% compared to the previous year, with all six core merchandise categories showing growth in traffic.

TGT’s Valuation, Dividends, and Wall Street Consensus

A key point in my bullish thesis on Target is its attractive valuation. The company currently trades at a forward P/E ratio of 15.6x, which is approximately 13% below the industry average and 17% below its historical average over the past five years.

Furthermore, Target excels with its appealing dividend yield, currently at 3.1%, which is about 30% above its five-year average. In the second quarter alone, the company paid out $509 million in dividends, and it grew the dividend per share by 1.9% compared to the previous year.

Finally, Wall Street’s consensus reflects overall optimism. Target stock holds a “Moderate Buy” rating, with 17 out of 28 analysts recommending a buy. The average price target of $173.58 indicates an upside potential of 15.27% based on the latest share price.

Walmart (WMT)

My bullish investment thesis on Walmart is grounded in its extensive network of physical stores, but it distinguishes itself from Target by focusing on low prices and product variety. This strategy attracts consumers seeking savings and convenience, supported by Walmart’s vast store footprint and its significantly larger global presence.

As a leading global retailer, Walmart’s performance often reflects retail sector trends. Its share price has surged nearly 50% this year shows success in benefiting from inflation, as consumers sought affordable options have enabled Walmart to gain market share without relying heavily on promotions or discounts. Walmart’s Q2 results exceeded expectations with net sales of $115.34 billion up 4.1% and consolidated operating income of $7.94 billion growing at 8.5%, prompting an increased FY25 outlook.

WMT’s Valuation, Dividends, and Wall Street Consensus

One major concern for Walmart’s bullish thesis is its high valuation. Since June 2022, Walmart’s stock has surged nearly 100%, resulting in a current forward P/E ratio of 32.2x, which is about 30% above its average over the past five years. Additionally, metrics such as a forward price-to-sales ratio of 0.9x and a forward price-to-cash flow ratio of 19.3x show premiums of over 30% compared to the last half-decade.

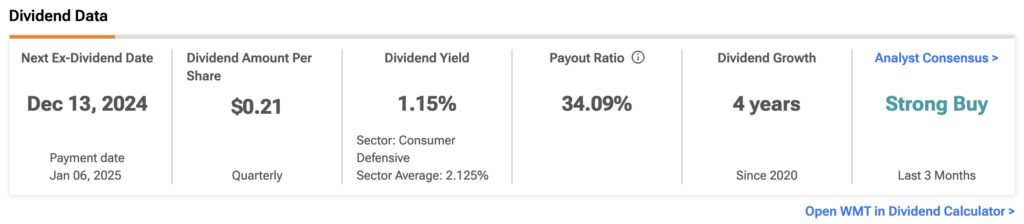

Another issue is its modest dividend yield, which stands at just 1.15%, approximately 30% below the average over the past five years. This weakens the dividend thesis, especially in light of the 10-year Treasury yield of 3.7%.

Despite these concerns, Wall Street remains optimistic about Walmart. The consensus is a “Strong Buy,” with 27 out of 30 analysts recommending a buy. However, due to the high valuations, the average price target of $74.11 suggests a potential downside of 4.91% based on the current share price.

Costco (COST)

Costco stands out in the retail landscape due to its distinct business model, which focuses on low-cost, high-volume sales and relies heavily on membership fees for profitability. This model has established Costco as a reliable growth stock with defensive characteristics over the years and sustains the bullish sentiment on the stock.

Since mid-last year, Costco’s stock has steadily risen, driven by its bulk goods strategy that appeals to cost-conscious consumers during economic stress. In July, sales increased by 7.1% to $19.26 billion, up from $17.99 billion the previous year.

Furthermore, a cornerstone of Costco’s investment thesis is its recurring subscription revenue. In 2023, membership income reached $4.58 billion (assuming full margins), together accounting for more than a half of Costco’s $8.14 billion operating income. Additionally, in the most recent quarter (Q3), Costco’s memberships grew by 7.8% to 74.5 million. In summary, as long as membership fees continue to increase, Costco’s financial performance is expected to remain robust.

COST’s Valuation, Dividends, and Wall Street Consensus

Costco stands out in retail due to its recurring revenue subscription model, which has driven high valuations in recent years. However, skepticism arises due to the extraordinarily high valuations. The company’s forward P/E ratio is 55.6x, over 200% above the industry average and nearly 43% above its historical average of the past five years. This valuation is based on Costco’s projected annual EPS growth of 13.8%.

Despite Costco’s high valuation, its dividend yield is only around 0.5%, which is insufficient to qualify it as an income stock. This positions Costco as a high-quality growth compounder with a valuation more aligned with growth stocks rather than defensive ones.

However, the elevated valuations appear to be justified according to Wall Street consensus. Analysts have given Costco a “Strong Buy” rating, with 18 out of 22 experts recommending the stock. The average COST price target is $936.05, indicating a potential upside of 4.65% based on the current share price.

Conclusion: TGT Is My Best Pick

Retail giants like Target, Walmart, and Costco have recently reported that consumer spending has turning into normal and is not as weak as expected. While each of these companies is well-positioned within its business model, I see more value in taking a bullish stance on Target due to its attractive valuation and dividend yield. In contrast, I maintain a neutral stance on Walmart and Costco due to their valuations being incredibly stretched.