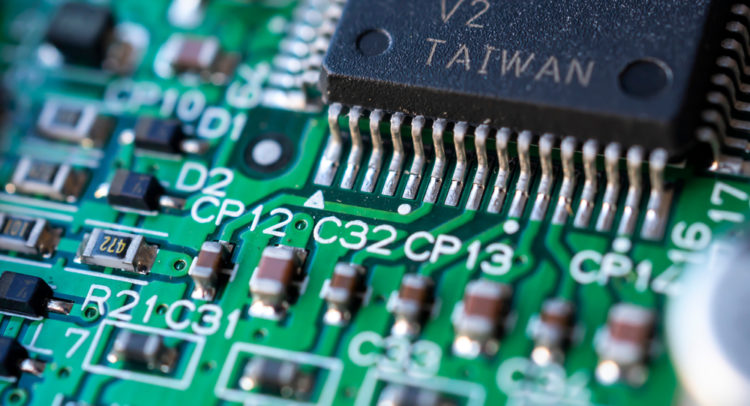

Taiwan Semiconductor Manufacturing Company (TSM) is currently the world’s largest specialized foundry in the semiconductor industry. As a foundry, TSM manufactures semiconductors, based on proprietary integrated circuit designs requested by its customers. The company produced 24% of the world’s semiconductor (excluding memory) output value in 2020 vs. 21% in 2019, further bolstering its industry-leading position.

TSM shares have lagged over the past few months, despite the company’s continuous advancement. The company should keep growing as the global demand for semiconductors rises, so investors are likely to find attractive opportunities in TSM’s dips. For this reason, I am bullish on the stock. That said, TSM shares are not inexpensive, coming with a premium price tag attached. (See Taiwan Semiconductor Manufacturing stock charts on TipRanks)

Growing Financials Backed by Growing Semiconductor Demand

Year after year, the semiconductor industry has enjoyed fantastic growth across the globe, powered by the chips’ growing popularity. Indeed, they have gradually become essential for virtually any device we use these days. Anything inside computers, TVs, and even washing machines and refrigerators utilizes semiconductors to function properly.

As the demand for electric devices expands and trends such as the Internet Of Things, self-driving electric cars, VR, and AR, amongst others, continue to rise, the semiconductor industry should continue enjoying favorable tailwinds.

Powered by the growing demand for processing power, TSM’s financials should keep growing. The company’s revenues and net income feature a 3-year CAGR (Compound Annual Growth Rate) of 12.8% and 15.5%, respectively, and TSM is likely to keep expanding both the top and bottom line in the double digits.

TSM Valuation

While I remain confident that TSM’s market-leading position will result in growing financials powered by a growing market, TSM investors should be wary of the stock’s valuation. TSM shares are currently trading at a forward P/E of 23.15. While the multiple itself is not crazy-high, generally speaking, it is high when it comes to the semiconductor industry. Since demand for semiconductors can be cyclical, it’s not rare to see stocks in the industry trading with a multiple in the single digits.

However, TSM’s market-leading position does deserve a premium, and the company should be able to withstand short-term headwinds due to its size alone. Further, assuming EPS growth retains its present pace in the medium term, investors are currently fairly valuing the stock. In my view, TSM is a quality company with strong prospects, and so a modest valuation multiple expansion ahead should not surprise investors in the current, low-rate environment.

Growing capital returns should also assist in the stock’s retaining a premium multiple. The company has never cut its growing dividend since initiating it in 2004. While the yield of around 1.32% may not be substantial, the latest DPS hike was by 11.1% and increases are likely to continue to be by north of 10% moving forward, supported by a comfortable payout ratio, which stands at 37.9%.

Wall Street’s Take

Turning to Wall Street, Taiwan Semiconductor Manufacturing has a Moderate Buy consensus rating, based on one Buy assigned in the past three months. At $138.00, the average Taiwan Semiconductor Manufacturing price target implies 23.70% upside potential.

Disclosure: On the date of publication, Nikolaos Sismanis had a beneficial long position in the shares of TSM through stock ownership.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.