China has long been considered an essential component of Tesla’s (TSLA) ongoing success. The country has not only been committed to advancing electric vehicles, but is also home to its flagship Gigafactory, located in Shanghai.

Wedbush’s Daniel Ives has repeatedly stressed the region’s importance to Tesla and thinks the current China headwinds are “hard to ignore.”

“The success of the China story on both the supply and demand side are the linchpins to our long-term bull thesis in Tesla,” the 5-star analyst explained. “That said, the reality is the current Shanghai lockdowns have been an epic disaster so far in the June quarter.”

The zero Covid policy saw the Shanghai factory shutdown during April which obviously hit production hard and despite a reopening – which Ives notes as being “very choppy,” – the supply chain is now facing a host of issues all the way through to the logistics of shipping Model 3’s/Y’s.

The effect of the lockdown has been a “deterrent for delivery growth” with Ives now anticipating Q2 will show weak China sales with some “spillover” into Q3. Although Ives expects the company to push ahead in 2H, the prospect of another outbreak and lockdown looms large and could provide yet more “bumps in the road.”

As such, to reflect “softness” in China and the ongoing supply woes, Ives has lowered estimates for Q2. Ives now expects total deliveries of 277,000, a drop from the prior forecast of 297,000 units. The revenue estimate is also reduced – from $16.9 billion to $15.9 billion, while the EPS forecast is also to $2.10 from the prior $2.80.

China is not the only issue for Tesla right now. Musk’s bid to buy Twitter has been a constant sideshow recently which the analyst believes is causing investors to turn away. Although the “Tesla fundamental story” is not directly impacted from the ongoing Twitter shenanigans, given we are currently in the midst of the “worst supply chain crisis seen in modern history,” Ives thinks Musk should be focused on more on Tesla, and less on other distractions.

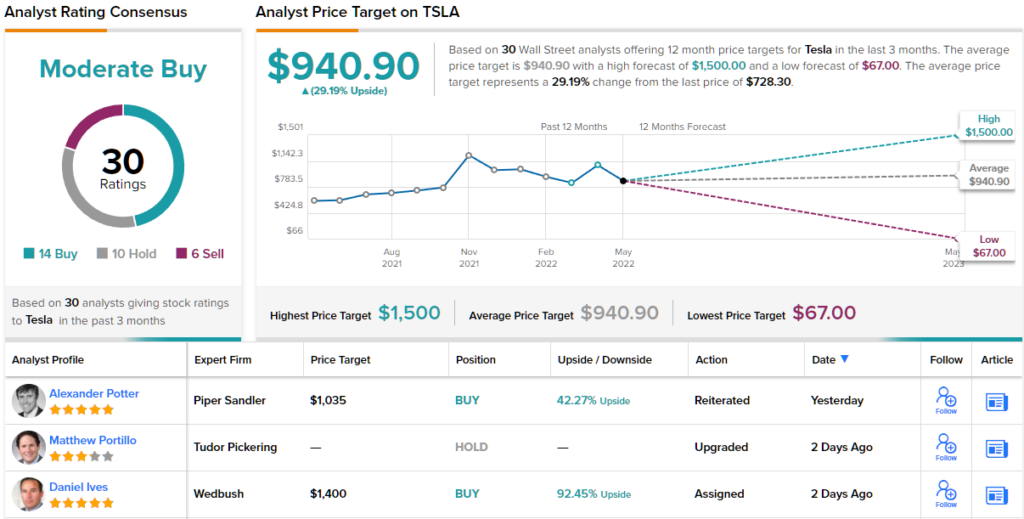

While Ives reiterated an Outperform (i.e., Buy) rating on Tesla shares, the analyst slashed the price target to $1,000 (from $1,400). (To watch Ives’ track record, click here)

Most on the Street also back Tesla but not all are on board. The stock claims a Moderate Buy consensus rating, based on a mix of 14 Buys, 10 Holds and 5 Sells. According to the $940.90 average target, the shares will climb 29% higher in the year ahead. (See Tesla stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.