Coffee giant Starbucks (NASDAQ:SBUX) has some trouble on its hands. On one side, there’s a macroeconomic picture that threatens to make pricey coffee inaccessible for most of its customer base. On the other side, a growing unionization push threatens to send labor costs spiking. However, a new deal with Delta Air Lines (NYSE:DAL) sent Starbucks shares higher. The two companies merged their rewards programs, which allows anyone who spends a dollar at Starbucks to land a frequent flier mile with Delta.

Those who buy Starbucks ahead of a Delta flight will earn double “stars,” reports note.

Starbucks will face plenty of headwinds going forward, but it’s also clearly making efforts to protect itself against these troubles and keep itself viable going into a likely recession. Having seen what this company can do in both directions, I’m currently neutral on Starbucks. There are almost as many paths to victory as there are to disaster.

Investor Sentiment is Clearly Conflicted for SBUX Stock

As for how investors feel about Starbucks right now, the answer is largely “depends on who you ask.” Currently, Starbucks has a Smart Score of 9 out of 10 on TipRanks. That’s the second-highest level of “outperform,” and the second-highest score the scale can provide. That suggests a very high likelihood that Starbucks will ultimately do better than the broader market.

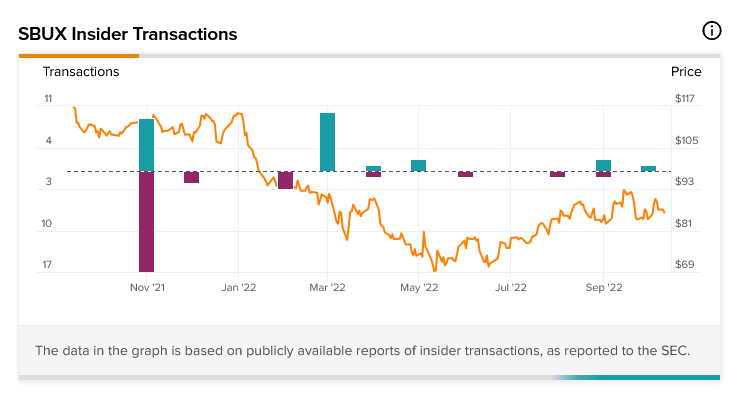

Despite that, however, it’s clear that Starbucks insiders do not feel the same way. Insider trading at Starbucks shows a souring sentiment, particularly recently. In the last three months, there’s been one informative transaction. That was a sale staged by Zabrina Jenkins, the company’s general counsel and acting executive vice president. She sold $373,860 worth of stock in that sale.

The aggregate, however, reveals something a bit different. The last three months of aggregated trading show three buys and two sales from Starbucks insiders. Going back over the last 12 months, meanwhile, offers up 26 sales and 25 buy transactions.

Things are improving a bit when uninformative transactions are considered, but there’s still a pretty clear rift between buyers and sellers on the inside.

Partnership Appears to Benefit Delta More than Starbucks

It’s actually pretty clear how Delta wins in this exchange. Customers who buy coffee from Starbucks get a cheap way to add miles to their Delta accounts by doing something they’d already be doing. Meanwhile, Starbucks members with 25 stars on their accounts can get a free coffee drink. While Starbucks members can get double stars for buying coffee on a day they have a flight, as mentioned previously, that’s kind of a disproportionate circumstance.

Interestingly, those who link their accounts also get 150 stars with Starbucks upon making a “qualifying purchase.” So linking your account basically lands you sufficient stars for six free drinks. Undoubtedly, this will be a winning move for some travelers. Though it does seem like Delta will reap more benefits than Starbucks here, and at a time when Starbucks needs all the wins it can get.

Starbucks is currently facing hundreds of allegations of union-busting. A Bloomberg report recently detailed one manager who was reportedly told that he should “discourage” those who talk of unionization.

Not just discourage but actively punish. The manager detailed—and under oath, no less—that he was given a list of names who supported a union and was told to punish said individuals.

It gets worse. While Starbucks sent a list of dates and locations to engage in contract bargaining sessions, reports from Reuters note that Starbucks had already sent out one list accepted by Workers United, the union covering Starbucks baristas. However, Starbucks soon pivoted to a completely new list that was outside the period that Workers United had already approved.

Mall owners, like Arden Fair, are suing Starbucks for breach of contract. A proposed Starbucks site in Pittsfield is facing questions over traffic safety. It’s starting to look like Starbucks is facing death by a thousand cuts.

However, things aren’t all bad at Starbucks. The company recently rolled out a new line of coffee cups that glow in the dark, a promotional gimmick for Halloween. While the cups are fairly pricey—in the $15 to $30 range, depending on the model—Starbucks points are on hand for those who use the cups to refill their drink of choice.

Further, a survey from Piper Sandler revealed that Starbucks is still a major draw for the teenage set. The survey of 14,500 teens with an average age of 16 featured Starbucks as second only to Chick-Fil-A in terms of popularity. This was mainly thanks to rising cold drink sales, interim CEO Howard Schultz noted.

Is SBUX Stock a Buy or Sell?

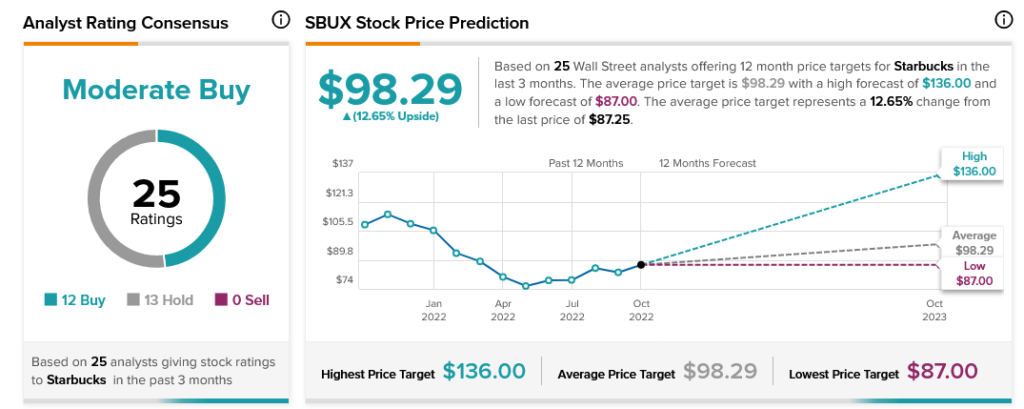

Turning to Wall Street, Starbucks has a Moderate Buy consensus rating. That’s based on 12 Buys and 13 Holds assigned in the past three months. The average Starbucks price target of $98.29 implies 12.65% upside potential. Analyst price targets range from a low of $87 per share to a high of $136 per share.

Conclusion: SBUX Stock isn’t a Compelling Investment at the Moment

In the end, there are almost as many reasons to stick with Starbucks as there are to shy away. The company is currently trading near its lowest price targets, which represents a decent entry point. However, we’re walking into a macroeconomic disaster area that’s likely going to preclude a lot of expensive coffee and expensive coffee mug purchases.

Starbucks’ team-up with Delta is more likely to help Delta than help Starbucks, but even here, it’s limited impact all around. The macroeconomic conditions that preclude fancy coffee will definitely have an impact on travel.

Give Starbucks credit for trying, though, and in circumstances like these, every little bit helps. This is going to let Starbucks hit the ground running when the overall environment improves. That’s why I’m neutral overall.

Starbucks will have a rough time for the next few months—almost every branch of retail will. However, when things improve, Starbucks should be able to take advantage of improved consumer sentiment.