Shares of Starbucks (SBUX) have been picking up meaningful traction over the past month. With Starbucks’ Q3 results coming in better than expected, the coffee giant may have permission to claw higher going into year’s end. Even with several macroeconomic headwinds that could take a stride out of Starbucks’ step, expectations seem way too low right now, as it has intriguing catalysts that could help turn it from ice-cold to scorching hot.

I remain incredibly bullish on Starbucks stock at around $85 and change per share.

Undoubtedly, Starbucks is a discretionary play that faces considerable downside potential in the face of a recession-driven market-wide plunge. When times get tough, discretionary goods and services tend to be the first to face demand destruction. Expensive coffee from Starbucks is a nice-to-have, not a necessity. Although I’m sure many young millennials would agree otherwise!

Starbucks Stock: The Discretionary Discount May Already be Priced In!

Despite Starbucks’ propensity to fold at the first signs of market-wide trouble, it’s worth noting that much damage is already behind the stock. Shares have already shed north of 43% of their value from peak to trough. That’s a decline indicative of a drastic slowdown.

Though a full-blown recession may not be fully baked in, I do think the risk/reward on the stock is terrific, given the likelihood that this economy can hold its own as the Fed continues hiking rates. Unlike prior recessions, the job market is still robust, with 528,000 positions added just last month. Not at all indicative of a moderate, severe, or even mild recession.

Sure, inflation has eaten away at consumer cash cushions, but as long as employment holds steady, it’s hard to imagine the coming slowdown as being near as bad as the 2008 Great Financial Crisis.

In recent weeks, investors are growing optimistic that the Fed won’t need to be as hawkish to reduce the impact of inflation. The 10-year Treasury yield is now comfortably below the 3% mark. While the Fed is hinting at potential rate cuts following hikes if needed, it’s tough to gauge where rates will ultimately settle.

If the bond market is correct and the Fed can combat inflation without hiking on the higher end of its dot plot, discretionary companies and growth could lead this rally.

Discretionary stocks like Starbucks have had ample time to cool off. As the tides turn and investors focus on the bull that follows this bear, Starbucks could surge nearly as fast as it crumbled.

Now, Starbucks has its fair share of idiosyncratic issues. However, it’s never a good idea to bet against Howard Schultz, especially when shares of his firm are trading at a discount to historical and industry averages.

At writing, shares of SBUX trade at 24.1 times trailing earnings, below the industry average just north of 31 times.

Starbucks: Intriguing Catalysts That Could Propel Shares amid Its “Reinvention”

It isn’t just an alleviation of macro headwinds that could allow Starbucks to sustain its recent run. Management is investing in itself, with its reinvention plan to help ease unionization efforts while bringing in greater store traffic. Investments in technologies (think mobile ordering and automation) may also provide a long-lived boon to margins while boosting customer loyalty.

Indeed, Howard Schultz is keen on investing to “reinvent” Starbucks for the new age. He’s done it before with great success, and he’s likely to pull it off again. As a part of the firm’s strategic pivot, which aims to improve retail partner relations and the overall customer experience, Starbucks could make its baristas, customers, and shareholders happy again.

Starbucks faces an uphill battle, as it looks to continue powering through macro headwinds. In any case, I think Schultz’s initiatives have laid down a runway for the stock to return to its highs.

Updates to the company’s mission will make anyone warm and fuzzy. However, it’s the technological initiatives that could provide the most room for productivity gains. In a prior piece, I outlined that automation was key for Starbucks to get around the labor shortage and unionization attempts.

Looking ahead, I don’t expect such high-tech efforts to experience a slow of pace. Just one month ago, Starbucks and Amazon (AMZN) launched their second “Just Walk Out” cashier-less store in New York City.

Amazon is arguably one of the most innovative firms in automation and robotics these days. As the Amazon-Starbucks partnership continues bearing fruit, it’s not hard to imagine more similar stores being rolled out nationwide. In 10 years, your local Starbucks store will likely look much different than it has in recent years.

China Headwinds Could Turn to Tailwinds

Finally, China remains a crucial pillar of growth that could strengthen as COVID-19 lockdowns continue to abate. Schultz sees the Chinese market surpassing the U.S. market one day. With a generational wealth transfer in China and a newfound love for premium beverages, I think he’s right on the money.

In the first half, the Chinese market was weighed down by ongoing COVID-19 headwinds. Such headwinds should be considered a road bump for Starbucks rather than a long-lived setback. I don’t think it will take long before China shines brightly for Starbucks stock once again.

What is the Target Price for Starbucks?

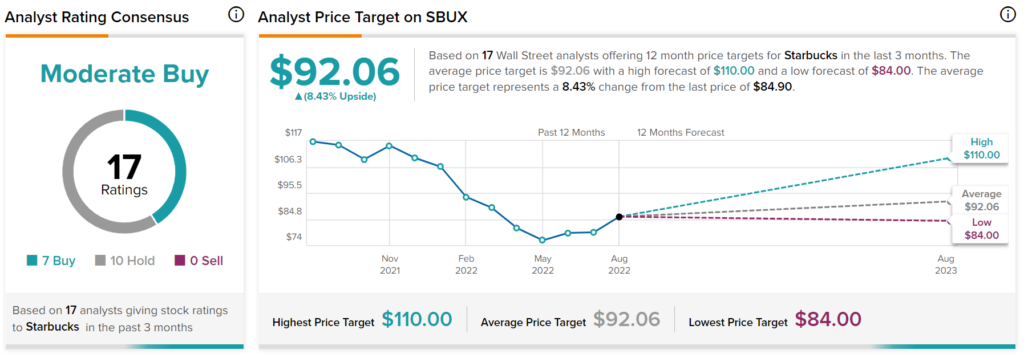

Turning to Wall Street, SBUX has a Moderate Buy consensus rating based on seven Buys and 10 Holds assigned in the past three months. The average SBUX price target of $92.06 implies 8.4% upside potential. Analyst price targets range from a low of $84.00 per share to a high of $110.00 per share.

Takeaway – Shares Still Have Room to Run

Starbucks stock is picking up quite a bit of momentum, but it still has room to the upside, as Schultz pushes for positive change while macro headwinds look to fade. I think investors would be wise to give management the benefit of the doubt while shares look to turn a corner.