Teladoc Health, Inc. (TDOC) has been languishing this year despite phenomenal growth in 2020 and guidance for growth of 80% in 2021.

Teladoc is an industry leader in remotely delivered healthcare, a market segment that is growing by leaps-and-bounds, but also attracting increased competition from tech behemoths such as Amazon (AMZN) and Microsoft (MSFT), as well as from upstarts such as American Well Corporation (AMWL). Not only is competition heating up, but there is also an expectation that the demand for tele-visits will subside in the US once most of the population is vaccinated.

The concerns mentioned above, along with the recent tech meltdown, have led to a decline of 16% for TDOC over the last three months.

However, the good news is that the company has a much more reasonable valuation now, with a price/sales ratio (trailing twelve months) of 26.8, which is pretty good given its exceptional five-year revenue growth rate of 70% CAGR.

Two Major Tech Companies Entering The Virtual Healthcare Market

Amazon is perhaps the company that generates the greatest fear among Teladoc shareholders. Amazon has announced that Amazon Care, a pilot program launched one and a half years ago, will be expanded to serve all of its employees this year. Indications are that Amazon Care will eventually be extended to outside companies in the not-so-distant future.

Microsoft is also making a serious move into the healthcare market with the announced acquisition of Nuance Communications, Inc. (NUAN), a leader in conversational AI that operates primarily in the healthcare industry.

Of particular interest is the application called Nuance Dragon Ambient Experience (DAX), a service that addresses the clinical documentation requirements from doctor-patient interactions, thus allowing physicians to focus on patients instead of paperwork. Nuance DAX is currently being integrated with Teams as a part of Microsoft’s tele-health product. In this application, DAX documents the details of the virtual doctor visit in a secure fashion.

End Of Pandemic Isn’t Necessarily A Headwind

2020 was an exceptional year for Teladoc, with the total number of virtual doctor visits growing by 156% to 10.6 million, largely due to the pandemic.

While that kind of performance isn’t anticipated in 2021 as the world emerges from the pandemic, Teladoc is still expecting to deliver a strong performance this year, partly thanks to its merger with connected care provider Livongo Health, a company that digitally manages chronic conditions such as diabetes and hypertension. The merger between Teladoc and Livongo is expected to generate new cross-selling opportunities.

Wall Street’s Take

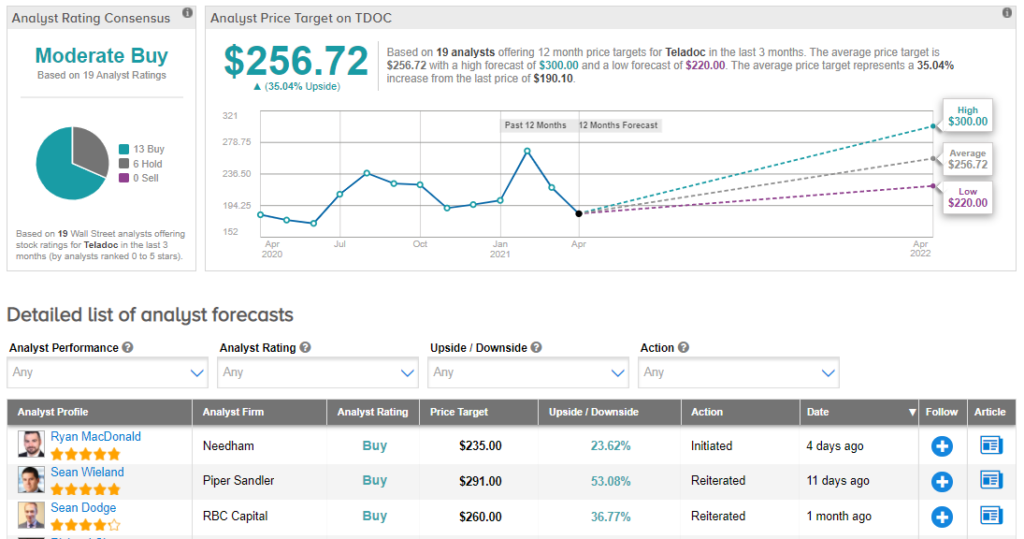

From Wall Street analysts, Teladoc earns a Moderate Buy consensus rating, based on 13 Buys and 6 Holds. Additionally, the average analyst price target of $256.72 puts the upside potential at 35%. (See Teladoc stock analysis on TipRanks)

Summary And Conclusions

Pioneer and industry leader in the field of virtual healthcare, Teladoc had a tremendous 2020 as tele-health took a major step forward during the pandemic. That said, in spite of encouraging guidance from company management for 2021, Teladoc stock has tumbled over the last few months primarily due to fear of increased competition from major tech companies, as well as the belief that vaccines will result in reduced need for doctor tele-visits. So, the currently depressed share price may present an ideal entry point.

Disclosure: On the date of publication, Steve Auger did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.