The increased adoption of virtual healthcare services skyrocketed during the pandemic, driving shares of the companies operating in this space higher, including Teladoc (NYSE:TDOC). However, moderating growth amid economic reopenings, profit-taking, and difficult year-over-year comparisons took a toll on Teladoc stock, erasing a significant portion of its market cap.

Teladoc’s membership and revenue growth rates have witnessed a slowdown over the past couple of quarters. Teladoc’s member base increased by about 5% in Q3, significantly lower than 74% and 31% increases in Q1 and Q2, respectively.

Further, revenues increased by 81% in Q3 compared to the 109% growth registered in the previous quarter.

Amid the slowdown, Teladoc stock has fallen over 52% in the past three months. Further, it is down about 24% this year.

Now What?

Management recently provided its FY22 outlook and expects revenues to be $2.6 billion, representing year-over-year growth of 29%. Further, Teladoc’s top-line is expected to increase at a CAGR of 25-30% through 2024.

Moreover, it expects memberships to increase by 1-5% annually, while revenue per member is anticipated to grow by 25% per annum from 2021 to 2024. Meanwhile, the adjusted EBITDA margin is projected to expand by 100-150 basis points during the same period.

In response to Teladoc’s guidance, Jefferies analyst Glen Santangelo lowered his FY22 and FY23 EBITDA estimates to reflect a “more conservative outlook.” Santangelo stated, “The expectation of ~25% annual revenue growth/member still seems to incorporate a somewhat aggressive outlook for new enrollment.”

Commenting on Teladoc’s Primary360 offering (its new primary care service), Santangelo stated, “While we are encouraged by the early client traction with Primary360, we continue to believe a wait-and-see approach is prudent as it relates to the LT (long term) product viability, particularly as slowing overall membership growth remains a key concern for investors.”

Valuation

Teladoc’s valuation multiples have witnessed a sharp compression following the recent selloff. Santangelo said that Teladoc stock is “trading at ~3.5x our C23E revenue, which is well below the 3-yr historical average of 9.3x.”

However, the analyst maintains a Hold rating on TDOC stock, reflecting his below consensus EBITDA estimate for FY22. Further, Santangelo expects a moderation in consensus EBITDA expectations.

Wall Street’s Take

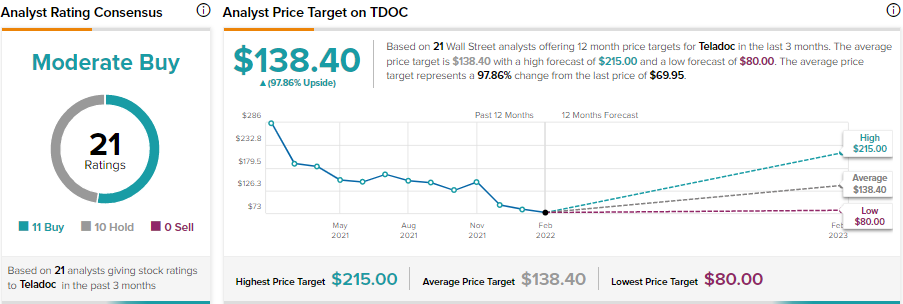

Due to a slowdown in membership growth and increased competition from Amazon (NASDAQ:AMZN), analysts maintain a cautiously optimistic outlook on TDOC shares. Teladoc’s Moderate Buy consensus rating on TipRanks is based on 11 Buy and 10 Hold recommendations.

However, TDOC’s stock price forecast on TipRanks shows significant upside potential due to the recent correction in price. The average Teladoc price target of $138.40 implies 97.9% upside potential to current levels.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.