Texas Instruments (TXN) is a sustainable semiconductor company specializing in the production of analog chips. Over the years, it has gradually increased its marginality by reducing its cost of goods sold (COGS) and operating expenses as a percentage of revenue.

In 2022-2023, it is expected to launch two new plants to produce 300 mm plates, which are 40% cheaper in production; thus, Texas Instruments can become even more profitable. However, according to my valuation, TXN is trading at a premium to its fair value. I am neutral on Texas Instruments.

Company Profile

Texas Instruments develops and sells semiconductors and various integrated circuits for electronics manufacturers worldwide. The company specializes in analog chips and embedded processors. TXN was founded in 1930 in Texas, USA.

92% of TXN’s total revenue comes from analog chips and embedded processors. Texas Instruments manufactures semiconductors primarily for the industrial and automotive markets and also the personal electronics market. The largest market is Asia (65.7%). In 2020, China brought in $8 billion revenue or 54.6%. The revenue structure is presented below:

Industry Overview

Sources report that in 2021, semiconductor sales are expected to reach $553 billion, which is 25.6% more than in 2020 ($440.4 billion). By 2022, the global semiconductor market is expected to grow by 8.8% and reach $601.5 billion.

The largest segment for the company is Industrial Semiconductors, accounting for 37% of revenue. Industrial semiconductors are expected to grow at a 13% CAGR from 2021 to 2028, reaching $121.2 billion in value by the end of the period.

The second most important is Consumer electronics (27%). This market is projected to keep growing at a CAGR of 7.2% until 2025.

The Automotive Industry brings Texas Instruments 20% of its revenue. According to Bloomberg, it is quite promising and it will grow at a CAGR of 11.8% from 2021 to 2030.

Thus, the company operates in growing markets, with an even revenue distribution between them. However, the main driver for TXN is its production, not external factors.

RFAB2 and Lehi as Drivers for Texas Instruments

TXN specializes in producing integrated circuits that are “applied” to plates. Thus, flint plates are used as substrates for future ICS.

In 2009, Texas Instruments became the first company to build a 300 mm plate manufacturing plant. Currently, TXN has two such plants (RFAB1 and DMOS6). In the second half of 2022, the company expects to launch a third RFAB2 plant in Texas. Also, to increase its production capacity, TXN bought the Lehi plant (Utah) from Micron Technology, which is also designed to produce 300 mm plates and will be operational in 2023. The deal is valued at $900 million.

300 mm plates are 40% cheaper in production than 200 mm plates (the most common plates in the world). Also, according to TXN, fully packaged and designed integrated circuits manufactured according to the 300-mm standard are 20% cheaper than the 200-mm standard.

Financial Performance

TXN’s revenue over the past ten years has been in the range of $12.2 billion to $15.7 billion, but at the same time, net income has been steadily growing. Over the last five years, the average annual profit growth rate was 11.7%. By the end of 2021, I expect record figures in both revenue and net income.

For 10 years, the company’s net margin has been steadily growing due to the reduction of COGS and operating expenses as a percentage of revenue. At the moment, the net profit margin is 41.6%.

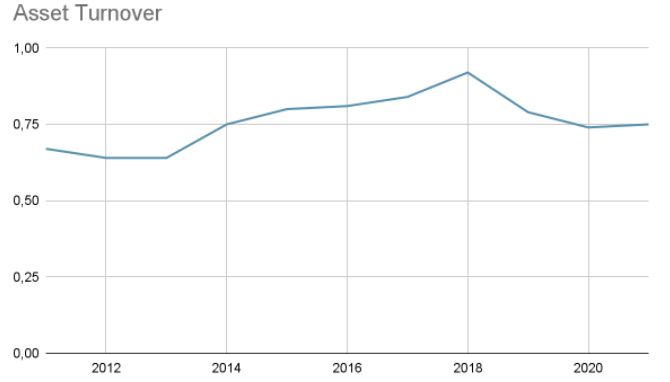

The asset turnover is relatively high and is equal to 0.75. Over the past ten years, this indicator has been in the range from 0.7 to 0.9, and I expect this trend to continue.

The asset-to-equity ratio, or financial leverage, is also high. Over the past three years, this indicator has been around 2. The company has reduced equity over the past 10 years by repurchasing shares. On average, TXN buys back its shares worth about $2.5 billion annually.

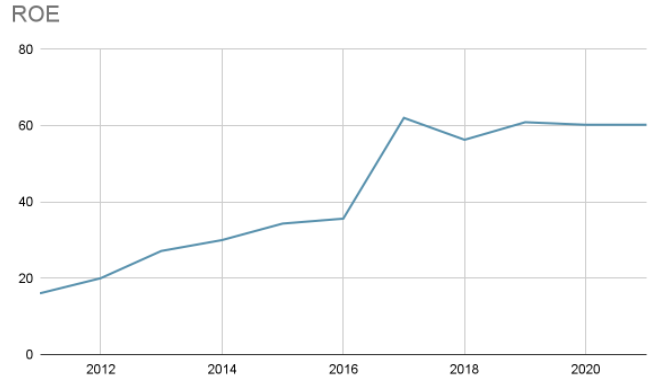

The return on equity of TXN currently stands at 60.2% due to a high assets-to-equity ratio and net profit margin. This is 3.5 times higher than the industry average (16.4%). Over the past ten years, ROE has grown by 42 percentage points.

Thus, the company works very efficiently. Due to the launch of two new plants in 2022 and 2023, the company can significantly increase revenue at a reduced cost by 40%, thereby increasing its net profit margin. I expect TXN to improve profitability in the coming years significantly.

Valuation

In the DCF model, I made several assumptions. I expect revenue to grow in line with the Wall Street consensus, followed by a slowdown in the growth rate. Relative indicators, including margins, are predicted based on historical dynamics and the current trend. The terminal growth rate is 4%. The assumptions are presented below:

Based on the assumptions, the expected dynamics of key indicators are presented below:

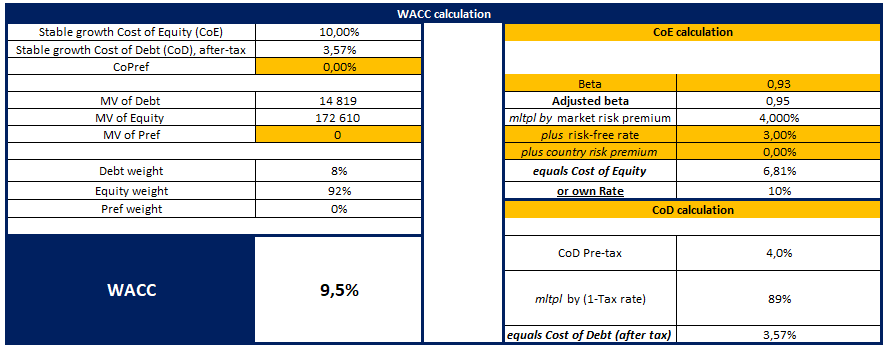

With the cost of equity equal to 10%, the weighted average cost of capital (WACC) is 9.5%.

With terminal EV/EBITDA equal to 13.32x, the company’s fair value is $205.6 billion or $172.78 per share. Thus, the company is trading at a premium to the fair price.

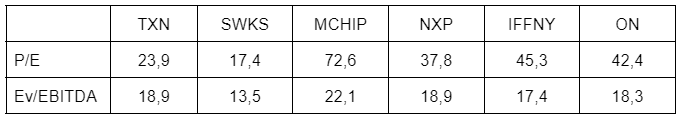

Compared with its direct competitors, Texas Instruments is trading cheaper in terms of P/E, second only to Skyworks Solutions. The EV/EBITDA multiple is comparable to the industry average.

Wall Street’s Take

From Wall Street analysts, Texas Instruments earns a Moderate Buy consensus rating based on eight Buys, six Holds, and two Sells assigned in the past three months. At $207, the average Texas Instruments price target implies 17.8% upside potential.

Conclusion

Texas Instruments is a leader in the field of analog chips. Due to the efficient production and construction of factories to produce 300mm wafers, it regularly improves its margins. In my opinion, this is the only significant driver for TXN. According to the valuation model, the company is trading at a premium to a fair value.

Wall Street is bullish on the company. However, the target price of investment banking analysts does not provide a sufficient margin of safety for buying. Thus, I am neutral on TXN.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure