Cannabis stocks are having another moment. The so-called Blue Wave of Democrats controlling the government is believed to usher in the legalization of cannabis on the Federal level. Because of that, cannabis stocks were pushed significantly higher. Then Reddit traders joined in and pushed the prices even further upwards.

One of the companies that had its stock price move upwards was Sundial Growers (SNDL). It’s a Canadian cannabis adult-use company that gets a lot of positive attention.

SNDL rose almost 10-fold in a short period of time. Here is a look at SNDL over the past year:

However, since the ‘Reddit attack,’ all the cannabis stocks have been selling off as the valuations were dramatically misaligned.

Let’s go over a few data points for Sundial and see what is a practical valuation and whether the stock is currently valued correctly.

First up is a look at Sundial’s revenues:

In Canada, retail sales for adult-use cannabis have gone from $121M in October 2019 to $270M in October 2020. That is an increase of 130% in a year’s time.

Yet, during the same period, Sundial’s revenues declined YoY. Whereas the rest of the industry is expanding rapidly, Sundial is missing a significant opportunity to acquire a strong customer base and increase revenues. On $9M in revenues, shown above, Sundial lost $53M for the quarter.

The problem with the loss is that Sundial only has ~$15M remaining with cash-on-hand. Recently, Sundial did a capital raise of $89M in warrants and is already preparing to issue more. With only $15M in cash remaining and a one-year burn rate of what is now ~$200M, even the $89M will not sustain the company for one year. This continual capital raise dilutes shareholder value and moves the yardstick further down the field for profits and stock value appreciation.

A look at margins and cost efficiencies shows that Sundial is all over the board with its metrics. Here is a look at gross margins:

A consistent number within the cannabis industry is to hit about 60% on gross margins. Granted, Sundial over-achieved in eclipsing this number with 394% gross margins. What company in the world would not want to print double-digit gross margins?

But, gross margins become unreliable when you start looking at other financial numbers for Sundial.

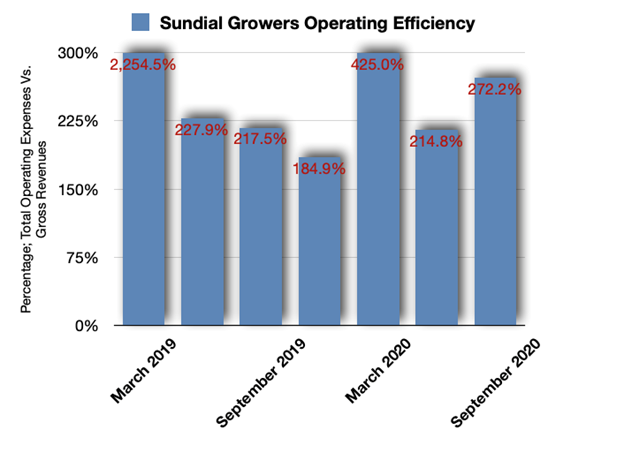

Warning signs start to flash when you combine gross margins with operating efficiencies, a metric that is the total operating cost over revenues:

With this number, you are looking for somewhere in the neighborhood of 30%. After all, you would subtract this number from gross margins to get to what is ultimately left over for investors: profits!

In the case of Sundial, the 272% negates the positive gross margins.

There is one very bright spot with Sundial Growers, however. Recently, they inked a bought deal with Indiva, an edibles company in Western Canada. As it turns out, this edibles company sells some 50% of all edibles in Western Canada. And, their financials are strong with a lot of potential.

Cannabis is a fairly new industry and an investor will want to be somewhat forgiving in their analysis. But, I recommend you marry forgiveness with pragmatism. Companies with solid and reasonable gross margins are above 60%. Simultaneously, cost metrics should be well below gross margins, and reasonable numbers average around 35%. This is the mathematics necessary to achieve profitability.

At the same time, consistency is very valuable to stock analysis. I feel confident in saying that Sundial is outside of the industry’s norm with consistency. And, despite printing a solid gross margin, the combined metrics simply don’t add up.

Sundial garners a lot of attention through public relations. Because of that, investors without much in-depth knowledge tend to gravitate towards investing in companies they have heard of. But, when you look at the numbers above you can see that Sundial’s future is very uncertain from one quarter to the next. As it turns out, popularity does not translate into profits.

In the meantime, the investment into Indiva may prove to be a boon for Sundial.

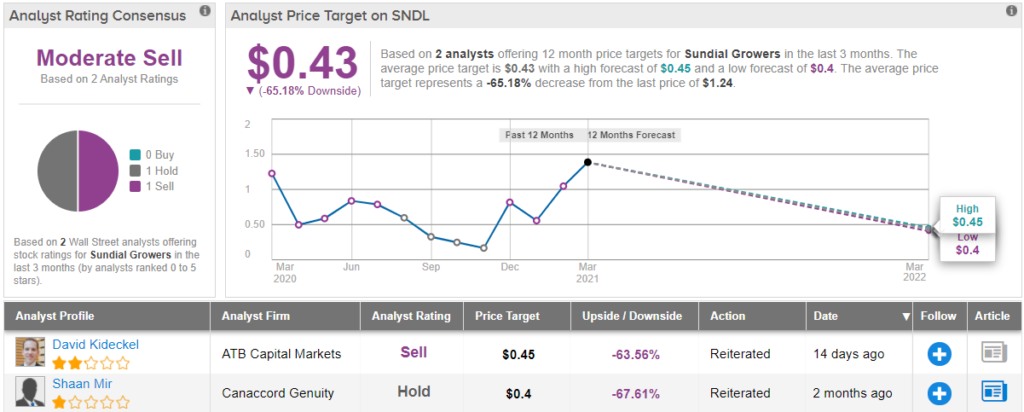

It has been relatively quiet when it comes to analyst activity. Over the last three months, only 2 analysts have reviewed the cannabis supplier. The conclusion? SNDL is a Moderate Sell. These two analysts expect the share price to crash 65%, given the average price target currently stands at $0.43. (See SNDL stock analysis on TipRanks)

Disclosure: No position.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.