After getting a fillip from the Russia-Ukraine conflict in the first half of 2022, oil prices have been falling for the past three months. From a ~$120 high in June, they are now at $87.5 levels, and a host of factors such as recession fears, contraction of factory activity in China for a second consecutive month, and growth concerns in Europe are not helping.

Nonetheless, the oil industry has been a major value creator for investors this year, and Occidental Petroleum (NYSE:OXY) (GB:0KAK) is a case in point. In this article, we will take a look at two other names in the space, Suncor Energy (NYSE:SU) (TSE:SU) and Enbridge (NYSE:ENB) (GB:0KTI) (TSE:ENB), which look promising at present.

Suncor Is Marching Towards a Sustainable Future

Shares of this integrated energy company have jumped 73.2% over the past year, and Credit Suisse’s William Janela sees a further upside of 49.75% in the stock at a price target of $48.80. The analyst has a Buy rating on SU stock.

The Canadian company is engaged in activities like the development of oil sands, conventional and offshore oil and gas production, and petroleum refining. Suncor also owns a network of fast-charging EV stations, called Electric Highway, in Canada.

The company’s revenue has grown from $19.38 billion in 2020 to $30.95 billion in 2021. It is further expected to rise to $45.22 billion in 2022. Concurrently, Suncor has posted a turnaround — from a net loss per share of $1.15 in 2020 to a profit per share of $2.03 in 2021. The figure is now expected to balloon to $7.46 in 2022.

Further, Suncor’s downstream operations are the most profitable in the North American region on a per barrel metric.

The company recently boosted its quarterly dividend and bought back about 4% of its public float in Q2. At present, its quarterly dividend of $0.36 indicates an impressive dividend yield of 3.44%.

What Is the Future of Suncor Stock?

The company is aiming to devote 75% of the excess funds it generates toward buying back its shares. This should continue to drive value for investors. With a price-to-earnings multiple of 6.4, a price-to-sales ratio of 0.89, and a return on equity of 24.59%, Suncor looks fairly attractive at current levels.

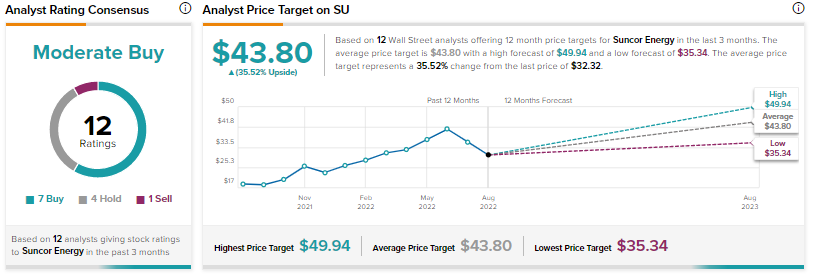

The overall consensus rating for Suncor on Wall Street is a Moderate Buy. SU’s average price forecast of $43.80 indicates a further upside of 35.52%.

Multiple Positives Are in Play for Enbridge

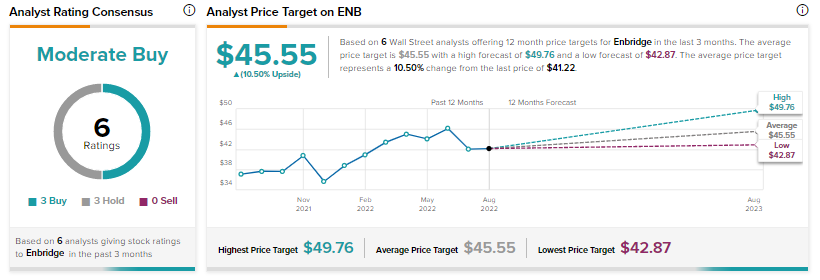

In contrast to Suncor, Enbridge is up only 4.8% over the past year, and the Street sees a modest 10.5% upside in the stock, which has a Moderate Buy consensus rating and an average price target of $45.55.

Nonetheless, this energy infrastructure provider is marching towards expanding its traditional pipeline assets and export operations while making strides in low-carbon opportunities.

Owing to robust demand and execution, Enbridge’s revenues increased from $30.7 billion in 2020 to $37.2 billion in 2021. The metric is expected to rise to $40.2 billion in 2022. Concurrently, EPS rose from $1.91 in 2020 to $2.15 in 2021. Earnings are expected to rise to $2.25 per share in 2022.

Enbridge is augmenting its U.S. Gulf coast operations via a joint venture merger with Phillips 66 and will operate the Gray Oak pipeline. Importantly, it expects the Permian oil supply to rise by about two million barrels a day by 2030.

Through this deal, Enbridge’s indirect interest in Gray Oak has increased to 58.5% from 22.8%. Simultaneously, its risks from commodity price gyrations are expected to come down with the DCP stake reduction (13.2% from 28.3%). The deal will also mean a cash payment of $400 million to Enbridge from the merged entity.

While its European offshore wind portfolio continues to grow, Enbridge is also investing in wind, solar, hydrogen, renewable natural gas as well as carbon capture and storage.

Does Enbridge Pay a Dividend?

Enbridge’s recent dividend of $0.66 indicates a mouth-watering dividend yield of 5.99%. Further, with a price-to-sales ratio of 1.69 and a price-to-cash flow ratio of 11.90, Enbridge looks enticing at current levels.

RBC Capital’s Robert Kwan remains optimistic and has reiterated a Buy rating on Enbridge with a price target of $49.76, which indicates a 20.71% upside.

Final Thoughts

Both Suncor and Enbridge have been the beneficiaries of rising oil prices over the past years. These stocks look attractive at current levels and it would behoove investors to keep these names on their radar.

Read full Disclosure