Texas Instruments (TXN) is a high-quality semiconductor company that has an excellent growth track record, and continues to offer attractive shareholder returns through dividends and buybacks.

Shares have gotten more expensive than they used to be, however, which is why I am neutral on the stock at current valuations. (See Analysts’ Top Stocks on TipRanks)

Macro Tailwinds

Texas Instruments is a specialized semiconductor company that designs and sells power products under its Analog business.

Texas Instruments’ second business unit, Embedded Processing, offers microcontrollers, wireless connectivity solutions, application processors, and more.

Texas Instruments’ end markets include personal electronics, automotive, and industrial equipment, but also enterprise systems and communication equipment.

With its product portfolio, Texas Instruments benefits from macro themes such as Industry 4.0, i.e. digitalization in manufacturing, and increased usage of robotics in manufacturing processes.

On top of that, Texas Instruments also has exposure to consumer electronics products, and will thus benefit from global digitalization efforts. Its exposure to automotive markets allows Texas Instruments to capitalize on rising EV adoption around the world.

EVs do, on average, use more semiconductors than comparable ICE vehicles, which means that Texas Instruments and its peers are poised to benefit from rising sales for EVs in markets such as the U.S., China, and Europe.

With autonomous driving being another megatrend for the next decade, demand for semiconductors from the automotive industry could climb further.

Texas Instruments has grown its business at an attractive pace in the past, including during the most recent quarter.

Texas Instrument’s Q2 earnings report featured a sales increase of 41.4% year-over-year, although it should be noted that the comparison was made easy by a relatively weak sales performance during the company’s pandemic-impacted Q2 2020.

Still, sales were also massively higher (24.9%) versus the comparable quarter from 2019, which shows that Texas Instruments has been able to capitalize on the current semiconductor shortage.

The company has grown its earnings per share by 38.5% year-over-year during the most recent quarter, to $2.05 on a GAAP basis.

Strong Shareholder Returns

Texas Instruments generates attractive free cash flows, and management has been generous to the company’s owners in the past. In most years, free cash flows are paid out to investors at a roughly 50:50 split between dividends and share repurchases, although the amounts paid out through share buybacks fluctuate more than the company’s dividends.

Texas Instruments has raised its dividend for 15 years in a row, and its five-year dividend growth rate stands at a very attractive 21.8%.

Investors get a dividend yield of 2.1%, which is significantly more than what one can get from the broad market, or from most fixed-rate investments.

This above-average yield, when combined with reliable and strong dividend growth, makes for a compelling dividend growth investment.

Valuations should always be considered, however, and right now, Texas Instruments is looking a little expensive. Based on current earnings per share estimates for this fiscal year, Texas Instruments trades at 24.5x net profits.

Wall Street’s Take

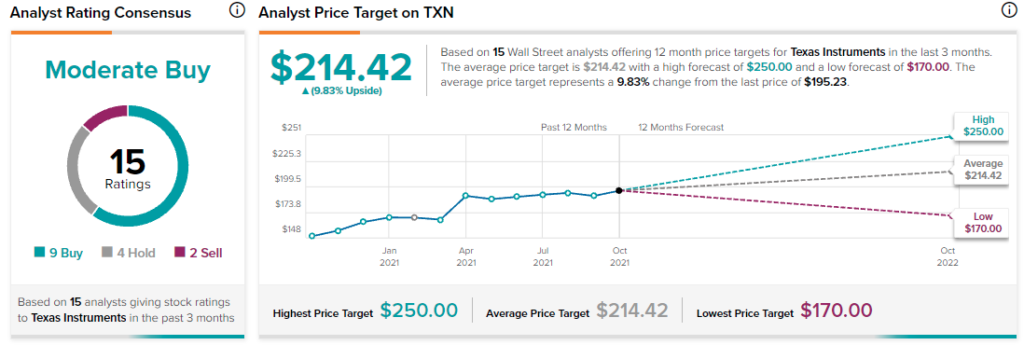

Turning to Wall Street, Texas Instruments has a Moderate Buy consensus rating, based on the nine Buys, four Holds, and two Sells assigned in the last three months.

At $214.42, the average Texas Instruments price target implies 9.8% upside potential.

Disclosure: At the time of publication, Jonathan Weber did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.