That the auto industry is in the midst of a massive transformation is hardly news anymore. Wedbush analyst Daniel Ives calls it an “EV revolution,” which by 2025 will see electric vehicles representing 10% of all autos across the globe and as much as 30% by 2030.

This opportunity is open both to legacy car makers and new startups alike, and to other companies providing the ancillary services and required infrastructure, which the Biden infrastructure plan is set to help kick into action.

However, while there are many companies well-positioned to benefit from the “biggest transformation to the auto industry since the 1950’s,” one name stands above them all – Tesla (NASDAQ:TSLA), of course.

Ives thinks Wall Street is only just coming to grips with the way it analyses this new segment’s leading players.

“How do you value EV vendors in this parabolic growth backdrop with a fundamental profile still in the early days of playing out?” the analyst asks, “Herein speaks to the emotional bull/bear debate on EV names as valuations continue to move higher and many wondering if this is a bubble or the first stage of a decade long EV metamorphosis?”

What does Ives think, then? Well, first off, the analyst has always looked at Tesla as a “disruptive technology vendor and not a traditional auto vendor.” Secondly, in what Ives estimates over the next decade will be a $5 trillion auto/software driven market, Tesla is likely “to own $2.5 trillion of this pie,” i.e., half, with 100+ OEMs left to fight it out for the remaining ~50%.

As ever, the “linchpin” to Ives’ Tesla bull thesis remains China, which the analyst estimates next year will account for 40% of the company’s deliveries. While Tesla has encountered several headwinds including component shortages and more company specific PR/safety issues, Ives claims there has been an “aggressive” reversal to the “demand trend,” which heading into 2022 puts the EV player on a ~50k monthly run-rate in China.

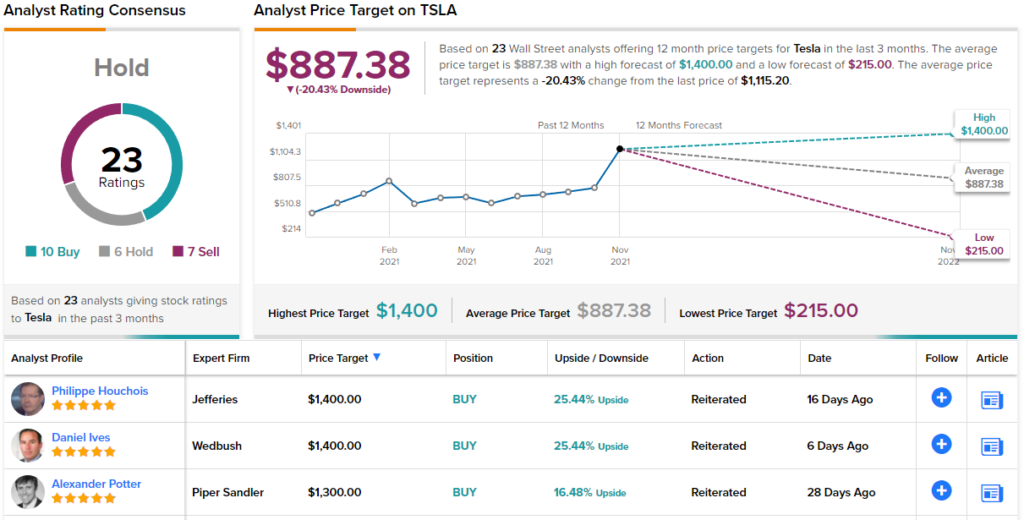

As such, the analyst believes the “China story is worth $400 per share to the Tesla story for 2022,” and raised the price target from $1,100 to a joint Street-high of $1,400, suggesting shares will climb by 23% over the coming months. No need to add, Ives’ rating stays an Outperform (i.e. Buy). (To watch Ives’ track record, click here)

Ives’ new objective, however, takes his assessment further away from the Street’s call; according to the $887.38 average target, shares are currently overvalued by 20%. Rating wise, opinions are mixed; the stock’s Hold consensus rating is based on 10 Buys, 6 Holds and 7 Sells. (See Tesla stock analysis)

To find good ideas for EV stocks trading at attractive valuations, visit TipRanks’ Best EV Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.