After last year’s share-price collapse, is it now time to bet on Target (NYSE:TGT) stock? Target’s results indicate that the U.S. consumer is stronger than you might expect. After foraging through the fiscal facts, I’m bullish on TGT stock and expect a strong recovery in 2023.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Target operates a famous big-box retail store chain; chances are good that you’ve seen the red logo with concentric circles. Target’s advantage is that it has a reputation for being cheap, but not so cheap that the products are unreliable or it’s embarrassing to shop there.

On the other hand, Target struggled just like other retail chains did in 2022, as inflation forced consumers to cut back on their spending. Still, Target has survived previous crises and will undoubtedly get through this one. If you like the bargains you’ll find at Target stores, then you should also appreciate the current sale on TGT stock.

Target’s Financial Results Were Actually Pretty Good

I’m not going to claim that Target knocked it out of the park with its fourth-quarter 2022 results. Yet, investors should consider everything within its context. During a time when the economy was on shaky ground, Target’s pretty good results should provide a sense of relief and optimism to current and prospective shareholders.

Before delving into the details, I should mention that Target offers a decent annual dividend yield of 2.5% on a trailing basis and 2.7% on a forward basis. Plus, the company has been a dividend grower for over 50 consecutive years, making it a Dividend King. Therefore, income-focused investors should definitely have TGT stock on their watch lists.

Dividend payments are a nice bonus, but how is Target faring on the fiscal front? If you’re burning for earnings, you won’t be disappointed as Target delivered Q4-2022 adjusted EPS of $1.89, easily beating the consensus estimate of $1.40. Admittedly, Target’s EPS declined year-over-year, but again, we have to take everything in context here; at least the company managed to post an EPS beat after several quarterly misses.

Here’s where it gets even better. Impressively, Target’s revenue actually grew 1.3% year-over-year to $31.4 billion. Furthermore, this result outpaced Wall Street’s forecast of $30.68 billion. On top of all that, Target’s total comparable (i.e., same-store) sales increased by 0.7%, while analysts expected to see a decline of 1.6%.

What can investors conclude from these results? There are broader implications here, as America’s shoppers are clearly willing to remain active despite economic headwinds. Concerning Target in particular, though, it’s nice to know that consumers will still shop there even when their purchasing power is diminished.

Target Wisely Courts Cost-Conscious Consumers

While some retailers might try to bulk up their bottom lines by pursuing high-end spenders, Target is wisely taking the opposite route: courting bargain hunters. This is a sensible strategy during a time when plenty of Americans are struggling just to make ends meet.

Target Chairman and CEO Brian Cornell hinted at this strategy as he explained his company’s surprisingly strong fourth-quarter performance. “Strength in Food & Beverage, Beauty and Household Essentials offset ongoing softness in discretionary categories,” he observed. That’s just a fancy way of saying Target sold lots of bargain-priced products – but will the company continue to pursue this path in 2023?

The answer is definitely yes, as Target promised to deliver “affordable joy” and “a renewed focus on deal-conscious shoppers” this year in the company’s annual Financial Community Meeting. It’s a broad-ranging road map in which Target expects to invest $4 billion to $5 billion on various changes and revamps.

First of all, Target plans to “launch or expand more than 10 owned brands” with products offered at “incredible prices.” Furthermore, the company will bring “enhancements” to its Target Circle loyalty program (I suppose we’ll have to wait to find out what those “enhancements” might be) and will introduce a “new advertising campaign that celebrates how Target delivers affordable joy.” Here’s my favorite part, though: Target announced that it will offer “more items starting at $3, $5, $10, and $15.” Are you guys and gals ready to go bargain shopping, or what?

Is Target Stock a Buy, According to Analysts?

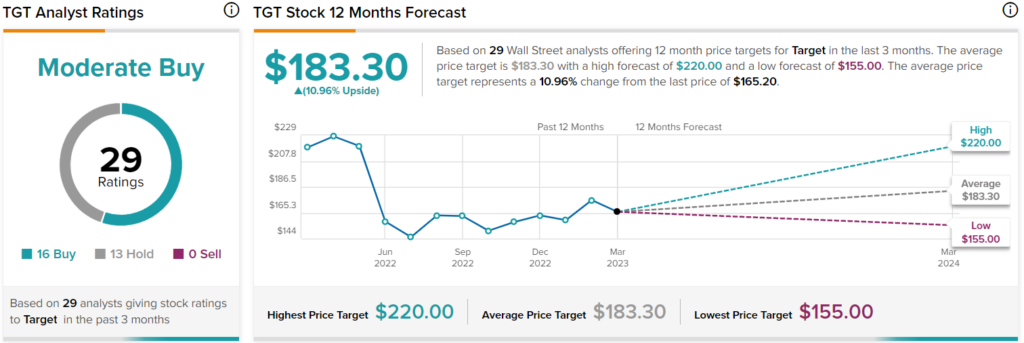

Turning to Wall Street, TGT stock is a Moderate Buy based on 16 Buys and 13 Hold ratings. The average Target stock price target is $183.30, implying 11% upside potential.

Conclusion: Should You Consider Target Stock?

Target continued to pay dividends and beat the Street’s expectations during 2022’s challenging final quarter. That’s a notable feat, and the context definitely matters when evaluating Target’s performance.

Looking ahead, Target’s management appears fully prepared to court America’s horde of cost-conscious shoppers. It’s a savvy strategy, so consider a stake in TGT stock while it’s still well below its all-time high and the U.S. consumer remains resilient.