Shares of Elon Musk’s EV and green energy firm Tesla (TSLA) have not gotten off to the best start to the new year, with TSLA stock now sitting down just under 1% year-to-date. This looks worse when you consider that TSLA stock is now sitting at about $1,050 after closing near $1,200 on the first trading day of the year.

With concerns over the coming interest rate hikes, it’s not a surprise to see one of the highest-flying tech stocks of 2020 reversing course so sharply.

In 2022, competition in the EV space is slated to intensify. With that, Tesla stock may finally see its stellar growth be curbed by some magnitude that’s difficult to gauge. Indeed, the traditional automakers are catching up, and Tesla will not be one of few games in town anymore as the EV market powers forward.

The real question is if Tesla can justify its valuation as a technology company. While the firm may be in a league of its own, with some of the most loyal customers out there (perhaps even comparable to the likes of Apple (AAPL)), the electric auto space is getting more crowded. However, with more people switching from gas to electric, will the stickiness of Tesla vehicles remain as the temptation to try new brands of EVs grows over the coming years?

While I do view Tesla as a very tech-savvy firm, given the intriguing technologies under the hood (pardon the pun) of the firm’s line of autos, I can’t say I’m enthused to be paying up a hefty multiple for such exposure, especially as rates rise.

For now, I think the stock’s valuation is a concern, as too are competitive pressures. Further, the technicals are getting ugly, and the broader weakness in high-multiple tech could get worse from here.

Despite the recent pullback, I remain bearish on TSLA stock. However, I wouldn’t short it or play put options against the name, given its near-term bounce-back potential.

Tesla Stock Corrects, but Shares Are Nowhere Close to Cheap Yet

After a relatively modest pullback, Tesla stock trades at just south of 24 times sales. That’s incredibly expensive, even if the company has a wider moat in the form of its loyal fanbase.

Though Tesla is cheaper than it was a few weeks ago, it remains tough to gauge the real value to be had in the name. The stock still looks priced for perfection here, and if any future EV rivals pressure Tesla on a sales or margins front, things could get really ugly for the stock. Indeed, the risks are elevated as investors take a raincheck on the high-multiple names in 2022.

Perhaps Elon Musk was right to sell so many of his shares?

Apple and Its Car Is on Elon Musk’s Radar

Unlike Apple, Tesla’s fanbase has yet to be put to the test with the likes of some real competition in the EV space. Many Apple lovers have stood by the company through the course of decades. With many younger users preferring iPhone over Android alternatives, brand loyalty looks like it could get even better with time.

Tesla’s brand loyalty? It seems hazier.

More offerings in the EV space are popping up, and over the next five years, the price of such autos is likely to retreat, lowering the barriers to entry for drivers on the fence about making the jump to electric.

Indeed, the total addressable market (TAM) is sizeable. While Tesla is likely to carve out a nice slice for itself amid the rise of more rivals, retaining its dominance in the booming market looks like a tough task.

In any case, it’s tough to tell what the longer-term future holds for the firm and the auto market, with autonomous technologies that could be thrown into the mix.

Could Autonomous Represent the Next Frontier After Electric?

The electrification tailwind still has a way to go. However, to justify Tesla’s steep valuation, the company needs to have an industry-leading position in autonomy.

While Elon Musk has touted his firm’s autonomous capability prospects, it remains very difficult to tell who will win the race in a few years down the road. Indeed, Tesla’s autopilot driver assist technology has been making headlines over the past year, and not for good reasons.

Undoubtedly, tech titan Apple has been reported to be hard at work on an autonomous and electric tech for a potential Apple Car.

With deep pockets and a knack for attracting talent, Apple is a worthy future rival of Tesla that should not be scoffed at, even if it is making a massive pivot into a very different market.

Apple’s track record is enviable. It just doesn’t have that many flops, even as it broadens its growth horizons. Unlike most firms, Apple can’t spread itself too thin, given the gigantic free cash flows it continues pulling in. It’s these cash flows that I believe will mostly spare Apple as the high-multiple tech trade sinks lower.

Wall Street’s Take

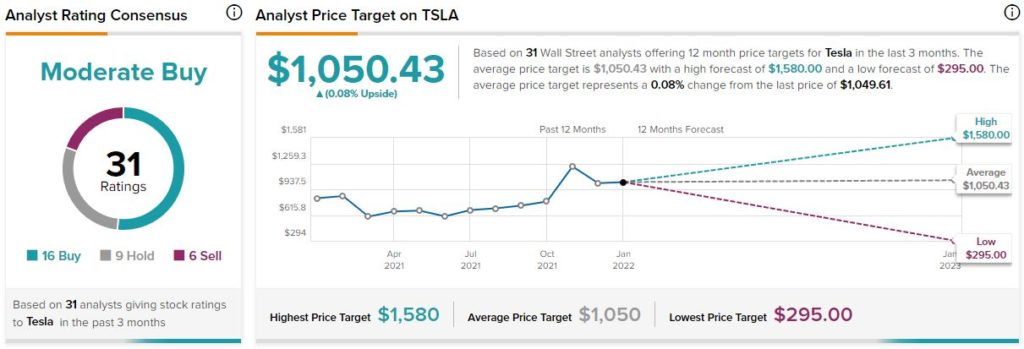

Turning to Wall Street, TSLA stock comes in as a Moderate Buy. Out of 31 analyst ratings, there are 16 Buys, nine Holds, and six Sell recommendations.

The average Tesla price target is $1,050.43, implying just 0.1% upside potential. Analyst price targets range from a low of $295 per share to a high of $1,580 per share.

The Bottom Line on Tesla Stock

The future could be full of headwinds. With such a lofty stock at $1,050 per share, I’d rather wait for a steeper pullback that could happen as the tech wreck continues into February.

Though Elon Musk can prove his firm is worth a sky-high premium multiple, it remains too difficult to tell how Tesla will perform over the next decade, as the race to electric and autonomous vehicles is sure to be full of surprises.

Tesla may be in the lead now, but can it stay in the lead, as rivals put their foot on the gas?

I’m not so sure.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure