One thing Tesla (TSLA) has done consistently well over the past several years is beat Wall Street’s predictions. And according to Wedbush’s Daniel Ives, a similar story is taking place right now.

“Based on the current demand trajectory for Tesla we are seeing so far in the March quarter,” said the 5-star analyst, “we believe unit deliveries are trending well ahead of Street expectations.”

Sales in China and Europe in particular, says Ives, are charging ahead of Street estimates by at least 15%. Add into the mix US Model Y-driven “strength,” and it’s not out of the realms of possibility that exiting 2022, Tesla will be on a 2 million unit run-rate.

Moreover, coinciding with last week’s opening of the flagship Berlin factory, there has also been “incremental Model Y strength in Europe over the past few months.”

In fact, Ives considers cutting the red ribbon on the Berlin factory as a bit of a game changer which will address prior supply issues. “The Berlin factory establishes a major beachhead for Tesla in Europe with potential to expand this factory to production of ~500k vehicles annually with Model Y front and center over the coming 12 to 18 months,” the analyst went on to say.

The pivot to EVs was already taking place, but EV makers also stand to benefit from the macro developments which have seen oil/gas prices rise significantly. This especially pertains to Europe, even more so now, as it looks to address its dependence on Russian energy, with the race for electrification in Europe “hitting another gear.” Additionally, consumers who had previously been on the fence regarding EVs, are likely to consider transitioning. And while Ives notes the competition is “increasing from every angle,” the clear leader of the EV pack Tesla should be the prime beneficiary of this development. As such, Ives views the Giga Berlin as a “major competitive advantage for Tesla to further build out its supply footprint in this key region.”

Ives also thinks Tesla stock has been the victim of the “risk-off mentality among tech investors,” with the shares now way oversold. That said, according to the analyst, the Street has recently “started to better appreciate what the seminal launch of Giga Berlin means for the Tesla supply story in 2022 and beyond.”

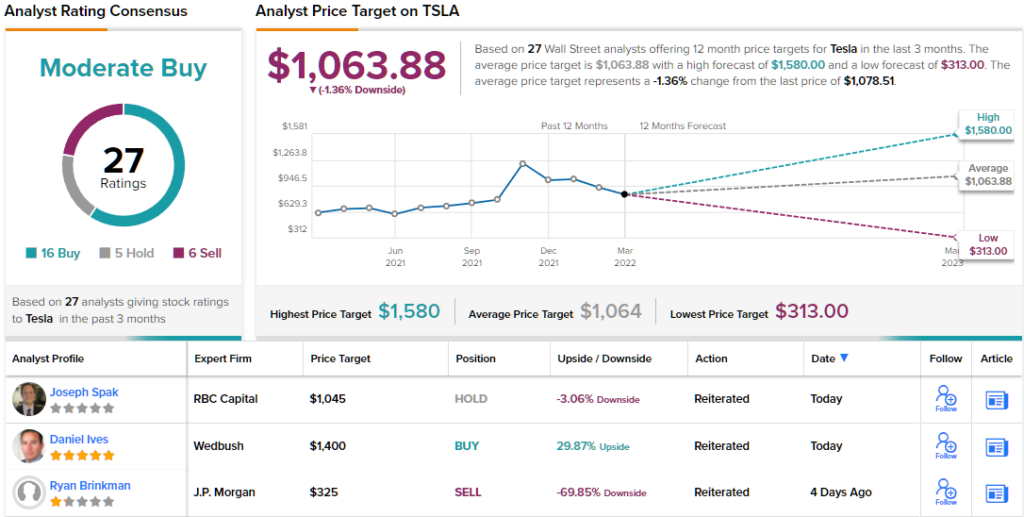

To this end, Ives maintained an Outperform (i.e., Buy) rating for Tesla shares along with a $1,400 price target. Should the figure be met, investors are looking at one-year returns of ~29%. (To watch Ives’ track record, click here)

The rest of the Street appears to think TSLA is trading relatively close to its fair value; going by the average price target of $1,063 and change, share are expected to stay range bound for the foreseeable future. All in all, the stock’s Moderate Buy consensus rating is based on 16 Buys, 5 Holds and 6 Sells. (See Tesla stock forecast on TipRanks)

To find good ideas for EV stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.