The Cambria Shareholder Yield ETF (BATS:SYLD) has been quietly beating the market over the past five years, and it isn’t investing in the Magnificent Seven, mega-cap tech, or the hottest growth stocks.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

I’m bullish on this relatively unheralded ETF from Cambria because of its unique strategic focus on shareholder yield, its market-beating returns over the past five years, and its portfolio of undervalued holdings.

What Is the SYLD ETF’s Strategy?

SYLD is an actively managed ETF that launched in 2013. It now has $1.1 billion in assets under management (AUM). According to fund sponsor Cambria, the Cambria Shareholder Yield ETF “focuses on high-cash distribution companies that are returning their cash to investors through three attributes – dividends, buybacks and debt paydown – collectively known as shareholder yield.”

Cambria reminds investors that dividends aren’t the only way that companies can use excess cash to create value for shareholders. If investors focus exclusively on dividends, they may be missing out.

Shareholder yield is calculated by adding these three factors (dividends, net share repurchases, and net debt reduction) and dividing them by a company’s market capitalization.

To create its investment portfolio of stocks with attractive shareholder yields, Cambria uses a rigorous and interesting investment process. SYLD starts with a broad universe of 3,000 stocks with market caps over $200 million that pass its screens for liquidity and price.

SYLD’s managers then select the top 20% of these stocks based on shareholder yield, remaining debt paydown, and valuation metrics. The fund’s managers then use valuation metrics like price-to-earnings ratio, price-to-book ratio, and price-to-free-cash-flow ratio to find undervalued stocks. Lastly, the managers then select the top 100 stocks that exhibit the best combination of shareholder yield and attractive valuation.

The fund is rebalanced on a quarterly basis, and then Cambria begins this process of sifting through the universe of 3,000 stocks for the best opportunities on a shareholder-yield and valuation basis all over again.

While the fund aims to be equal-weighted, position sizes can fluctuate based on market conditions, investment opportunities, or tax considerations.

Market-Beating Performance

So what kind of returns has this comprehensive investment process generated for investors? It turns out they are pretty good. Over the past three years, as of January 31, 2024, SYLD generated a total annualized return of 11.7%. This compares favorably with the 11.0% total annualized return that the Vanguard S&P 500 (NYSEARCA:VOO) (a good proxy for the broader market) has generated over the same time frame.

Over the past five years, SYLD has generated an exceptional annualized total return of 16.3% (as of January 31), again beating VOO’s return of 14.2% over the same time horizon. And over the past decade, SYLD has generated a 12.2% return (as of January 31), which slightly underperforms VOO’s 12.6% return.

Finally, since the fund’s inception in 2013, SYLD has produced a very respectable 12.8% annualized return.

SYLD’s Holdings

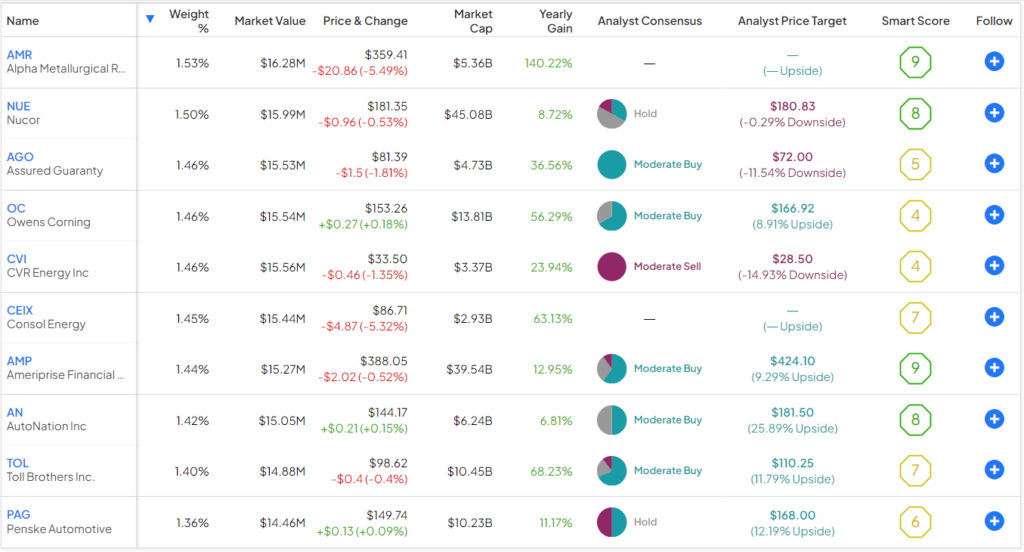

SYLD offers attractive diversification and very little concentration. The fund holds 101 stocks, and its top 10 holdings account for just 14.5% of its assets. Below, you’ll find SYLD’s top 10 holdings using TipRanks’ holdings tool.

As you can see above, SYLD isn’t investing in the Magnificent Seven or high-flying growth stocks.

It is instead invested in coal stocks like Alpha Metallurgical Resources (NYSE:AMR) and CONSOL Energy (NYSE:CEIX); steel stocks like Nucor (NYSE:NUE); financial companies like Assured Guaranty (NYSE:AGO) and Ameriprise Financial (NYSE:AMP); homebuilders like Toll Brothers (NYSE:TOL); and other names like AutoNation (NYSE:AN) and Penske Automotive (NYSE:PAG).

So how is SYLD generating market-beating returns with these less heralded stocks from largely out-of-favor market sectors? These stocks often trade at low valuations, and they typically return a lot of capital to shareholders in the form of dividends, share repurchases, and debt paydowns.

Additionally, many of these holdings trade at significant discounts to the broader market. As of December 31, SYLD’s holdings traded at a dirt-cheap price-to-earnings ratio of just 8.3, compared to a much higher 22.1 average price-to-earnings multiple for the S&P 500 (SPX) index. This low valuation gives investors downside protection while leaving plenty of room for upside.

High Fee, But Is It Worth It?

While I’m bullish on SYLD, it has to be said that the fund charges a fairly high expense ratio of 0.59%. This means that an investor in the fund will pay $59 in fees on a $10,000 investment annually.

That being said, with SYLD’s strong, market-beating performance over the years, this fee can be justified. Furthermore, this fee isn’t out of line with those of other actively-managed ETFs.

Does SYLD Pay a Dividend?

While it is not focused exclusively on dividend stocks (these are just one component of shareholder yield, along with share repurchases and debt paydown), SYLD pays a dividend and currently yields 1.9%. SYLD has paid a dividend for 10 consecutive years.

Is SYLD Stock a Buy, According to Analysts?

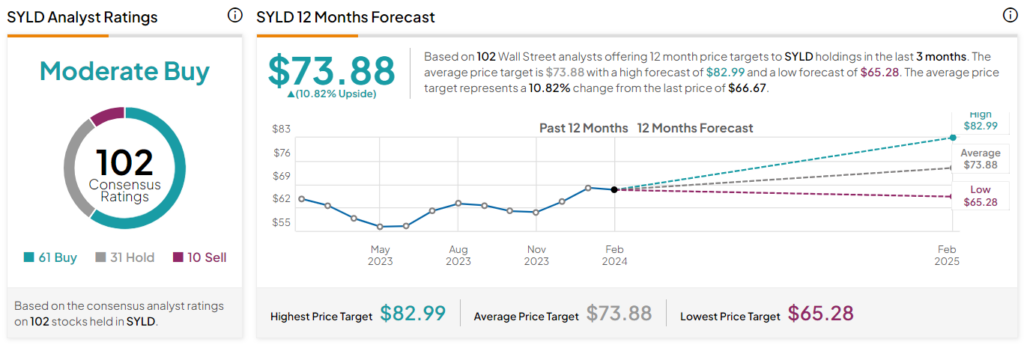

Turning to Wall Street, SYLD earns a Moderate Buy consensus rating based on 61 Buys, 31 Holds, and 10 Sell ratings assigned in the past three months. The average SYLD stock price target of $73.88 implies 10.8% upside potential from current levels.

The Takeaway: More Than One Way to Beat the Market

SYLD shows that there are many ways to succeed in the market. The fund doesn’t own any of the mega-cap tech stocks or other hot growth names that dominate much of the conversation surrounding the stock market, but it has managed to generate market-beating returns for its investors over the past five years and very respectable double-digit annualized returns for over a decade. It does this by focusing on stocks trading at attractive valuations that pay dividends, buy back shares, and pay down debt.

I’m bullish on this underrated ETF going forward because of its focus on this unique and proven strategy, its excellent returns, and the relative undervaluation of its portfolio. While the fee it charges may seem a bit high, it isn’t out of line for an actively-managed ETF, and the 16.3% total return it has generated over the last five years makes it a lot easier to take this fee in stride.