In recent weeks, Sundial Growers (SNDL) has been on a high. Trading at $0.56 on Jan. 26, SNDL stock skyrocketed to a 52-week high of $3.96 on Feb. 10. The hyperbolic move has been followed up by a sharp correction, and the stock now trades at $1.72.

With the outlook for the cannabis industry looking bright, there are several attractive company specific factors that make Sundial shares worth accumulating.

On Feb. 16, Sundial announced a $22 million strategic investment in Indiva Limited. The latter is involved in the development and sale of premium cannabis products, including the likes of pre-rolls, dry flowers, gummies, chocolates, and infused sugar.

With the introduction of new products and increased store penetration as a result of the investment, Indiva is positioned for top-line growth acceleration. The strategic investment by Sundial is likely to deliver value, and in all probability, is the first step towards acquiring a controlling interest in Indiva.

It’s worth noting that Sundial has also been on a fundraising spree. On Feb. 4, the company closed a $74.5 million registered offering, after which, the company reported $610 million in unrestricted cash.

Taking all of this into consideration, the company is well positioned to pursue aggressive organic and inorganic growth. Therefore, it’s not surprising that the markets are excited, and the stock has delivered multi-fold returns in a short period of time.

Well Positioned for Strong Growth

Sundial is focused on premium cannabis products, with inhalables being its largest segment. The good news for the company is that branded cannabis sales have been increasing as a percentage of total sales. For Q3 2020, branded cannabis sales accounted for 77% of total sales, with the medium to long-term implication being that the EBITDA margin should improve on a sustained basis.

It should be noted that for Q3 2020, the company reported 120% growth in sales and marketing expenses on a year-on-year basis. With a strong cash buffer, the company is likely to continue investing in brand visibility. This will translate to revenue growth in the coming quarters.

In terms of product portfolio expansion, there are two potential triggers. First and foremost, Sundial has collaborated with Choklat for the launch of cannabis-infused chocolate bars, infused sugar and drinking chocolate. A wider product portfolio with new premium products will most likely support growth.

Furthermore, the company has a 50% equity interest in Pathway Rx. The license agreement with Pathway will allow the company to use certain cannabis strains for commercial production, which will help Sundial make inroads into the medicinal cannabis segment.

Is Sundial a Potential Acquisition Target?

With its recent fundraising, Sundial looks well positioned to accelerate growth. However, a potential acquisition cannot be ruled out.

It seems that the cannabis industry is moving towards consolidation. In December 2020, Tilray (TLRY) and Aphria (APHA) announced a business combination agreement to create the world’s largest cannabis company. This might just be the beginning of the industry consolidation phase.

Specific to Sundial, the following point from the Q3 2020 management discussion puts things into perspective.

“Sundial’s Board has authorized management and its external advisors to consider a broader range of strategic alternatives, including a potential sale of the Company, merger or other business combination, investments in other Canadian cannabis companies.”

Clearly, with the ramp up in its cash position, the company will be looking to acquire strategic interest in other cannabis players. However, a merger with a bigger player remains a possibility, and any such news could trigger a sharp upside move for SNDL stock.

Analysts Weigh In

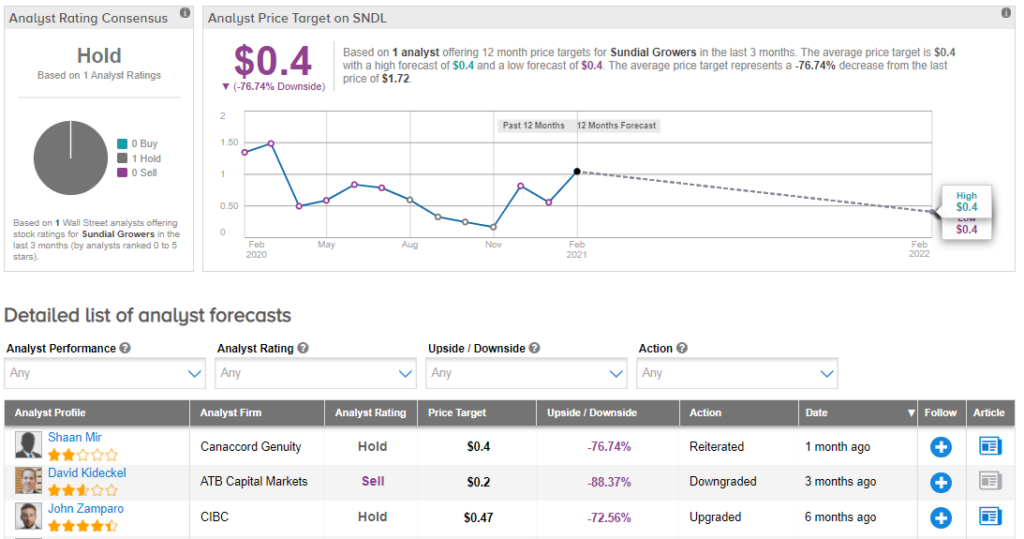

Looking at the consensus breakdown, only one analyst has thrown an opinion into the mix recently, rating the stock a Hold. So, SNDL has a Hold consensus rating. (See Sundial Growers stock analysis on TipRanks)

Final Thoughts on Sundial Stock

For Sundial Growers, the latter part of 2020 was focused on fundraising and strengthening the balance sheet. This year, the focus has shifted to organic growth, brand visibility and strategic investments.

This is likely to result in accelerated top-line growth and a potential improvement in margins. Therefore, despite the recent spike in SNDL shares, fresh exposure at current levels remains an attractive option for investors.

Disclosure: On the date of publication, Faisal Humayun did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.