At its recent much-hyped Investor Day, Tesla (NASDAQ:TSLA) unveiled the production-ready Cybertruck. Early pre-production models are already being tested, production on the vehicle is slated to begin this year, and by 2024 the truck should be commercially available.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

However, since the concept was revealed back in 2019 by CEO Elon Musk and lead designer Franz von Holzhausen, in what turned out to be an embarrassing event (von Holzhausen threw a metal ball at one of the pickup truck’s armored windows, which shattered in response), much has changed at the world’s EV leader.

The company’s market cap is about 10 times higher and annual unit volume is more than 5x what it was back then. Additionally, at that time Tesla had only started to report positive GAAP profits and was still ramping up its Shanghai facility, which has completely changed the company’s manufacturing economics.

These are all points made by Morgan Stanley analyst Adam Jonas, who notes that the “scale and scope of ambitions for the company has evolved meaningfully since the Cybertruck unveil.”

With this in mind, Jonas believes that expectations might just be too high, with many believing Tesla could sell many hundreds of thousands of Cybertrucks a year. However, Jonas thinks that financially, the Cybertruck may turn out to be “more of a ‘side-show’ to the Tesla story today.”

With its lack of a Tesla logo anywhere on its exterior, Jonas calls the Cybertruck the “ultimate avant-garde vehicle” that also acts as an important element of Tesla’s futurist brand image. That said, he just does not believe it has mass market appeal. “We think it will more likely be an enthusiast/cult car with far more limited volume (closer to 50k units/year) with some design and manufacturing learnings that could ultimately migrate to the rest of Tesla’s core lineup,” he went on to say.

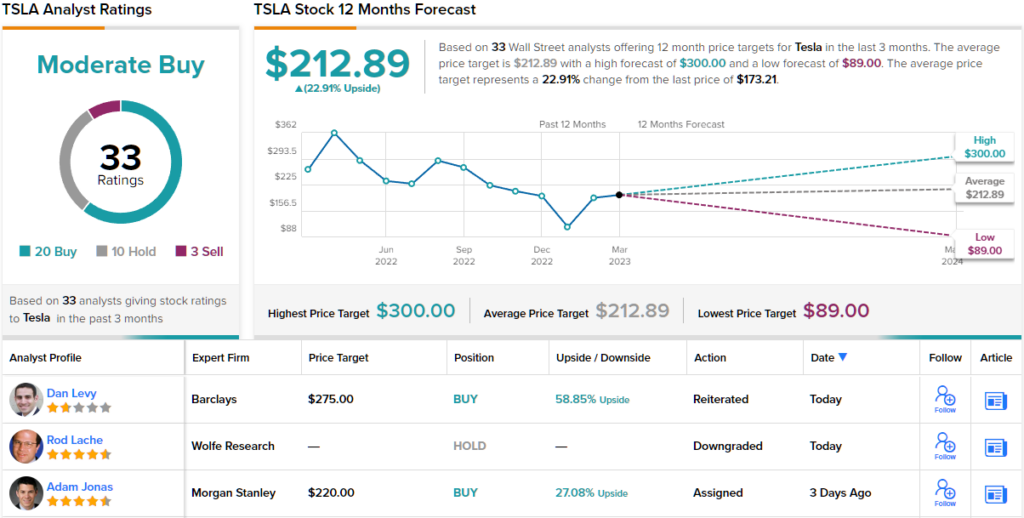

All told, there’s no change to Jonas’ stance; the analyst maintained an Overweight (i.e., Buy) rating on Tesla shares, backed by a $220 price target. The implication for investors? Upside of 27% from current levels. (To watch Jonas’ track record, click here)

Elsewhere on Wall Street, Tesla garners an additional 19 Buys, 10 Holds and 3 Sells, for a Moderate Buy consensus rating. Going by the $212.89 average target, a year from now, investors will be sitting on returns of ~23%. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.