At a time when the resumption in exports of grains from some Ukrainian ports has calmed down the rising food prices, the United States is on the brink of witnessing the lowest cotton production in over a decade, setting the stage for a sharp rise in its price.

While Food processing stocks like Archer Daniels Midland (NYSE: ADM) and Conagra Brands (NYSE: CAG) are expected to benefit from the falling food prices, rising cotton prices could prove to be beneficial for companies like Farmland Partners Inc. (NYSE: FPI).

Now, let’s take a closer look at the factors that are influencing the U.S. agriculture industry.

The Russia-Ukraine July Grain Export Deal

In order to manage the severe food crisis, the July grain export deal has been signed between Russia and Ukraine. The deal, brokered by the United Nations and Turkey, has been currently signed for a period of 120 days and is renewable. As a direct consequence of the agreement, Ukraine can export up to 5 million tons of grain a month, which is at par with its pre-war level.

Under the deal, authorization has been given to 21 ships carrying corn, wheat, sunflower meal, soybeans, sunflower oil, and other products, which weighed around 563,317 metric tons, as per the United Nations (according to a Wall Street Journal report).

The timing of the deal is important as 18 million tons of grain were lying in Ukrainian warehouses as of July. Further, an additional 65 million tons of inventory will be produced from the country’s summer harvest.

According to a Wall Street Journal article, Ukraine was responsible for supplying around 10% of the global wheat demand and acted as a major exporter to the Middle East, Africa, and Asia regions.

The above-mentioned facts explain the deal leading to a decline in wheat prices to their lowest level of around $7.86 a bushel since the highs of around $12.94 a bushel due to Russia’s invasion of Ukraine.

The calming food prices are ideal for food processing companies and retailers but can weigh on the stocks that are involved in the primary trading of grains.

Let’s take a look at some food stocks that are well-poised to gain.

Archer Daniels Midland (NYSE: ADM)

ADM is a multinational food processing company, boasting a market cap of $48.53 billion. The company engages in the procurement, transportation, storage, processing, and selling of agricultural commodities, products, and ingredients across the globe.

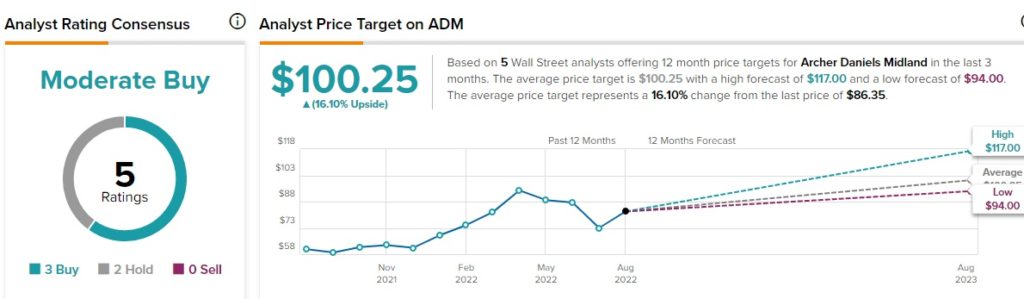

As of now, the Street is cautious but optimistic about the stock. On TipRanks, the company has a Moderate Buy consensus rating, which is based on based three Buys and two Holds. ADM’s average price target of $100.25 implies 16.1% upside potential. Shares of the company have climbed about 29.1% so far this year.

Further, financial bloggers are 92% Bullish on ADM, compared to the sector average of 74%.

Conagra Brands (NYSE: CAG)

Conagra Brands manufactures and sells processed and packaged foods and has a market cap of $16.91 billion. It has iconic brands like Birds Eye, Duncan Hines, and Healthy Choice in its portfolio.

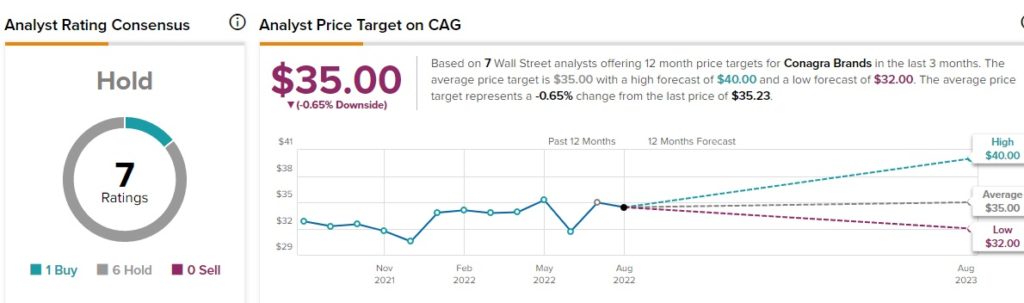

According to TipRanks, analysts have a Hold rating on the stock, which is based on one Buy and six Holds. CAG’s average price forecast of $35 implies 0.7% downside potential. Shares of the company are up 6.3% year-to-date.

On the contrary, financial bloggers are 100% Bullish on CAG, compared to the sector average of 66%.

Climbing Cotton Prices in the U.S.

The cotton futures rose nearly 13% in the last week ending on August 12, witnessing the sharpest weekly jump since March 2011. The upside is widely driven by the shrinking cotton production due to extreme drought conditions in the Southwest regions of the United States.

The U.S. Department of Agriculture (USDA) has reduced the estimate for the domestic cotton crop to 12.6 million bales, down 28% from the previous year. The USDA also projects to witness the lowest end-of-season inventories after a long period of time, which is setting the tone for a further rise in cotton prices.

Against this backdrop, investors could consider taking a look at the companies that majorly focus on primary crops like cotton. One of the companies that could gain from the rising cotton prices is given below:

Farmland Partners Inc. (NYSE: FPI)

With a market cap of $808.82 million, Farmland Partners is a real estate investment trust (REIT) that purchases, leases, and manages high-quality farmland throughout North America. FPI’s property portfolio focuses on primary crops like corn, soybean, wheat, rice, and cotton.

Turning to Wall Street, analysts seem to be cautiously optimistic about FPI, which has a Moderate Buy rating based on one Buy and one Hold. FPI’s average price target of $16 implies 7.1% upside potential. Shares of the company have grown about 23.5% year-to-date.

Meanwhile, financial bloggers are 100% Bullish on FPI against the sector average of 67%.

Final Thoughts

The agriculture sector will always remain the most important and essential industry. The change in the commodity prices might impact the margins of the players in the space, but they will continue to witness sustainable demand levels. However, with respect to the current environment, a sharp rise in food prices can be once again witnessed if there is an escalation in the Russia-Ukraine conflict. Meanwhile, the decline in cotton production is expected to hurt United States’ exportable inventories and its position as the top cotton exporter.

Read full Disclosure