Martin Lau, Tencent’s (TCEHY) President stated during the Q2 conference call that the company’s “share price is very undervalued,” indicating that it could continue to buy back its stock. However, it has denied selling any stake to fund its share repurchases, Bloomberg reported.

Notably, several media reports stated that China’s largest internet and technology company is considering selling some of its investments in order to fund ongoing buybacks and growth. In response to these reports, Tencent’s spokesperson told Bloomberg that there is no need to unwind its investments and free up cash. Further, there is no timeline for when the company plans to divest its investments.

This comes amid China’s regulatory crackdown on large tech giants. China’s sweeping regulatory changes are aimed at reducing the market power concentration of large tech giants.

Earlier in April, Tencent announced that it was divesting 2.6% of its equity interest in Sea Limited. Post divesture, Tencent’s stake in Sea was reduced to 18.7% from 21.3%.

Though the sale of equity interest provides Tencent with resources to fund its growth and expansion, the company has no cash shortage to boost shareholders’ value.

More Buybacks on the Horizon

During the Q2 conference call, Lau said that Tencent has “annual free cash flow in the teens billions of dollars, the listed and unlisted investments in excess of $150 billion,” which is more than enough “to continue doing dividends and buybacks at an aggressive rate.”

Tencent has returned around $18 billion to its shareholders year-to-date without unwinding its investment portfolio. As indicated by Lau, Tencent could continue to return capital to its shareholders. However, it is highly unlikely that it will be funded through selling stakes.

Bottom Line

Tencent’s solid financial position and focus on returning cash to its shareholders would act as a catalyst. Further, an improving regulatory environment is positive.

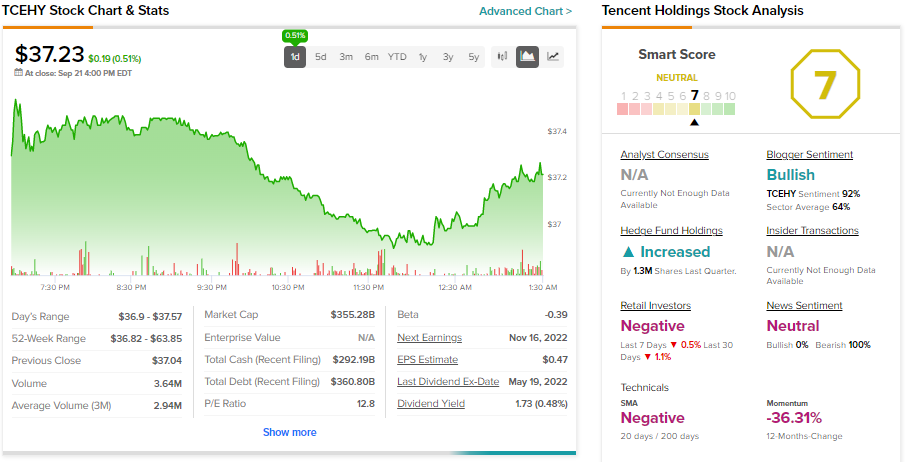

Tencent stock has declined over 34% year-to-date, which has caught hedge funds’ attention. As per TipRanks’ data, hedge funds acquired 1.3 million Tencent shares in the last three months. However, investors remain negative on TCEHY stock due to the weak macro environment and COVID-led uncertainty. Retail investors decreased their exposure to TCEHY stock by 1.1% in the last 30 days.

Overall, TCEHY stock has a Neutral Smart Score of 7 out of 10 on TipRanks.

Read full Disclosure