Not long ago, Sundial Growers (SNDL) was in danger of running out of cash. Yet, after completing a series of financial restructuring measures and becoming debt-free, the Canadian cannabis company recently announced it has acquired a special purpose vehicle for a total of C$58.9 million in cash.

The strategic investment means the company will now own C$58.9 million of Zenabis Investments’ (a subsidiary of Zenabis Global) senior secured debt. The note has an annual interest rate of 14% and is due by March 31, 2025.

As the company allocated more than half of the recently raised C$110 million for the investment, Canaccord analyst Shaan Mir wonders if the cash injection has been utilized correctly.

“Given the growth profile inherently expected in the Canadian Cannabis space, we would have expected to see additional investment in building out this business vertical and are therefore less encouraged by the impact of this transaction on the long-term value in the core operation. However, with C$51M of cash on hand (and no debt), we believe the company is better situated today to capitalize on cannabis-related opportunities as they arise,” Mir noted.

Sundial’s new clean balance sheet has come at the expense of more share dilution. The count has multiplied more than eightfold in 2H20.

Overall, the analyst views the transaction as “neutral,” noting that while it could “provide costless cash flow over time,” the stipulations concerning the debt will likely “stall Zenabis’ ability to invest in its growth – therefore capping royalty amounts.”

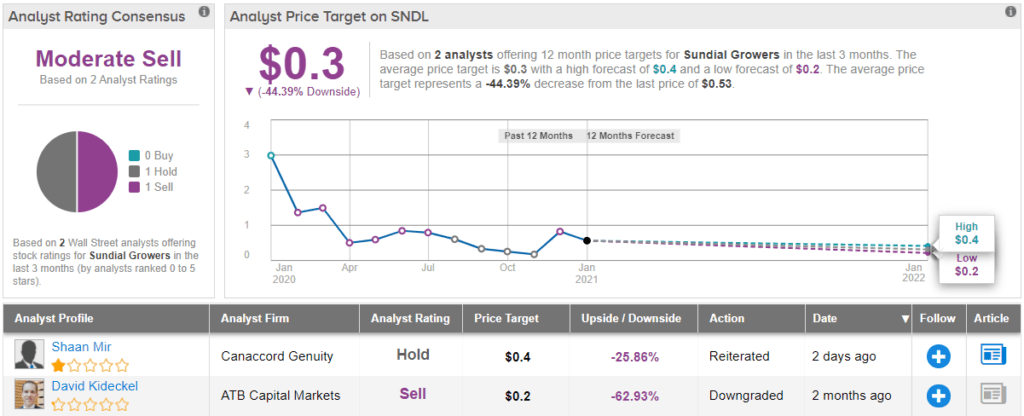

Mir reiterates a Hold rating on SNDL shares, while raising his price target from $0.30 to $0.40. Nevertheless, the new figure implies the stock will be changing hands for a 26% discount over the next year. (To watch Mir’s track record, click here)

Only one other analyst has recently thrown the hat in with a Sundial review, taking an altogether more downbeat stance. The additional Sell means SNDL qualifies with a Moderate Sell consensus rating. At $0.3, the average price target suggests shares will slide a further 45% over the next 12 months. (See SNDL stock analysis on TipRanks)

To find good ideas for cannabis stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.