Teva Pharmaceutical (TEVA) is not a company immune to controversy, but one long standing overhang might have just been removed.

Last week, the global generics pharma company announced the launch of the first FDA-approved generic versions of Gilead Sciences’ HIV treatments Truvada and Atripla.

The launch brings to an end a patent case which stretches back to September 2018, one which Raymond James analyst Elliot Wilbur calls “one of the lengthier PIV battles in recent memory.”

In addition to being able to tap into a lucrative market – Truvada generated global sales of $753 million in the first half of 2020, while Atripla snagged a more modest $176 million – Teva has an opportunity to establish its new offerings ahead of anticipated competition.

“While we expect other generic filers are not far behind in entering this market (there are at least 9 other filers on Truvada),” Wilbur noted, “Teva’s earlier settlement at least gives the company a head start relative to the competition in launching the generic versions of these drugs. The approval will help Teva finish the year strong, after generic versions of other potential 2020 launches including Restasis, Nuvaring and Forteo have seemingly been lost in FDA generic approval morass.”

While Wilbur assumes that Gilead could enter the market with a self-marketed or authorized generic, the analyst estimates Teva’s jump on the competition could provide it with 30 to 40% of this generics market.

Despite other patent cases also reaching settlement, it remains unclear when the next generic wave of generic offerings will hit the market, although Wilbur assumes “further generic competition is not far behind, resulting in pricing assumptions that largely reflect the eventuality of a more commoditized generics market.”

Wilbur estimates the branded market has annual sales of roughly $1.9 billion, putting generics “at roughly $500-$600M per year out of the gate.”

Based on this, Wilbur expects Teva to generate around $80 to 100 million in 4Q20 “channel stocking sales,” resulting in “incremental EPS of $0.04-$0.05 in 4Q20.”

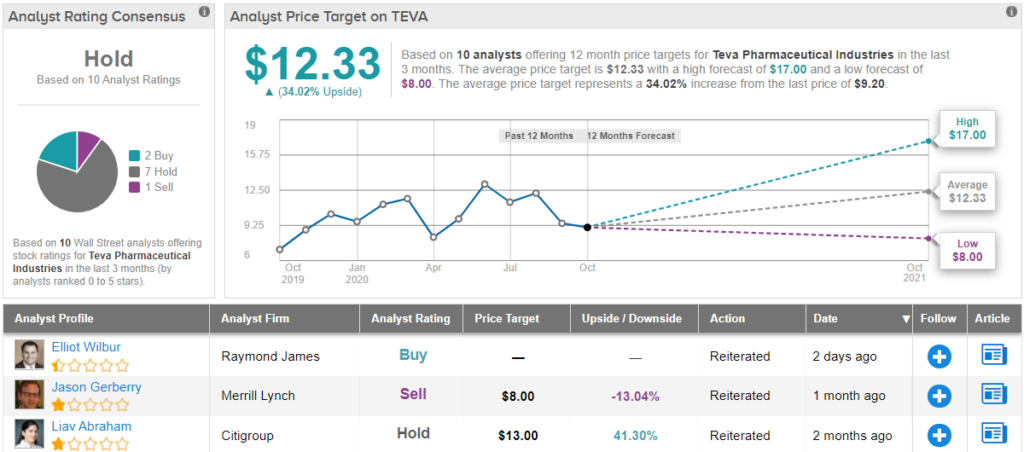

To this end, Wilbur keeps an Outperform (i.e. Buy) rating on TEVA shares alongside a $15 price target. This figure implies a 63% upside from current levels. (To watch Wilbur’s track record, click here)

Granted, not everyone is as enthusiastic about Teva as Wilbur. Out of 10 analysts tracked in the last 3 months, 2 are bullish on Teva stock, 7 remain sidelined, while 1 is bearish. Worthy of note, the 12-month average price target stands at $12.33, which implies a 34% upside. (See Teva stock analysis on TipRanks)

To find good ideas for healthcare stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.