T-Mobile (TMUS) is one of the better-performing American telecom stocks these days.

Although it doesn’t pay a bountiful dividend yield, as its peers in the space do, the stock has really delivered on the capital gains front, as the company has continued investing heavily and strategically in next-generation infrastructure.

There’s a reason Warren Buffett owns TMUS stock alongside his Verizon (VZ). T-Mobile has a proven management team with a knack for effective execution. While it’s easy to give in and just go for the massive 7.7% dividend yield of AT&T (T), investors have a lot to gain by going with the high-growth T-Mobile, as it continues to grow in a competitive landscape.

I am bullish on TMUS stock. (See TMUS stock charts on TipRanks)

T-Mobile Pulls Back

Shares of TMUS have slid 13.9% off their 52-week high of $150.20. The latest quarter revealed that Verizon and AT&T are more than capable of playing catch-up.

T-Mobile’s growth, while still very impressive, showed very mild signs of weakness. Now, T-Mobile is still a front-runner, as broader adoption of 5G continues into year-end. Still, you can’t count T-Mobile’s competitors out of the race quite yet.

Undoubtedly, the lack of a dividend does T-Mobile no favours, especially with AT&T outpacing it with over 100,000 more postpaid mobile additions in the second quarter (AT&T added over 750,000 versus T-Mobile’s 627,000).

Competition is fierce, and it could get much fiercer. Still, greater financial flexibility due to no dividend commitments, and ever-improving brand affinity could separate T-Mobile from the pack.

Wall Street’s Take

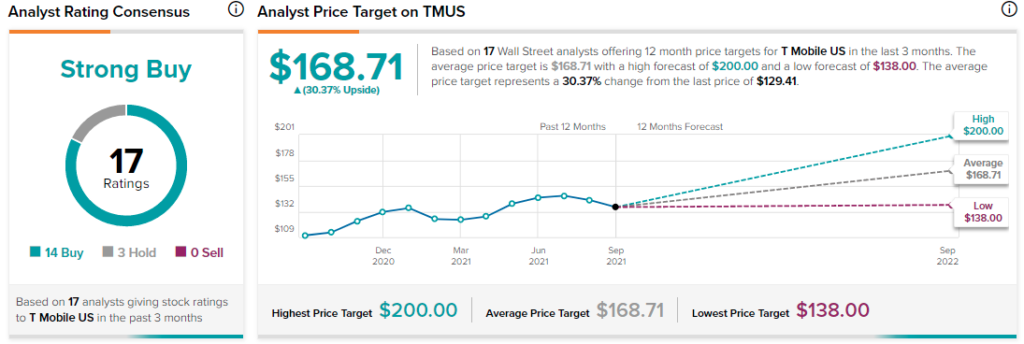

According to TipRanks’ analyst rating consensus, TMUS stock comes in as a Strong Buy. Out of 17 analyst ratings, there are 14 Buys, and three Holds.

The average TMUS price target is $168.71. Analyst price targets range from a low of $138 per share to a high of $200 per share.

Bottom Line

T-Mobile isn’t going to appeal to everyone after its latest slide. The lack of a dividend makes it a growth-first telecom first and foremost.

For those seeking year-ahead upside, though, T-Mobile stock appears to be the way to go.

Disclosure: Joey Frenette doesn’t own shares of any mentioned companies at the time of publication.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.