The tech sector is not the only corner of the market where lofty multiples have raised concerns. After a period of declining fortunes, the Canadian cannabis industry has been staging a comeback, with valuations across the board moving in one direction – higher

Since Joe Biden’s presidential win and the Dems taking control of the Senate, the promise of marijuana reform at the federal level is real and could open the door for Canadian companies to enter the lucrative US market. Investors have taken this as a buy signal and have loaded up on shares, in some cases, seemingly without care for fundamentals or how well some of the companies are positioned to benefit from US legislation.

Sundial Growers (SNDL) has been a prime beneficiary. The stock is up by 180% year-to-date, and for BMO analyst Tami Chen, the surge is hard to justify.

“In our view, valuation has deviated too much from fundamentals with the stock trading at 28x our revised C2022 sales forecast, which exceeds even the high end of our tiered valuation range,” Chen said. “SNDL needs to demonstrate more consistent topline momentum to ease concerns that there is soft consumer traction for its products.”

And there’s the nub of the matter. Against a backdrop of “strong” LDD% (low double-digit) industry growth, in 3Q20, Sundial’s recreational sales dropped by 30% quarter-over-quarter.

On a positive note, although the share count has ballooned following a February round of equity offerings, Chen notes that Sundial’s balance sheet now boasts $600 million of cash on hand and no debt.

However, it is not enough of a game changer for Chen, who still can’t see a “path to profitability,” and finds it hard to identify “specific points of differentiation or strategic attributes that warrant placing SNDL higher up on the y-axis in our framework.”

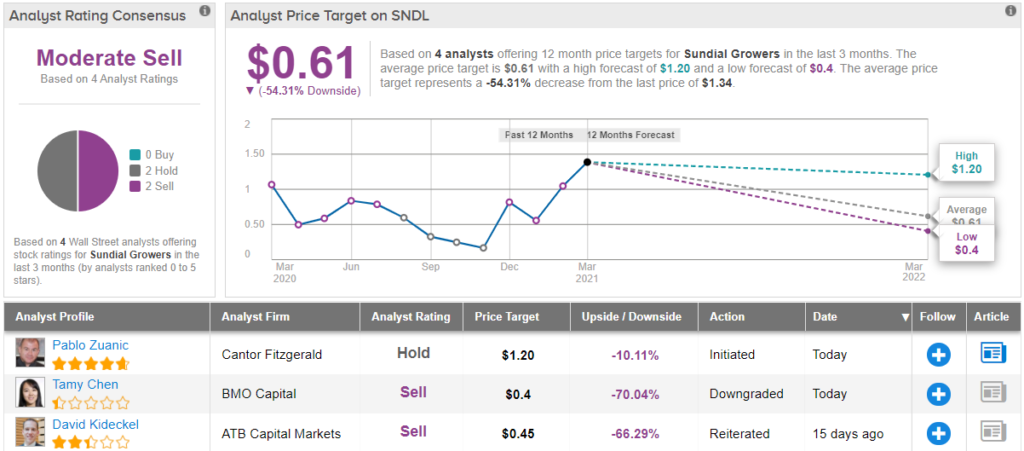

Therefore, attributing a “lower-end Tier 3 multiple (3.5x) to SNDL for all the fundamental challenges facing the company,” Chen downgraded her rating from Market Perform (i.e. Hold) to Underperform (i.e. Sell). At the same time, Chen raised her price target from $0.3 to $0.4. Still, it’s a sharp 70% drop from current levels. (To watch Chen’s track record, click here)

Three other analysts have recently chimed in with SNDL reviews with 2 recommending to Hold and the other suggesting to Sell. The Moderate Sell consensus rating is backed by a $0.68 average price target, which implies shares will be changing hands for a 51% discount in the coming months. (See SNDL stock analysis on TipRanks)

To find good ideas for cannabis stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.