Socially responsible investing has taken the world by storm over the last few years. However, as economic conditions weaken, many investors may wonder if it’s okay to pull back on ESG guidelines to improve a portfolio’s defensive characteristics.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A recession is on the way, and with too many ESG constraints, it can be tougher to find the perfect mix of value and recession resilience. Undoubtedly, the consumer-packaged goods space is rich with recession-resilient dividends, and right now, valuations aren’t all too absurd.

Indeed, not all stocks that are less than ESG-friendly ought to be thrown into the “sin” basket. Some firms, like tobacco stocks, should be graded lower in terms of social responsibility than sugary soda makers. While sugary sodas can be addicting to some, they’re nowhere near as addictive or harmful as cigarettes.

In this piece, we’ll have a closer look at the sugary beverage stocks that are in a bit of a moral middle ground, in my opinion. While they may be helping fuel obesity rates across the nation, I think they’re far more ethical than many give them credit for.

Sugary Beverage Stocks in the Social Responsibility Middle Ground

Sugary beverage stocks can also be pretty sweet for your portfolio at a time like this. Many have felt a bit of modest pressure amid the broader market pullback. Still, their dividends are incredibly well-covered. They’re also subject to growth less tied to the state of the broader economy. In such uncertain times, I’d argue sugary beverage stocks are magnificent core holdings to consider, even if you value ESG and social responsibility over cheap valuations and upside potential.

At the end of the day, there’s nothing wrong with drinking an occasional Coca-Cola (NYSE: KO). Certain consumers may be drinking it like water, which will have an adverse impact on one’s health. However, for those willing to find balance, I don’t see sugary beverage makers as immoral by any stretch of the imagination.

Still, many households are not huge fans of Coca-Cola. The stock took a hit (shares saw $4 billion in market value wiped out) back when soccer star Cristiano Ronaldo pushed two bottles of Coke away, urging people to drink water instead.

Indeed, the lack of a rich sponsorship may be more to blame for the mishaps. Though Ronaldo may not want his kids to drink soda like water, I don’t think investors should make too much of the rise of healthier alternatives. Further, sugary beverage makers are already diversifying into other product categories.

Coca-Cola is dipping a toe into the coffee space with an already sizeable business in water. The firm also made a big splash in premium milk with Fairlife Milk. With more protein and less lactose, milk is an area of growth that may help Coke diversify away from sugary soda.

Indeed, Coke is on the right track, and it’s no longer just a firm that ought to be viewed unfavorably by socially-responsible investors. Bill Ackman is just one investor who thinks Coke is hurting society. Despite how wonderful the business is (Warren Buffett will probably never sell his stake), Ackman is on the sidelines.

Now, it’s up for debate as to where Coke and its peers stand on the ethical compass. Regardless, I think the industry is on the right path, with lower-sugar offerings and diversification into healthier beverage categories.

Soda Makers Can Help Propel Your Portfolio in a Recession

Soda makers are about as steady as they come. Warren Buffett loves Coke for a reason. It’s been so steady through thick and thin. With a 3.23% dividend yield and a 0.57 beta, KO stock has a lot to offer in times of turmoil.

PepsiCo (NASDAQ: PEP) boasts a 2.85% yield with the same 0.57 beta. Though the Coke or Pepsi battle has been going on for decades, I do think investors seeking exposure beyond the flagship cola ought to consider Pepsi over Coke for the junk food business.

Indeed, Lay’s potato chips may also be unhealthy, but they do have some nutritional value, making them less socially harmful than cola. Further, Pepsi has exposure to other healthy consumer-packaged goods categories. Think rice, pasta, and cereals. Arguably, Pepsi is the more innovative company that’s not as bad for your waistline.

KO and PEP: Good Stocks to Buy, According to Analysts

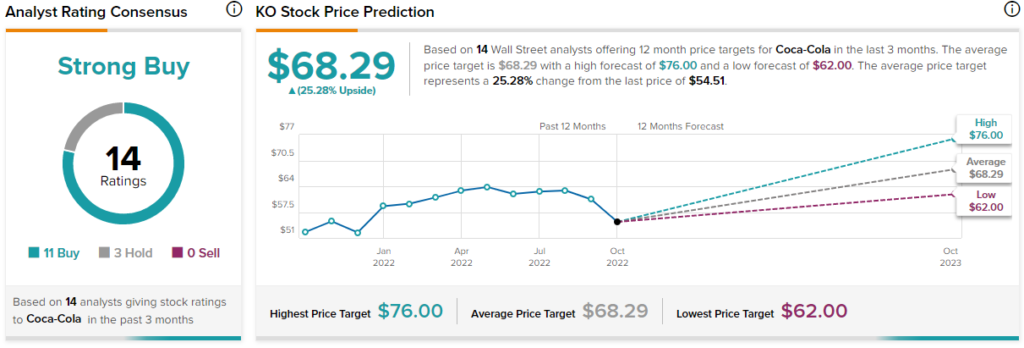

Turning to Wall Street, KO has a Strong Buy consensus rating based on 11 Buys and three Holds assigned in the past three months. At $68.29, the average KO stock forecast implies 25.3% upside potential.

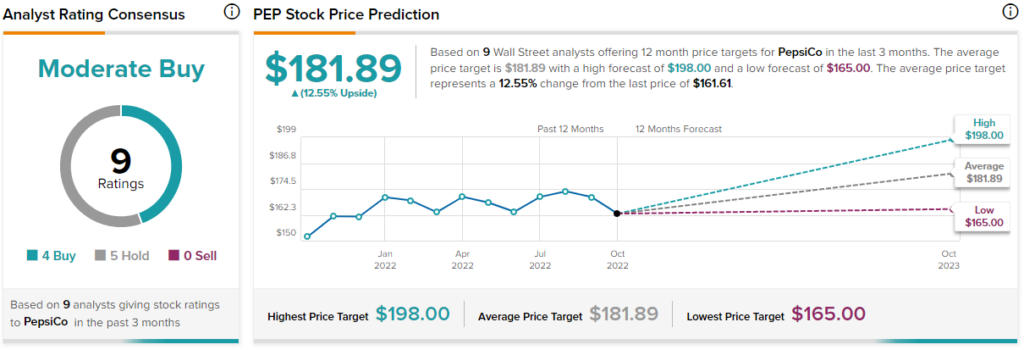

PEP, on the other hand, has a Moderate Buy consensus rating. This is based on four Buys and five Holds assigned in the past three months. At $181.89, the average PEP stock forecast implies 12.55% upside potential.

Coke or Pepsi: Which Stock is Right for Your Portfolio?

In addition to being a tad less reliant on sugary beverages, Pepsi is also the cheaper stock. At writing, PEP shares trade at 2.7x sales and 24.3x trailing earnings. Meanwhile, KO stock goes for 5.7x sales and 24.8x trailing earnings.

Between Coke and Pepsi, Pepsi stock looks like the better bet for ethical and defensive investors. It can offer all the recession-resilient traits as Coke at a lower price of admission.

Of course, everyone’s moral compass will be different. However, I’d argue that there are far worse things to invest in (think defense contractors) at a time like this.