Tesla (TSLA) will see out the year with an annualized run-rate of almost 2 million units. Within 2 to 3 years, Morgan Stanley analyst Adam Jonas thinks the EV leader should be able to double that figure.

So, good news? Well, yes and no.

“Size brings complexity in autos and exposes the company incrementally to macroeconomic and geopolitical risk,” Jonas said. “It’s ok for Tesla to be the best EV company with a stock that takes a break.”

So, what does that mean exactly?

Jonas highlights the fact Tesla appears to be pulling further away from other EV players, due to its “estimate beating/self-funding attributes.”

Yes, says Jonas, his recommendation to clients is that any energy transition/BEV portfolio should include Tesla in it, and filed in the ‘must own’ category. “However,” the analyst adds, “the company should not be seen as invincible to the rapidly changing consumer environment.”

As it grows as a firm and increases capacity to what Jonas anticipates will be 10 facilities by the decade’s end, margin-wise, the company will be susceptible to the variables that affect mass market vehicle OEMs.

The reliance on lithium and cathode material refining/processing in China and other far-eastern markets is one example of the limits of the larger EV supply chain that are not entirely under Tesla’s control. This could have its part to play as Tesla’s volume base expands.

Additionally, the current battery supply chain is defined by a whole set of “unsustainable ESG/CO2 and economic factors.” These are long overdue a “painful re-architecting” that could result in a ‘lull’ in EV company earnings expectations as the decade progresses.

Simultaneously, market expectations are set too high on the promise of vehicle autonomy, which Jonas thinks will progress at a slower pace than currently anticipated, leaving Tesla shares exposed to a “‘reset’ risk” around FSD/Autonomy.

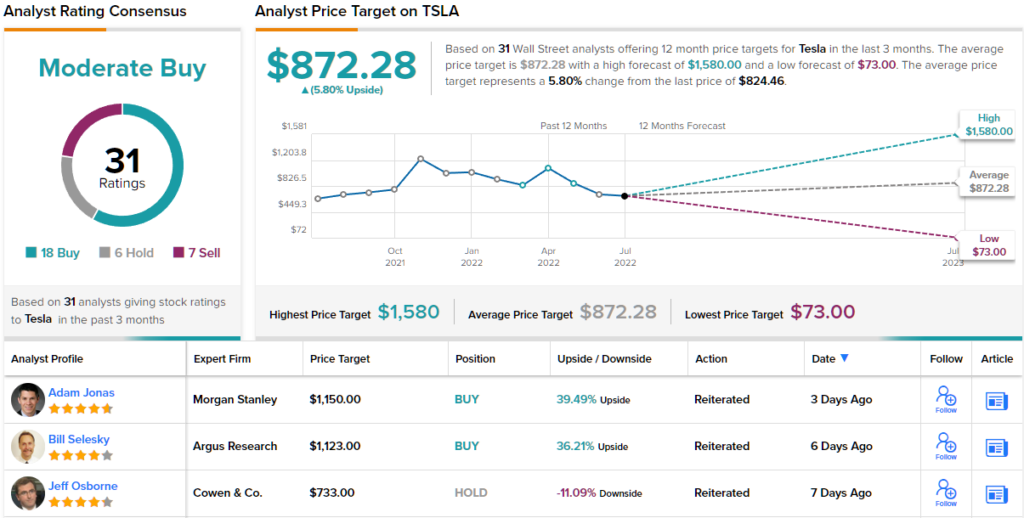

These concerns for now are not reflected in changes to Jonas’ rating, which stays at Overweight (i.e., Buy). According to the Morgan Stanley analyst, the EV giant is worth about 39% more than it’s currently selling for, and should hit $1,150 within the next 12 months. (To watch Jonas’ track record, click here)

Jonas remains positioned at the bullish end of the spectrum; his objective is some way above the Street’s average target which stands at $872.28, and representative of one-year returns of a modest 6%. Overall, based on 18 Buys, 6 Holds and 7 Sells, the stock claims a Moderate Buy consensus rating. (See Tesla stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.