Tesla (TSLA) is still pretty much the biggest name in electric cars. Getting the stock, however, has been challenging recently. Its high share price has kept some investors from buying in. However, that could change soon. Tesla shareholders are poised to vote later today, at 4:30 p.m. CT., on a three-for-one stock split that, according to reports, will make Tesla stock ownership “more accessible” to potential investors. The vote won’t start until the end of the trading day—4:30 p.m. CT.

TSLA stock gapped up this morning ahead of the new move but is now roughly flat on the day.

The last 12 months for Tesla shares have been fairly but positively volatile. The stock is up in the past year, as it was trading at just under $700 per share back in early August 2021. The share price spent much of late 2021 and early 2022 over the $1,000 mark. Prices dipped below $1,000—and stayed there—starting in late April.

I have been bearish on Tesla lately, owing to its elevated share price and its growing competition in the electric vehicle field. The competition part isn’t changing much. That’s really only gotten worse thanks to most of the major automakers looking to get in on the market.

However, Tesla’s move to make its shares more reasonably priced should catch some attention. Thus, I’m moving to neutral on Tesla stock.

Wall Street’s Take on TSLA Stock

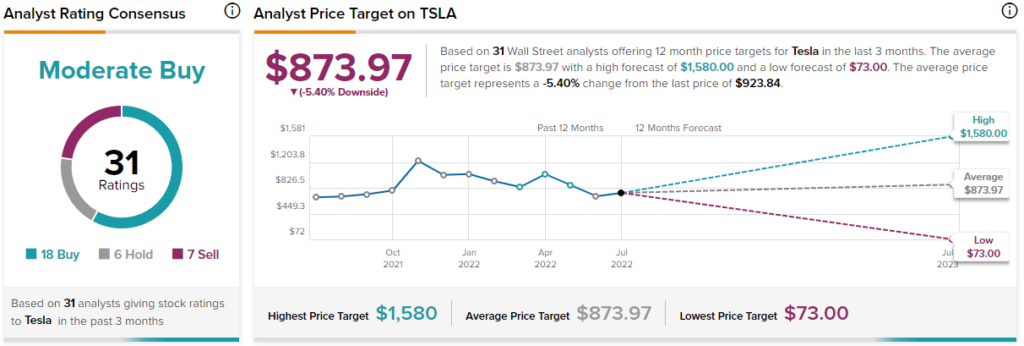

Turning to Wall Street, Tesla has a Moderate Buy consensus rating. That’s based on 18 Buys, six Holds, and seven Sells assigned in the past three months. The average Tesla price target of $873.97 implies 5.4% downside potential.

Analyst price targets range from a low of $73 per share to a high of $1,580 per share.

Tesla’s Smart Score Isn’t Impressive, Insiders Have Been Selling

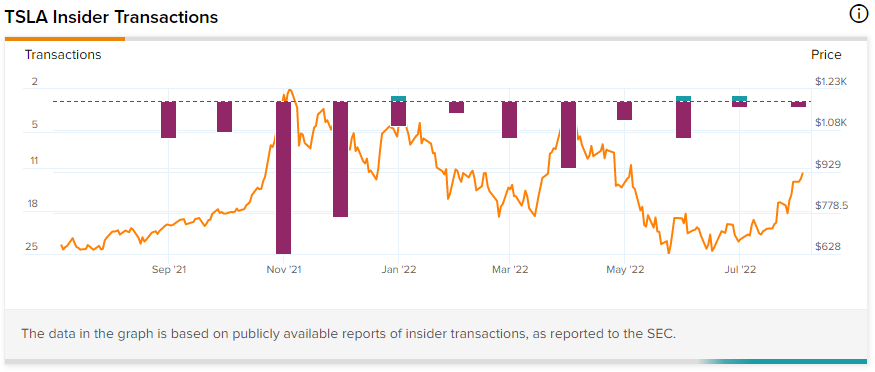

Tesla has a 6 out of 10 Smart Score on TipRanks. That puts it almost perfectly at Neutral; with a 10-point scale, there is no exact midpoint. This implies that the stock is likely to perform in line with the market, going forward. However, there’s the matter of insider trading. Calling it “heavily sell-weighted” is an understatement.

Granted, in the last three months, informative buys have given Tesla a bit of a push. Director Kimbal Musk bought $1.854 million in stock nine days ago, and CAO Taneja Vaibhav bought $138,300 two months ago. These numbers pale in comparison to the slate of uninformative Sells that have taken place since and prior to these moves.

Over the last three months, Tesla share sales have outweighed Buys by eight to two. Going back over the last 12 months inflates the ratio to nightmarish proportions, featuring 89 Sell transactions against just three Buy transactions.

Fixing One of Its Problems

TSLA investors who bought in, say, any time before 2020 are thanking their lucky stars as their investment blasted up better than 20-fold in some cases. Even simple investments of $1,000 or so would have represented modest annual salaries for some folks. Yet, this rally posed its own problem for Tesla. Not everyone wants to pay nearly $1,000 for one share. The stock split serves to make the stock more accessible to those who haven’t bought in yet. Good news by itself, certainly, but that’s not all there is to consider here.

The stock split vote is part of Tesla’s Cyber Roundup event, and there’s good news and bad news alike facing shareholders therein. There are, of course, ongoing issues between the U.S. and China.

House Speaker Nancy Pelosi’s recent—and rapid—visit to Taiwan proved a sore spot for China, which promptly mobilized large portions of its military to engage in training exercises nearby.

The good news is that Tesla may be able to simplify its supply chain significantly in the near future. Reports suggesting that Chinese battery maker Contemporary Amperex Technology Co. Limited, more commonly called CATL, would delay plans to expand into the U.S. appear to be exaggerated. The move is going ahead, after all, Reuters noted, despite reports from Bloomberg that the move was, in fact, delayed.

While CATL is poised to supply batteries to Ford (F) for its electric car ambitions, it’s a safe bet that Tesla can make a few orders itself and smooth out its supply chain. That’s been a problem for almost every business the world over in the last several months. Making a move to relieve those tensions should, in turn, help Tesla.

Conclusion: One Good Fix Deserves a Second Look

The problems for Tesla still largely remain. Simplifying its battery acquisition processes—assuming it can make any headway with CATL—will improve things, no doubt. In addition, the stock split—assuming it goes through, which reports suggest is likely—will go some way toward drawing new investment.

CATL’s entry into the United States also underscores the increasingly competitive market that Tesla faces. CATL is looking to supply batteries to Ford. The electric vehicle field is no longer limited to Tesla and a handful of Chinese upstarts.

Tesla is making smart moves to fix its problems, and some of these are fairly big. So for right now, keeping your distance while Tesla once again reinvents is likely the best strategy to take. Tesla’s days of stratospheric gains are likely behind it. Still, it will likely remain the biggest fish in the pond for quite some time. That’s true even as some fairly big fish like Ford get involved.