Teladoc (TDOC) was a darling of the markets in the wake of the COVID-19 pandemic as telemedicine became more popular. Fast-forward to mid-2022, however, and Teladoc’s investors are struggling. As the company posted a jaw-dropping loss, investing in Teladoc now could lead to further capital loss. Thus, I am bearish on Teladoc stock.

Teladoc provides virtual healthcare services in the U.S. and internationally. As we’ll see, the company is capable of generating hundreds of millions of dollars in revenue. Also, Teladoc is actually growing its revenue, and that’s a positive sign. However, there are more red flags than green ones, and Teladoc’s most recently issued quarterly financial results will show this.

In the final analysis, Teladoc will provide a textbook example of why bottom-line results can be more important than revenue growth. If you’re going to give a company a health checkup, you’ll want to make sure that the company isn’t bleeding money. Otherwise, your portfolio might end up in the intensive care unit, so check the fiscal stats before considering a stake in fast-falling Teladoc stock.

Teladoc Reported Some Good News, but It Wasn’t Enough

It wouldn’t be fair or accurate to say that there’s no positive news whatsoever concerning Teladoc. Indeed, the company provided a couple of encouraging highlights in its recent financial press release. Yet, Teladoc’s few bits of good news weren’t enough to make up for the preponderance of problematic data.

Frankly, Teladoc’s investors really needed the company to knock it out of the park during 2022’s second quarter. From January 1 to July 27, Teladoc stock had already fallen from $95 to $43. So, after a 55% haircut, Teladoc’s Q2 earnings release was truly make-or-break for the company as well as the stockholders.

As it turned out, the results weren’t up to par, and Teladoc stock immediately plunged to $33 and change. The stock has recovered somewhat since then, but the overall trend is still down.

To reiterate, there are a couple of positive notes in the press release. For one thing, Teladoc CEO Jason Gorevic observed “growing momentum” in Primary360, the company’s whole-person care segment. The press release noted that Primary360 added “multiple new clients, and new capabilities” but didn’t provide specific details on this.

The other major positive point was Teladoc’s revenue growth. Specifically, the company increased its revenue by 18% year-over-year to $592.4 million during the second quarter of 2022. On the surface, this might sound like a great outcome and a reason to buy Teladoc stock now. After all, contrarian investors are supposed to buy low and sell higher, right? So, what could possibly go wrong?

Teladoc’s Net Loss Was Shockingly Bad

If you’ve looked at enough earnings reports, it might be hard to surprise you anymore. However, Teladoc’s recently reported quarterly loss could shock even the most experienced investors. It’s not just a red flag; it’s an absolute deal-breaker.

Back in the second quarter of 2021, Teladoc posted a net loss of around $134 million, or $0.86 per share. That’s already a worrisome result. Even in mid-2021, it looked like the COVID-19 pandemic catalyst was wearing off for Teladoc.

Fast-forward to 2022’s second quarter, and undoubtedly Teladoc’s investors had hoped for a turnaround to the upside. Imagine their horror and disappointment, then, when Teladoc reported a Q2-2022 net loss of $3.1 billion. This translates to a loss of $19.22 per share on a stock that’s in the $30s. In contrast, the consensus estimate called for a $0.61 GAAP loss per share.

During the company’s earnings call, Gorevic tried to accentuate the positive, saying that Teladoc’s Primary360 business has been “a significant bright spot in terms of commercial momentum.” No amount of positive spin can mask the company’s dreadful bottom-line result, though. It almost seems like an act of desperation for the CEO to claim that Teladoc “delivered solid second-quarter results” in the Q2 press release.

Don’t expect Teladoc to swing to a profit anytime in the near future, either. For 2022’s third quarter, the company expects to report a net loss per share of $0.60 to $0.85. Moreover, for full-year 2022, Teladoc anticipates a per-share net loss of $61 to $62.

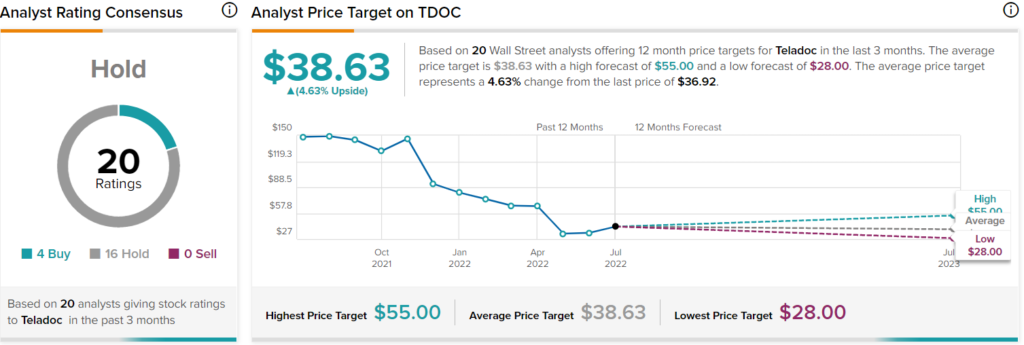

In light of Teladoc’s subpar quarterly results and unambitious outlook, analysts at Needham downgraded Teladoc stock to a Hold rating. Now, let’s take a look at how the analyst community sees Teladoc generally.

Wall Street’s Take on TDOC Stock

Turning to Wall Street, TDOC stock comes in as a Hold based on four Buys and 16 Hold ratings. The average Teladoc price target is $38.63, implying 4.6% upside potential.

Conclusion: Teladoc is Too Risky to be Considered a Bargain

Bargain hunters might be tempted to apply a “buy low, sell higher” strategy with Teladoc stock now. They might point to the CEO’s apparent optimism and Teladoc’s revenue growth. However, optimism won’t be enough to put Teladoc on a path to profitability as the company’s earnings loss is deep. There’s likely no bargain here, really, since Teladoc is vulnerable to further downside.

Therefore, it’s probably wise to check all of the data – not just the top-line results – and maintain a healthy distance from Teladoc stock.